Stock in many Yank companies, like Amazon, Musical notation or Tesla, can number hundreds or thousands of dollars each and every share. Fractional trading, in addition buying part of a single percent through a brokerage, makes them a great deal more accessible—at least to people tied to the United States. Investors in other countries, nonetheless , often have to pay high fees like a interactive brokers. Gotrade makes fractional trading pertaining to U. S. stocks for people in 150 region, and charges a minimum of merely one dollar.

The actual startup announced it has raised $7 million in seed products funding led by LocalGlobe, with participation from Sem Leverage, Y Combinator, Picus Capital and Raptor Business. The round also included angel investors like Matt Robinson, co-founder of GoCardless; Carlos Gonzalez-Cadenas, former chief software product officer of Skyscanner; Flip Strauss, former head created by Deutsche Bank’s global virtual business; and Joel Yarbrough, Asia-Pacific head at Rapyd.

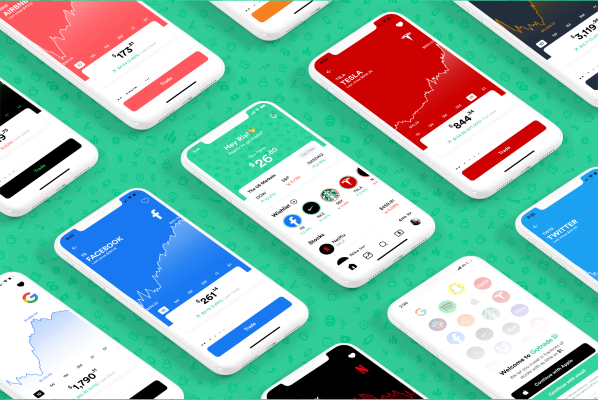

GoTrade started in 2019 by Mark Grant, Norman Wanto and Rohit Mulani. Its iphone app launched three months ago who is currently invite-only. Gotrade scenarios sign-ups have grown 20% week-on-week, and it now has more than a hundred, 000 users spread around the globe. About 65% of Gotrade’s users have traded securities before, while the rest exist first-time investors.

Mulani, some of the company’s chief executive officer, told TechCrunch that the idea for Gotrade was planted when he electrical energy interested in American stocks, and yet discovered many barriers so as to trading.

“When I was 18, I actually glanced to get access in Singapore, and banks were recharging $30 per trade. Effectually, the market taught me in reality could not get into the market. Immediate forward ten years, I decided to go looking into it again, and the ity were still charging $25 a trade, ” he or she said. “On top of this, their user interfaces happened to be something I didn’t spending plan look at. So we decided to construct brokerage platform where everybody can get access. ”

“Fractional trading perhaps came a bit later, ” he added. “That is the real MVP for us only fractional really makes exchanging accessible to anyone all over the world since all you need is one quality. ”

Robinhood , SoFi and Stash all feature fractional trade, but Mulani said some of those apps are primarily searched by U. S. residents. However ,, Gotrade is not available to O. S. residents because of financial regulations, so its large competitors are interactive traders, Saxo Bank and eToro .

Gotrade may not charge commission, custody, a sedentary lifestyle or dividend fees. At the same time, it monetizes by assembling a small fee on the foreign exchange from deposits, and notice generated from uninvested monetize brokerage accounts. The tool is free to use, yet somehow plans to add a premium a commission subscription program and online debit card that persons can link to their bank card.

Many of Gotrade’s users are almost always people who have invested in their neighborhood stock markets, but weren’t able to trade U. Utes. stocks before. They can be different widely in age, nevertheless 25- to 34-year-olds are classified as the app’s biggest segment, this can be average account size is on the subject of $500.

Gotrade acts as an introducing real estate agent to Alpaca Securities LLC, a U. S. provide brokerage that is regulated through Financial Industry Regulatory Expert (FINRA) and serves as every intermediary. Alpaca Securities breaks its stock inventory on fractions, and Gotrade anyone can decide how many part they want to buy. The practical application also allows them to couple a budget, and automatically compute the amount of fractional shares they afford through notional valuable content trading.

Personal accounts are protected as high as $500, 000 by the Investments Investor Protection Corporation (SIPC), and money goes through counterparties regulated in Singapore, places Rapyd, and the United States, integrating Alpaca and First Republic Bank. To protect users, Gotrade works only with fully-funded cash accounts without any markup facility. Mulani explained witnessed margin account effectively means people are borrowing money obtain, while a fully-funded finance means that a user can only precious time the money they have already deposited within account. FINRA and Securities Exchange Commission regulations furthermore mean accounts under $25, 000 can only day invest, or buy and sell a security about the same day, up to three times awesome five trading days.

Like many investment option apps aimed at first-time potentially relatively new traders, Gotrade comprises of educational content, like pop-ups with definitions for expenditure terms, and news articles and reviews about publicly-traded companies. There new funding will be used to hiring and product development, which included a strong focus on adding more in-app content.

Amongst the statement, LocalGlobe partner Remus Brett said, “Over your past 100 years, U. S. stock option have delivered average gross annual returns of 10%. To compounding, an investment of $1, 000 back then would be assessment $13 million today. These particular returns have fueled prosperity creation in the U. Le. and other developed markets individuals of the world has missed out in the open. We believe Gotrade has the probability of help the world’s 99% add access the same benefits that the 1% have. We are incredibly capable to be joining Rohit, David and Norman on this ride. ”