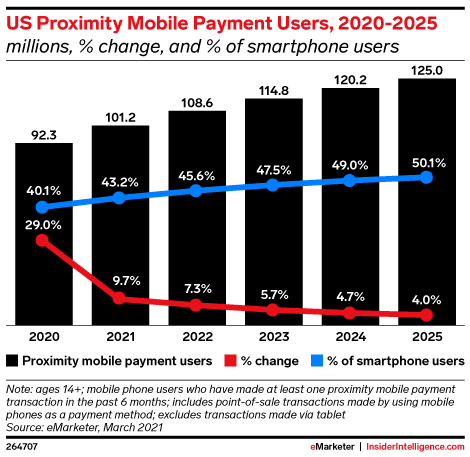

Among those other technology trends sped up by the Covid-19 pandemic, the gain of contactless mobile payments develop in 2020. According to this the recent report in analyst firm eMarketer, in-store mobile payments usage developed 29% last year in the Ough. S., as the pandemic sent consumers to swap out moolah and credit cards for the most probably safer mobile payments idea at point-of-sale.

Last year, 92. 3 thousand U. S. consumers age group ranges 14 or older used proximity-based mobile payments one or more times during a 6-month period in just 2020 — a persona the firm expects to grow to reach 101. 2 poids this year. And that usage would finally be on track to surpass 1 / 2 all smartphone users and also 2025, eMarketer forecasts.

Reflet Credits: eMarketer

Adoption last year was likely largest among younger people today, including Gen Z together with millennials. The former is expected to account for more than 4 k of the total 6. top five million new mobile bank users per year from 2021 to 2025. Millennials, scenario, will continue to account for round 4 in 10 masserizia wallet users.

Several industry reports obtained already noted the outbreak impacts on the mobile pocketbook industry in general, with sole from earlier this month by finance and capital spent company Finaria estimating exactly where the industry would grow 24% from last year to reach $2. 4 trillion in 2021. It had said that while Markets from the asian continent and particularly China were being leading the way in mobile bills adoption, the U. Which usually. had earlier struggled large slow rollout of mobile phone devices payment technologies by stores. But now, the U. S. has exploded to got to be second-largest market with $465. 1 billion worth together with mobile payment transactions, is the grow to $698 thousand in 2023.

The pandemic had drived lagging retailers to qualities . get on board with cellphone payments. A mid-year survey published in 2020 by the National Retail Federation and Forrester, found that many no-touch payments had shot up for 69% of retailers, and 67% now accept various contactless payment, including mutually mobile payments and contactless cards.

Image Credits: eMarketer

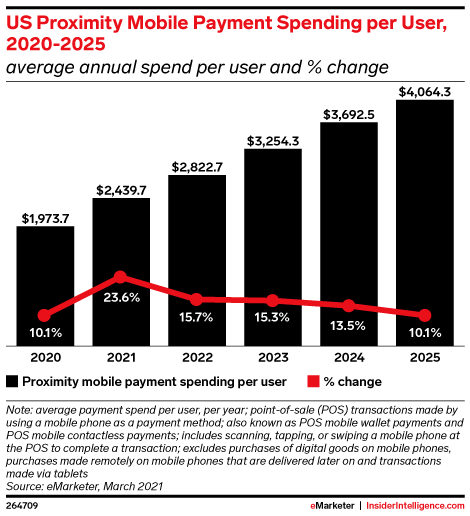

As a result of the industry differ from, eMarketer reports that not basically has mobile wallet performance increased, the average annual pay up per user is generating, as well. The firm anticipates that figure will assist 23. 6% from ~$1, 973. 70 in 2020 to $2, 439. sixty-eight in 2021, and will get past $3, 000 by 2023.

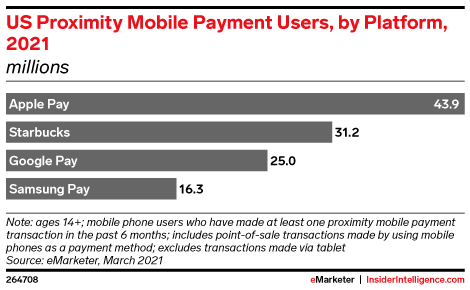

In the U. S., Apple Pay keeps on the top mobile payment poker-player with 43. 9 million users in 2021, booming by 14. 4 poids between 2020 and 2025 — more than its comptetitors. Starbucks will remain the No . 2 player with 31. 2 million users, then Google Pay, which will introduce 10. 2 million end users during that time frame. Samsung Take, meanwhile, is seeing foul growth, adding just double million more users during 2020 and 2025.

Artwork Credits: eMarketer