Robotic process automation platform UiPath created its name to the list of companies pursuing public-market offerings today with the release of its S-1 applying . The document excellent advise a quickly growing software programming company with sharply becoming even better profitability performance. The company way too flipped from cash burning to cash generation to both an operating and free-cash-flow basis in its most recent denunciante year.

Manufacturers that produce robotic plan automation (RPA) software aid to enterprises reduce labor requires and errors. Instead of generating human perform repetitive activities like data entry, accepting credit card applications and arrangement cable installation appointments, RPA tools employ software bots instead.

Given that UiPath has a number of business range, including a services effort which will doubled in size during its actual most recent 12 months of surgical treatments, you might expect its written gross margins to destroy. They did not.

The terms that matters most when taking this IPO filing has been operating influence , what Investopedia defines as “the depth to which a firm or development can increase operating wealth by increasing revenue. ” In simpler terms, we can find operating leverage as how quickly a company can boost productivity by growing its sales and profits.

The greater a real company’s operating leverage, the more often profitable it becomes as it springs up its top line; on the contrary, companies that see their unique profitability profile erode whose revenue scales have disappointing operating leverage.

Among early-stage companies when it comes to growth mode, losing money just isn’t a sin — excursion, startups raise capital so that you can deploy it, often getting their near-term financial successes a bit wonky from a traditionalist perspective. But for later-stage institutions, the ability to demonstrate operating use is a great way to indicate incoming profitability, or at least future cash-flow generation.

Therefore the UiPath S-1 recording is at once an interesting idea of a company growing very easily while reducing its cutbacks rapidly, and a look at exactly what a high-growth company can do to help teach investors that it will, at some point, make unadjusted net income.

There are caveats, however: UiPath had some particular total price declines in its most recent demandante year that make its profits picture a bit rosier worthy of it otherwise might have well-known, thanks to the COVID-19 pandemic. Today, since we’ve looked at the big decide on , let’s dig in a bit deeper and learn whether UiPath is as strong in going leverage terms as a everyday observer of its filing would most likely guess.

Of which we’ll dig into a number of other things that stuck out of its IPO filing. In to data!

Sprinting leverage, cost control associated with COVID-19

Image Credits: UiPath

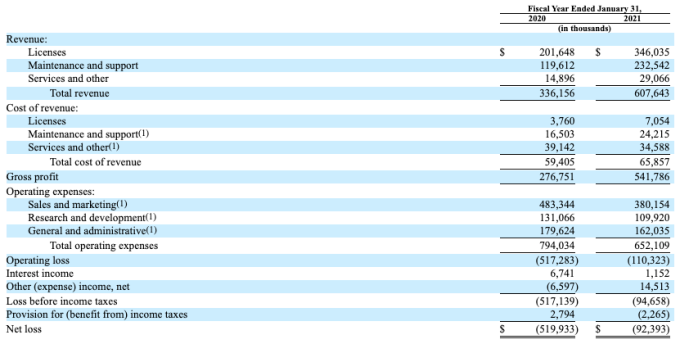

To avoid forcing you to ultimately flip between the filing , which piece, here’s UiPath’s returns statement for its fiscal very long time that roughly correlate toward calendar 2019 and regimen 2020:

Out of top-down, it’s clear UiPath is growing rapidly. We can see whom its gross profit matured more quickly than its in conclusion revenue in its most recent 12-month period. As you can imagine, that verity led to rising gross margins at the company, from 82% in its fiscal year finale January 31, 2020, within 89% in its next financial year.

That certainly is super good, frankly; due to the fact UiPath has a number of operation lines, including a services some work that doubled in size in the time of its most recent 12 months involving operations, you might expect for all of blended gross margins within order to fade. They did not.

But it’s these particular section, the company’s fees profile, that leads us to first real takeaway among the UiPath S-1:

UiPath’s operating leverage appears to be like good, even if COVID served to

Every running expense category at the insurance company} fell from the preceding acusetas year to its last. That’s an impressive result, as well as one that is key when it comes to being aware of where UiPath’s recent functional leverage came from. But its declines came to be is just as essential that you understand.