Bitcoin’s (BTC) abysmal December 2017 futures launch quickly fell short of investors expectations and even though the CME BTC market has surpassed $2.5 billion in open interest, the initial launch has reinforced the narrative that this week’s CME ETH futures launch will be equally bearish in the short term.

Prior to the CME BTC futures launch, Bitcoin had already gained 1,900% for the year, a rally which some analysts argue was propelled by the expectation of regulated futures.

Now that the CME ETH futures have launched, investors are watching closely to see if Ether (ETH) will face a similar situation as it has already gained 600% over the past year.

To date, there is no way to estimate how Bitcoin would have fared without the existence of the CME and CBOE futures. Nevertheless, traders still tend to connect the CME launch to the 70% crash in BTC price that occurred in the first 3 months following the launch.

Analyzing an assortment of commodities and FX contract launches over the past two decades might provide a better perspective on the matter so we will review data from the CME’s historical first trade dates index to see if there is a discernible price trend that occurs after CME listings.

Crude palm oil

Crude Palm Oil prices. Source: Worldbank.org

Crude Palm Oil prices. Source: Worldbank.org

When crude palm oil futures launched at CME in May 2010, they did not affect its ongoing price recovery as the above data indicates. Similar contracts had already existed for nearly a decade at NYMEX, thus the above event might have held lesser importance as both exchanges handle institutional clients.

Multiple factors could have caused palm oil prices to hike after the CME launch, including WTI oil’s 23% positive performance over the next five months.

South Korean won

On a similar tone, the South Korean won futures listed in September 2006 and in this instance the launch did appear to have an immediate impact on price.

South Korean won / USD spot prices. Source: TradingView

South Korean won / USD spot prices. Source: TradingView

Despite not having a futures contract, Non-Deliverable Forwards (NDF) for the South Korean won already existed ahead of the CME listing. These NDF contracts are usually traded over-the-counter (OTC) and are seldomly transferable between investors. This means that the listed futures contract had a broader number of institutions that might take part.

Once again, it is impossible to estimate whether this futures contract launch had an immediate impact on price. It’s possible that the South Korean won devaluation followed the trend of emerging or Asian economies. Therefore, pinning this movement to CME futures launch seems a stretch.

How did commodities fare?

Both Ether and Bitcoin are usually considered scarce digital commodities, thus it makes sense to compare it against other previous CME launches.

Going back to commodities, Diammonium phosphate (DAP), a widely used fertilizer, held its CME futures contracts debut in June 2004.

Diammonium phosphate (DAP) spot prices. Source: Worldbank.org

Diammonium phosphate (DAP) spot prices. Source: Worldbank.org

Prior to the CME launch, the Chicago Board of Trade (CBOT) held these contracts since 1991. Nevertheless, there’s potential evidence of a price dump ahead of the listing. However, for those analyzing a broader time frame, the listing itself seemed like a price catalyst rather than something negative.

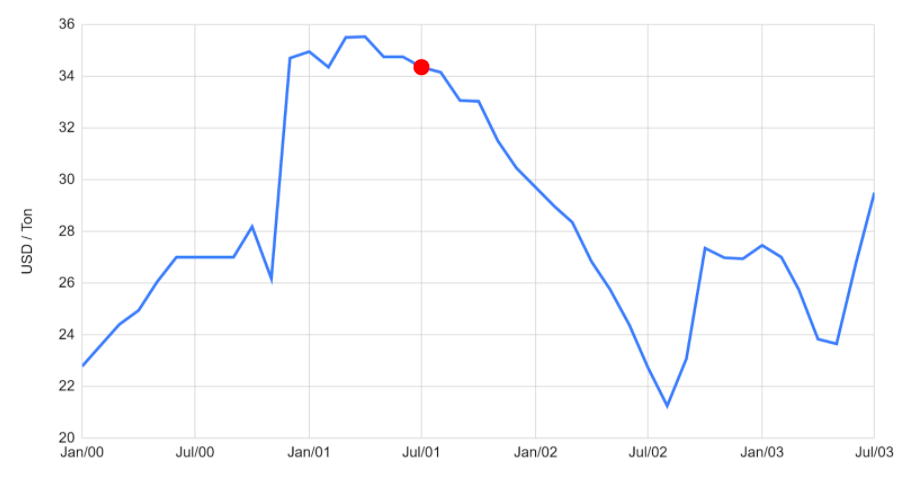

South African coal futures

South African coal spot prices. Source: Worldbank.org

South African coal spot prices. Source: Worldbank.org

Coal futures started trading in July 2001 at CME, and unlike the previously discussed examples, it did not have a listed proxy on other exchanges. Similar to Bitcoin, a 50% hike occurred over the year and a half that preceded its debut.

The result mimics Bitcoin’s listing, as the commodity dropped 33% during the next twelve months.

To conclude, there is no set trend which allows anlayts to predict an assets performance after a CME listing. Multiple historical events have been lined up, and a concrete pattern has not been found.

Not every futures contract gathers relevant liquidity and the CBOE Bitcoin futures delisting proves this point.

At this point, it’s safe to conclude that Ether’s future price performance will depend on a range of factors like the performance of Eth2 and its crucial role in the DeFi sector.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.