Bitcoin (BTC) is now worth more in gold than at any time in its history as the largest cryptocurrency passes $50,000.

Data noted by markets commentator Holger Zschaepitz on Feb. 17 confirms that one ounce of gold now buys just 0.0352 BTC.

XAU/BTC plumbs new depths

Since hitting new all-time highs on Wednesday, the price of gold in Bitcoin terms became even cheaper, with one ounce costing $1,794 or 0.0349 BTC at the time of writing.

“Bitcoin is eating gold in one chart!” Zschaepitz declared in comments.

Gold priced in Bitcoin. Source: Holger Zschaepitz/ Twitter/ Bloomberg

Gold priced in Bitcoin. Source: Holger Zschaepitz/ Twitter/ Bloomberg

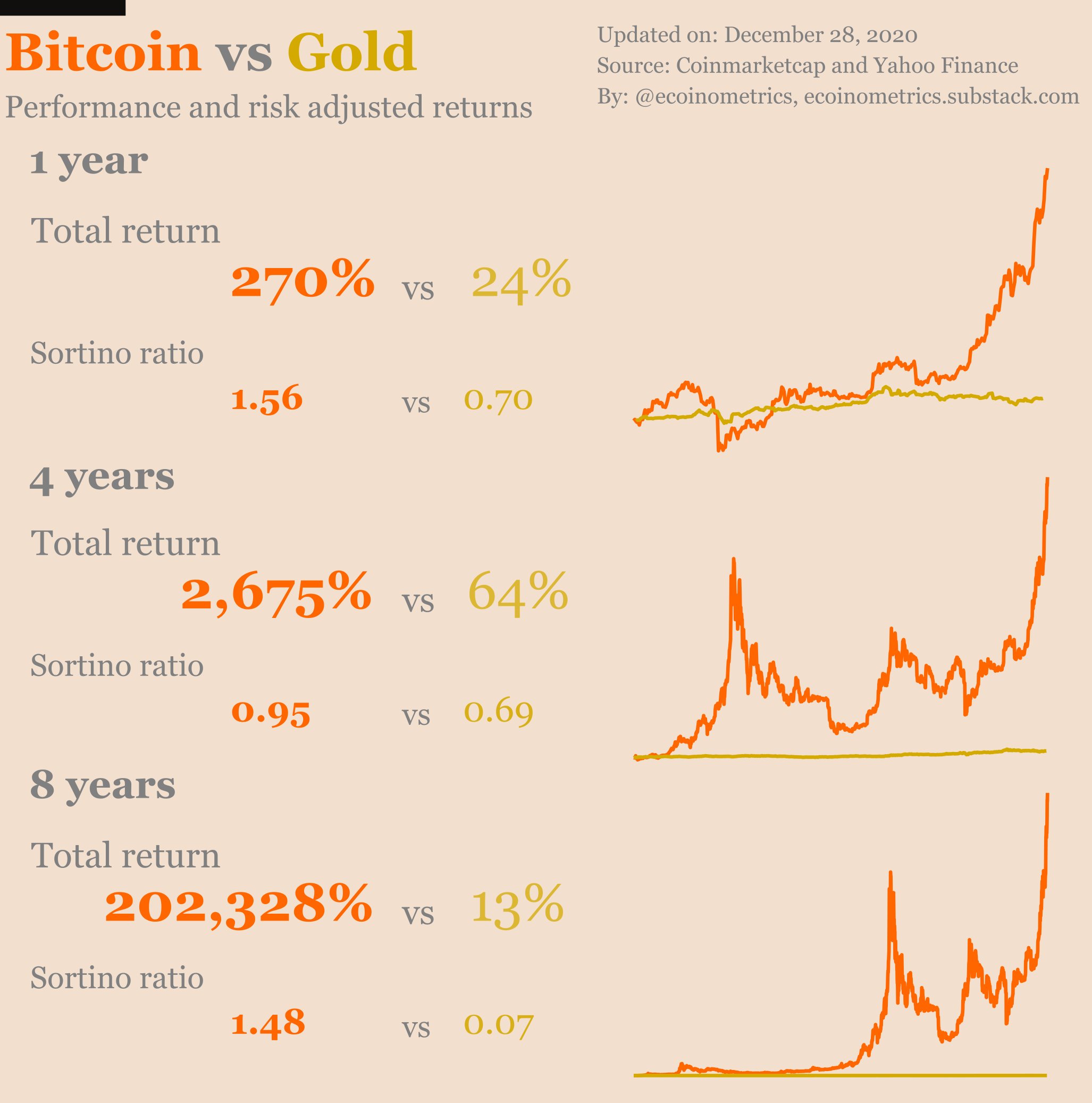

Responding, analytics account Ecoinometrics added that gold’s underperformance versus Bitcoin simply increases if longer timeframes are taken into account.

Bitcoin’s one-year risk-adjusted returns had topped 270%, compared to 24% for gold as of Dec. 28, 2020. Four-year returns contain an even starker contrast, with 2,675% versus 64% for Bitcoin and gold, respectively.

“When looking at Bitcoin vs. gold don’t zoom out too much or gold will turn into the horizontal axis,” Ecoinometrics commented presenting accompanying charts.

Bitcoin vs. gold risk-adjust returns comparison. Source: Ecoinometrics/ Twitter

Bitcoin vs. gold risk-adjust returns comparison. Source: Ecoinometrics/ Twitter

Schiff holds out against a deluge of Bitcoin gains

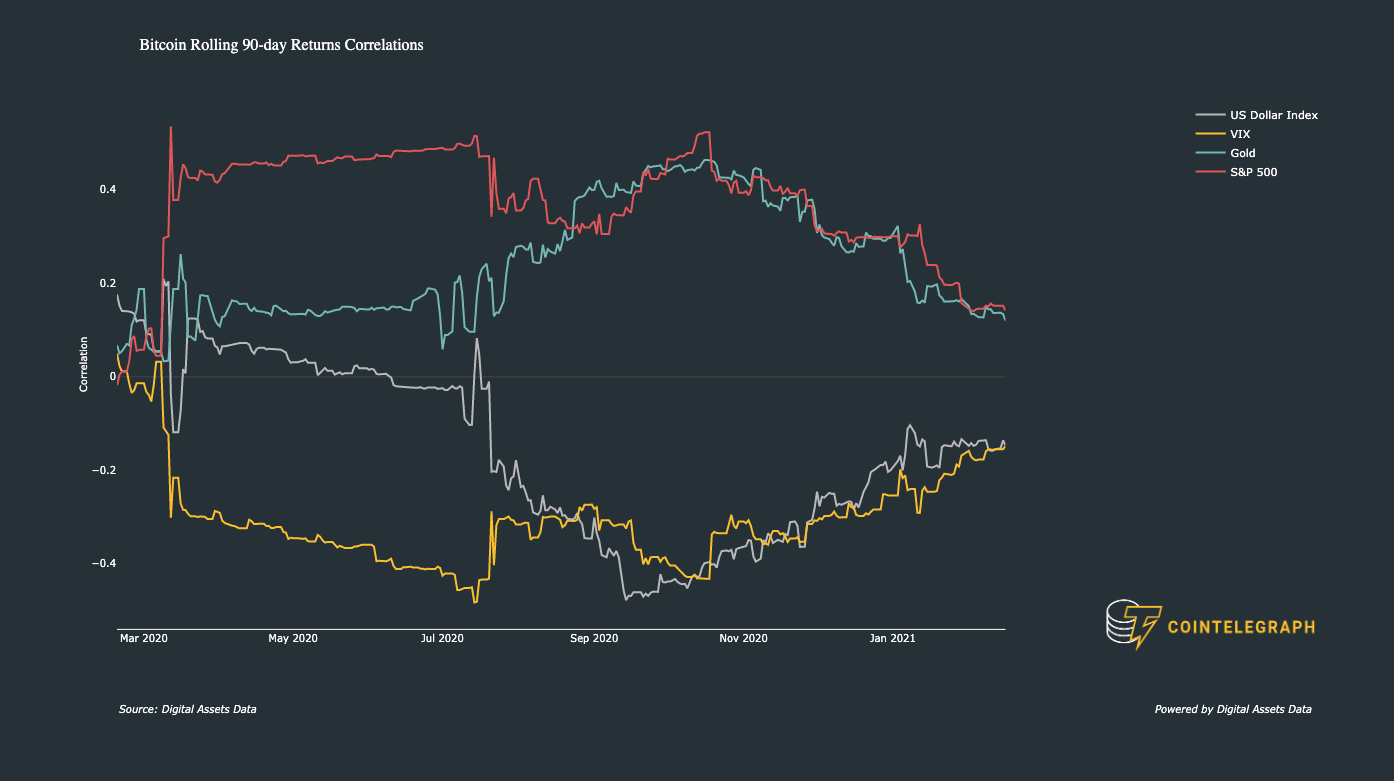

Despite the figures, gold bugs continue to pit Bitcoin against the precious metal and predict disastrous consequences for those holding BTC as the correlation between the two assets has noticeably decreased since September 2020.

Bitcoin rolling 90-day correlation vs. Gold, VIX, USD, S&P500. Source: Digital Assets Data

Bitcoin rolling 90-day correlation vs. Gold, VIX, USD, S&P500. Source: Digital Assets Data

Among them is Peter Schiff, who in his latest Twitter spat with proponents including his son, Bitcoin hodler Spencer Schiff, maintained that BTC/USD is destined to go to zero.

When asked whether the process would take thousands of years or longer by Bitcoin Foundation founder Charlie Shrem, Schiff replied that it should be a lot sooner.

“Serious answer – I doubt it will take anywhere near that long,” he claimed.

“But there may still be a bid in #Bitcoin for years after it collapses to near zero so who knows how many more it will take before that bid disappears completely.”

A $1 million Bitcoin, he added, was “highly unlikely.”

Spencer subsequently reminded him of a prediction he made in June last year, in which Schiff claimed that Bitcoin was “highly unlikely” to hit $50,000.