Cardano (ADA), the native token of the smart contract platform of the same name, has joined the altcoins hitting new all-time highs this week.

ADA/USD 1-day candle chart (Binance). Source: Tradingview

ADA/USD 1-day candle chart (Binance). Source: Tradingview

Cardano underscores “alt season 2.0” appetite

Data from Cointelegraph Markets Pro and Tradingview showed ADA/USD hitting over $1.70 for the first time on May 7.

In a move which an increasing number of large-cap altcoins are seeking to copy, Cardano gained impressively over the past few days, going from below $1.30 to the highs as sell-walls disappeared.

Now, analysts are eyeing short-term targets of $5 as Bitcoin (BTC) continues to range, giving fuel to an already lively altcoin scene.

“The thing I don’t like on ADA right now: there was a lot of volume and now there’s not,” popular trader Scott Melker said in a note of caution during a market overview earlier in the week.

He added that the ADA/USD chart nonetheless still “looked fine” but that the pair was currently better suited to investors rather than short-term traders.

Against BTC, ADA remains far below its all-time high — a trait common to many altcoins despite their USD performance. ADA/BTC reached 0.000071 BTC in January 2018, and currently resides at 0.00003 BTC.

ADA/BTC 1-week candle chart (Binance). Source: Tradingview

ADA/BTC 1-week candle chart (Binance). Source: Tradingview

What’s in a bull run?

As Cointelegraph reported, altcoin price action remains led by freak moves on tokens that have seen few or no events from a technical or adoption perspective.

First Dogecoin (DOGE) and then Ethereum Classic (ETC) became standouts, the latter seeing all-time highs of its own on Friday as DOGE/USD cooled from its recent run.

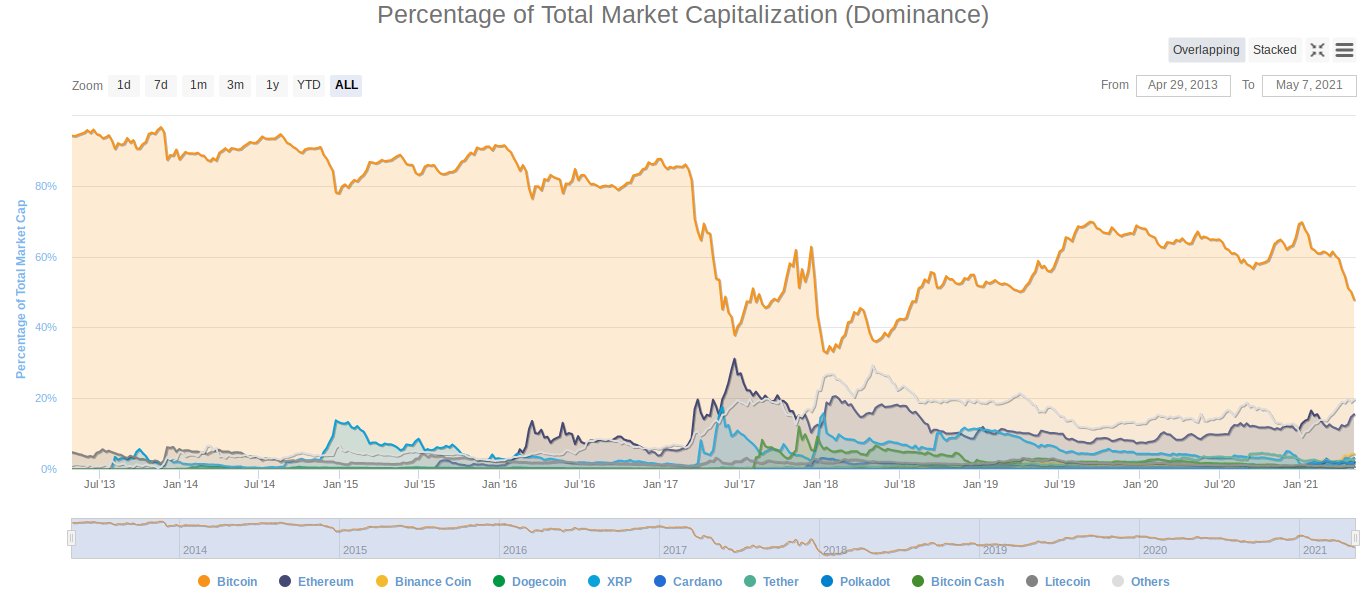

Cryptocurrency market dominance chart. Source: CoinMarketCap

Cryptocurrency market dominance chart. Source: CoinMarketCap

Famous cryptocurrency names have even taken to mainstream platforms to draw consumers’ attention to fundamental differences between Bitcoin and altcoins.

“In terms of Dogecoin, it’s no different than GameStop, where GameStop is a real company but became a bit of a meme with a certain contingent of the retail trading audience,” Ryan Selkis, founder of analytics platform Messari, told CNBC on Thursday.

Bitcoin’s dominance of the overall cryptocurrency market cap meanwhile continues to decline, hitting one-year lows below 45%.