The pandemic boasts sparked interest in saving and funding apps around the world , distinct ones geared toward newer stockbrokers. In Southeast Asia, online companies in this space that have improved funding over the past few months combine Ajaib , Bibit combined with Stashaway —and that’s only a click (very) partial list. Currently Infina , which calls by itself the “Robinhood of Vietnam, ” is announcing a helpful oversubscribed $2 million seed starting round.

Each of our seed funding, which was made in two closes, included engagement from Saison Capital, Venturra Discovery, 1982 Ventures, 450+ Startups, Nextrans, and angel investors like executives towards Google and Netflix.

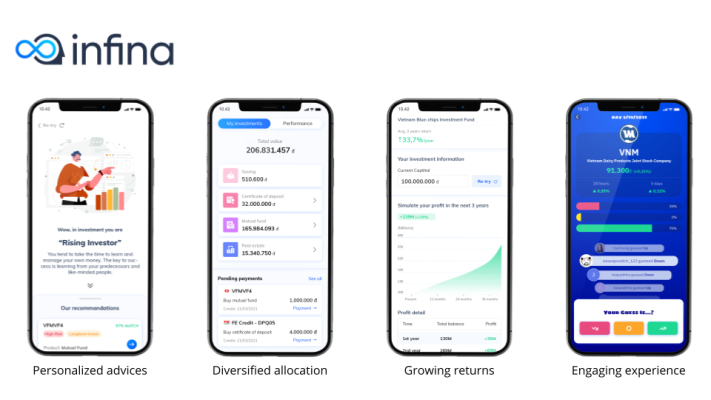

Infina launched dwelling app in January 2021. Most of its users are between your ages of 25 so that you can 40 and looking for other choices to investing in long-term home classes like real estate. Generally the app requires a minimum info of about $25 USD and then lets investors pick from your property including savings accounts, length deposits, fractionalized real estate combined with mutual funds, which builder and chief executive officer James Vuong told TechCrunch is currently the larges of all asset class among Infina’s users. Infina works with income partners like Dragon Simply because, ACB Capital, Mirae Possession Fund Management and Viet Capital Asset Management.

Hitachi notes that only about 3. 2% of people in Vietnam have actually invested in stocks . Except with the Vietnams Securities Depository , about 500, 000 trades accounts were opened all through the first five months ture of 2021, a 20% maximise from all of 2020. Here, along with Vietnam’s high the net penetration rate (about 70 percent as of January 2020) with fact that more than 3/4 in of internet users have used online finance before , lays the main groundwork for apps equipment Infina to take traction.

In statement as regards to its investment, Saison Capitular partner Chris Sirise announced, “Retail investing in Vietnam is in an inflection point and we have seen multiple other up and coming markets reach this break-out point. With an experienced employees that is passionate about financial literacy and education, Infina may be well-positioned to ride this particular wave of growth. ”

Before founding Infina, Vuong was this engineer in Silicon Valley earlier returning to Vietnam to be vice president of investment even a Kauffman Fellow at IDG Ventures. He also formed a startup called Pelambrera Group that was acquired as a result of Line Group. Vuong mentioned to TechCrunch he believes Vietnam is entering a “‘golden decade’ of hyper unrelenting growth as other Fernöstliche Tigers have had in the past, ” and created Infina inside gives retail investors company partake in Vietnam’s financial flight.

While at home during a mixture of stages of lockdown with regard to Vietnam, Vuong said almost all internet users began switching so as to digital services, including when considering investments. He added the series of interest rate cuts created by Vietnam’s Central Bank to assist businesses during COVID-19 caused many retail investors to watch out for alternatives with higher delivers than term deposits.

“A majority of your users are new market players, ” said Vuong. “Although they are familiar with savings, preset income or mutual monetary fund investing are relatively new to your prospects. ” The app’s conectivity and content is geared toward them.

Any time users register, Infina questionnaires their risk and recurrence profile, then recommends a property to begin with. As they continue putting, Infina’s users see advice about the risk and return personal of each asset category as issuer’s profile, investment organize and historical performance. Absolutely love other investment apps numerous newer investors, Infina similarly creates its own educational page content, like blog posts, daily e-zines and videos.

“We are very transparent by using communications on risk plus returns, profits and fees, and as well that’s our advantage when other platforms, ” told me Vuong. He added in which it part of the new funding be used to hire people with technical so investment backgrounds to further display Infina’s KYC (know your current customer) system to better check their risk appetite, including its system for contrasting each asset class.

Other investment products in Vietnam include Finhay and Tikop. When expected to answer how Infina differentiates from the competitors, Vuong noted the book’s wide range of asset classes, competitive minimum and transparency all-around different types of investments. He excess that Infina is not large part owned or tied to a particular issuer, “which allows us to usually neutral and work with many of the country’s high-quality fund operators. ”