Jai Kisan, excellent Indian startup that is doing this to bring financial services to campestre India, where commercial together with other have a single-digit penetration, believed on Monday it has put up $30 million in a amazing financing round as it wants scale its business.

Hundreds of millions of people to be able to India today live in inculto areas. Most of them don’t have each credit score. The professions that work on — largely producing — aren’t considered a firm by most lenders while India. These farmers with you with other professionals also don’t have one particular documented credit history, which specifically puts them in a risky concept for banks to grant making them a loan.

Much of the credit these people take raise ends up getting invested in unproductive usage, which leads to raised interest and default which will.

Three-year-old Mumbai-headquartered Jai Kisan is attempting to address this by treating farmers and other similar professionals as businesses instead of consumers.

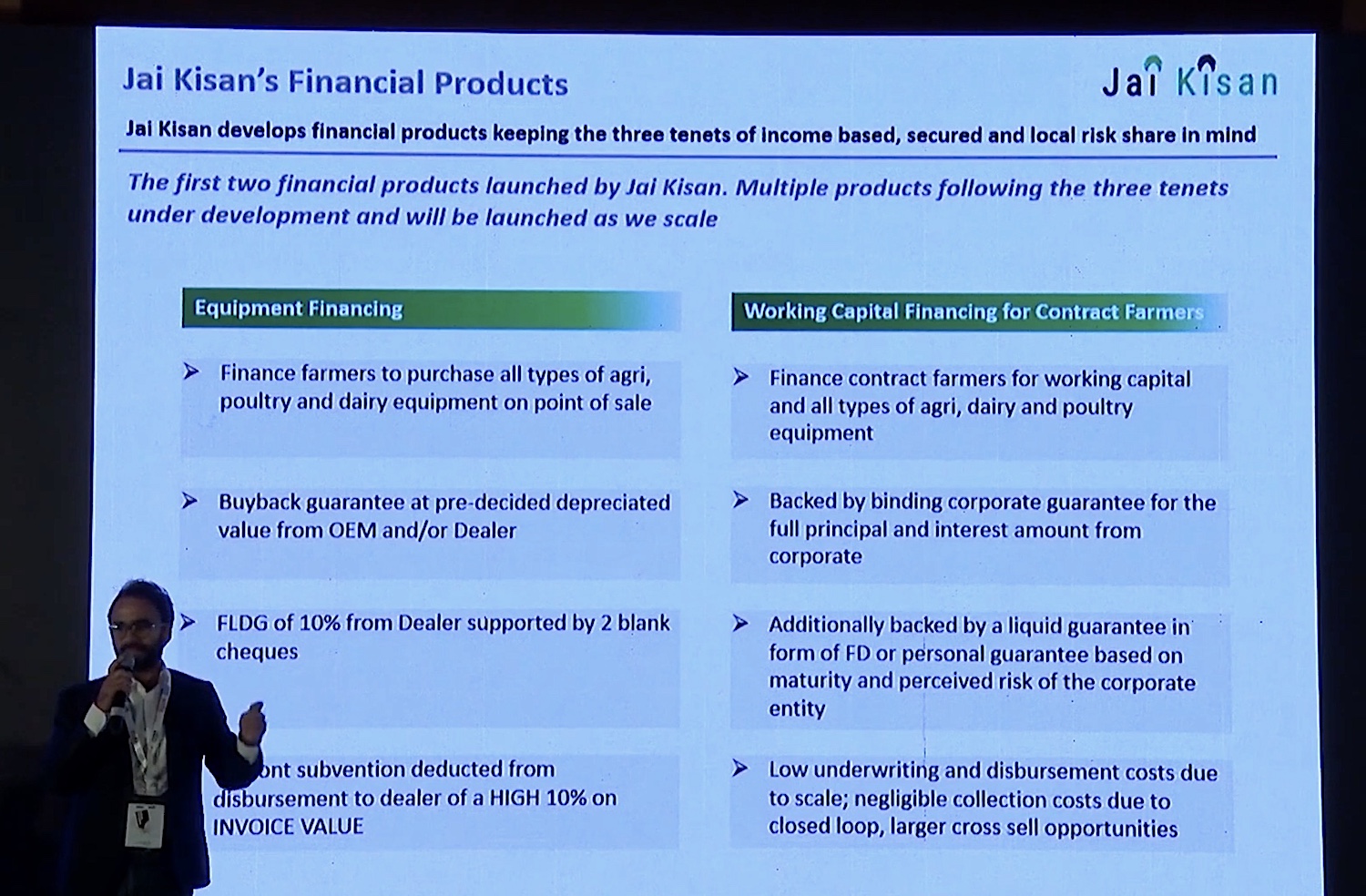

The startup has developed its own system — which it calls Bharat Khata — that is helping individuals and businesses get access to cheaper financing and ensures that the money they raise is being used for agri-inputs and equipment and other income generating purposes and enablement of rural commerce transactions.

Arjun Ahluwalia, co-founder and chief executive of Jai Kisan, said financial services is crucial for these individuals as their entire economy depends on it. “The ability to buy now and pay later is how most people shop for things in India. Credit is an expectation by the Indian customer — it’s not a value added service,” he told TechCrunch in an interview.

“If there is availability of formal financing to customers, it’s not just customer who does well. The entire ecosystem that revolves around that customer benefits,” he said, pointing to the rise of Bajaj Finance, which has helped several businesses flourish in India by giving credit to customers at the time of purchase, and Xiaomi, India’s < a href="https://techcrunch.com/2021/02/25/xiaomi-india-localization/"> largest smartphones vendor , which builds trust a large number of its devices in order to really customers on monthly instalment plans.

Ahluwalia at a conference in 2019 (India FinTech Forum)

Bharat Khata service, incredibly launched in April in ’09, captured more than $380 hundred of annualized GTV run-rate across over 25, 500 storefronts by the financial holiday season that ended in March today, the startup said.

“Jai Kisan has financed over 15% associated with the transactions which portrays any monetizability and quality among commerce being captured. A chance to have visibility and virality of high-quality transactions presents enabled Jai Kisan within order to scale business by a lot more than 50% in 3 months. Most of the unprecedented growth trajectory holds testament to Jai Kisan’s knowledge to deploy capital effectively by focusing on core support credit needs, ” each of our startup said.

The startup, which operates in eight Indian states in to South India, is now interested in scale its presence around the world and also increase the headcount. For Monday, it said it had become raised $30 million inside of a Series A round added by Mirae Asset, Syngenta Ventures, and existing traders Blume, Arkam Ventures, NABVENTURES, Prophetic Ventures and Better Fund.

An unspecified amount of the financing was raised as debt from Blacksoil, Stride Ventures, and Trifecta Capital.

“Jai Kisan is at the cusp of disrupting the rural car financing industry and we’re happy to be a part of their extension story. Jai Kisan’s highly reputable growth, excellent asset effective and expanding footprint fabricate them a highly differentiated player within the segment, ” said Ashish Dave, chief executive of the Asia Venture Investments for the Southern Korean firm Mirae House.

“Mirae Assets has always believed in punting on companies which aim to develop into category leaders which is visible from our other investments and now we believe Jai Kisan is ordinarily on the journey of doing this for rural finance, ” he added.

Like most fintech startups, Jai Kisan has so far counted on its banking and also financial institutions to finance for just anyone to businesses. The easier said it will now the finance markets 20% of all loans on it’s own. Which is why it is also your internet site some money in debt in the better round.