On Feb. 3, Cardano conducted a hard fork and successfully integrated the Mary upgrade to the testnet, transforming the blockchain into a multiasset network similar to Ethereum.

This event seems to be one of the reasons for the impressive 475% year-to-date rally of ADA, and the altcoin is now causing unexpected ripples in the derivatives markets.

Since the end of December 2020, ADA’s $81-million aggregate futures open interest hiked to the current $580 million, becoming the third-largest derivatives market, behind Bitcoin (BTC) and Ether (ETH).

Data indicates this was not purely a technical adjustment, as Cardano’s on-chain and trading metrics vastly outperform Litecoin’s (LTC).

ADA futures aggregate open interest. Source: Bybt

ADA futures aggregate open interest. Source: Bybt

A week ago, Litecoin led ADA’s open interest by a 50% or higher margin. That all changed over the past five days, as Litecoin’s aggregate futures position was cut by 40%.

Despite facing a similar price correction to Litecoin’s 30% one between Feb. 20 and 22, ADA had $125-million long contracts liquidations, roughly 19% of the open interest at that time.

ADA trading volume and on-chain metrics strengthen

Volume is the first and foremost indicator of investors’ interest. Regardless of the price movement, low trading activity reflects a small user base or a lack of new entrants, which is especially problematic for cryptocurrencies as an emerging asset class.

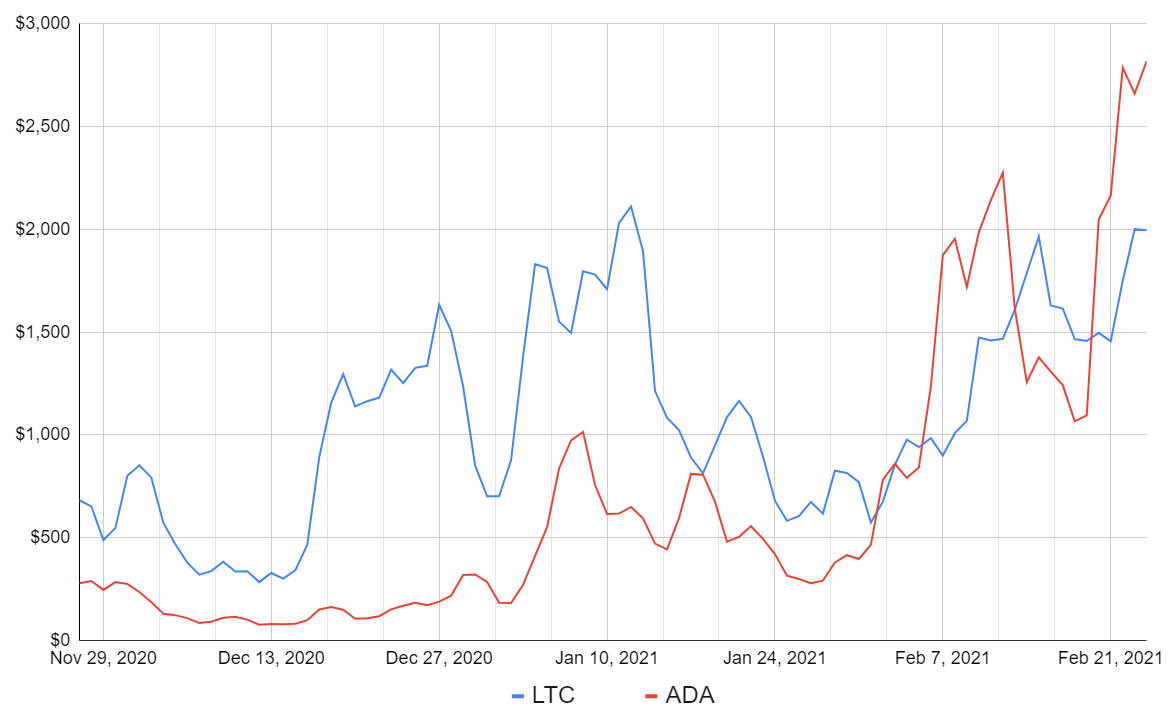

ADA and LTC 3-day average spot trading volume, USD. Source: Messari Screener

ADA and LTC 3-day average spot trading volume, USD. Source: Messari Screener

Although starting from a much lower base three months ago, ADA’s trading volume soared in February, while Litecoin was unable to surpass the $2 billion daily average mark. Meanwhile, ADA’s aggregate spot trading volume at exchanges currently sits at $2.8 billion.

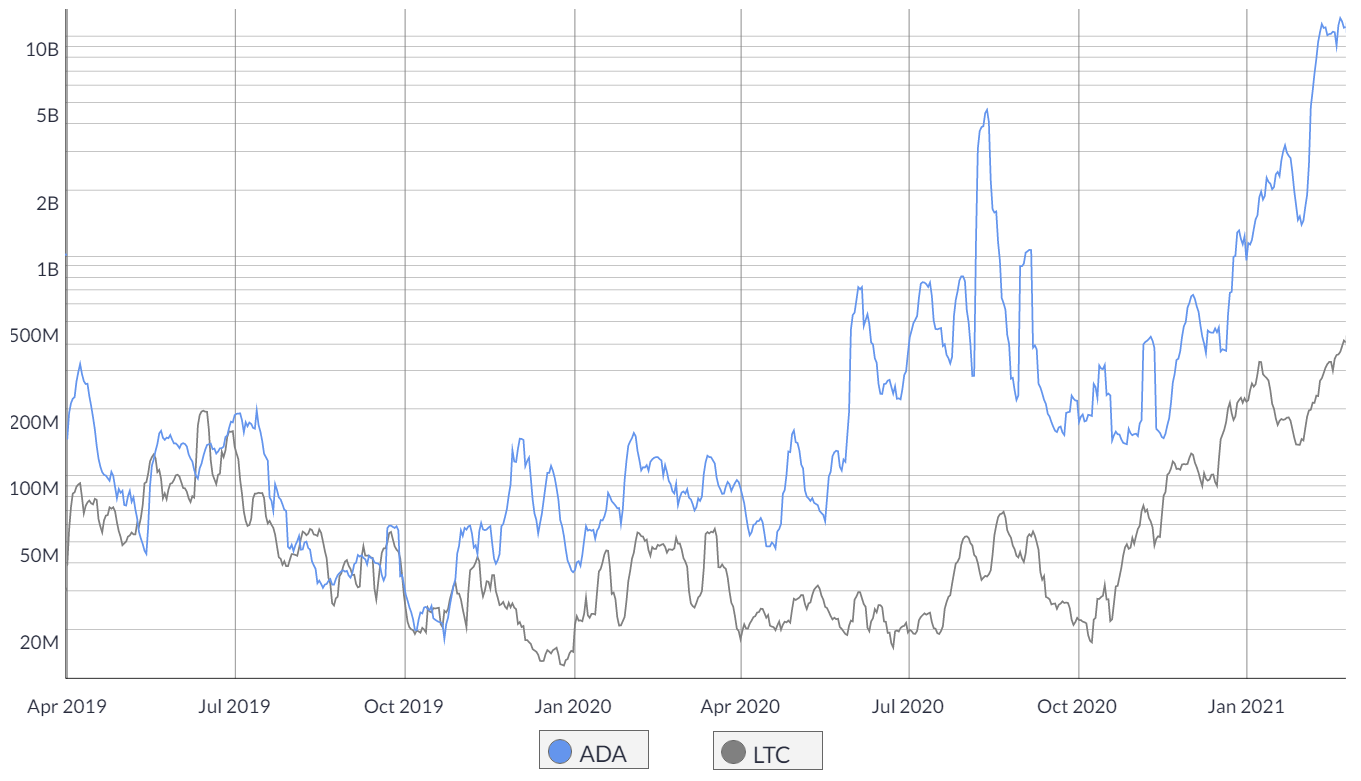

ADA and LTC 7-day average transfers and transactions, USD. Source: Coin Metrics

ADA and LTC 7-day average transfers and transactions, USD. Source: Coin Metrics

Cardano’s on-chain metrics also provide insight into its rising use and ADA’s rising open interest. Data shows that up to November 2019, both networks shared a similar level of transfer and transaction value. By mid-2020, Cardano took the lead, getting 10 times more on-chain activity. This difference is now 5 times larger.

Overall, both trading data and on-chain metrics validate ADA’s futures open interest flipping Litecoin’s.

VORTECS™ score (green) vs. ADA price. Source: Cointelegraph Markets Pro

VORTECS™ score (green) vs. ADA price. Source: Cointelegraph Markets Pro

Data from Cointelegraph Markets Pro illustrates that the number of tweets from unique accounts discussing Cardano is 24% higher than the 30-day average over the past 24 hours. Tweet volume is one component of the VORTECS™ score that identified bullish conditions for ADA on Feb. 18, before the recent price surge.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.