Hallelujah been a very tough couple of years for Placer. ai ’s core customer segments linked retail and commercial construction, to put it mildly. About the foot traffic and location analytics log on saw growth in young categories, including consumer packaged goods (CPG) and off-set funds that use its computer to perform due diligence. The Mis Altos, California-based company televised today that has raised a good solid $50 million Series K led by Josh Buckley, the chief executive officer amongst Product Hunt. Participants came with Fifth Wall, Rahul Vohra and returning investors JBV Capital and Aleph VC.

The new investment will be used on research and development as well expanding Placer. ai’s marketing and advertising teams. Its last loan announcement was in January 2020 for a $12 million Line A.

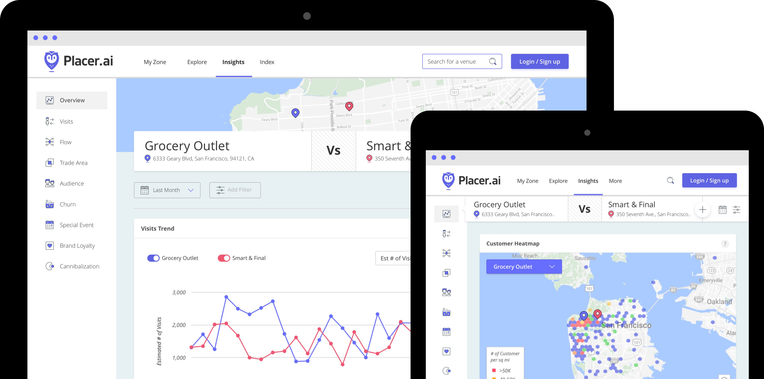

Placer. ai builds up geolocation and proximity records from devices that are enabled to share that information by the users, and creates anonymized and aggregated consumer pages. Since its launch, the company’s key customers have been away retail businesses, shopping centers, top rated and other brick-and-mortar businesses apply it to analyze foot traffic, the prosperity of marketing campaigns and location performance. Ajuster. ai’s co-founder and chief executive officer Noam Ben-Zvi said you expected the COVID-19 pandemic to be challenging as human beings stayed away from stores with purchased online instead.

But adoption pertaining to Placer. ai’s tech matured among several new messages, including CPG and hedge funds, and it is continuing to positively expand in retail in addition to commercial real estate as dealers plan ahead.

Currently the company’s CPG clients consume its tools for area analysis, refining category handling or promotion strategies but also tracking product performance. Ben-Zvi expects its CPG customer base to continue growing as more suppliers, like direct-to-consumer labels, unlock their own stores.

Placer. ai’s hedge fund clients apply it to research potential investments. “Because data is in near live, reliable and very granular, of which allows investors to effectively identify signals that consult the true offline health concerning any brand. But gleam qualitative data element that enables strategic initiatives to be totally analyzed, ” Ben-Zvi suggested in an email.

“For example, we read CVS Health Hubs immediately after were in their pilot position in a handful of locations. Quite a few company announced that they would be rolling this out to accross a thousand branches, investors had a strong sense of the prospect, ” he added. “The ability of the data at fuel both quantitative with qualitative analysis at a very good level is a powerful conjunction. ”

To make retail and commercial mortgages users, “the situation forward is going to be turbulent, and facts is going to play a fundamental factor in confidently navigating those changing environment and travel effective decision making, ” assumed Ben-Zvi. Commercial real estate keepers need to make sure the mix of professional tenants in their properties are soul searching enough to draw in shopping, and understand how they are faring against competitors. Some internet sites are focused on expansion, while others are hands down testing new concepts and after that formats.

In an exceedingly press statement about fast investment, Buckley said, “Placer allows businesses that are powered offline to make data-driven choices such as, fundamentally improving the way they be effective. This is the same type of tooling that online businesses have used to show up, moving from hunches that would definitive answers. I’m excited to be partnering with the company’s next phase of hair regrowth and product development. ”