Cross-chain decentralized exchange THORSwap has concluded a $3.75 million private token sale backed by leading venture funds within the blockchain industry, offering further evidence that investors are keen to back market-ready DeFi platforms.

The funding will be used by THORSwap to continue building its development and operational resources, including the launch of new products on top of THORChain, the decentralized liquidity network powering the exchange. The private token sale was led by IDEO CoLab Ventures with participation from True Ventures, Sanctor Capital, Nine Realms, Proof Group, 0xVentures, Qi Capital, THORChain and others.

THORSwap currently supports Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Ether (ETH), Binance Coin (BNB) and ERC-20 and BEP-20 standard tokens.

The platform also announced that its token generation event for the native THOR cryptocurrency is scheduled for later this month.

THORChain’s April launch was viewed favorably by the cryptocurrency community, with ShapeShift CEO Erik Voorhees describing it as a seminal moment for the industry. “Thorchain has no bridges. It has no wrapping. It is native assets, swapped across chains in a decentralized way, for the first time ever,” he said.

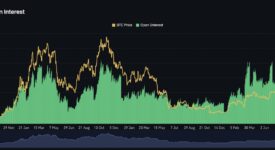

Decentralized exchanges have been a major catalyst for DeFi’s explosive growth over the past year. By June, DEXs accounted for 13% of cryptocurrency trade volumes, up from just 6% in February. As Cointelegraph reported, DEX trade volume tripled between January and May, reaching a high of $300 billion. At the same time, DeFi adoption continued to surge, with Uniswap and 1inch registering 2.5 million and 600,000 unique users, respectively.

That being said, DEXs and other DeFi protocols have been a primary target of sophisticated attackers and cybercriminals. As Cointelegraph reported, THORChain experienced a sophisticated attack during the summer that resulted in the loss of $8 million worth of Ether. Luckily, the attacker only wanted to expose the security flaw in exchange for a 10% bounty payment.

Related: SEC reportedly investigates decentralized exchange Uniswap

Meanwhile, in August, DeFi lending protocol Cream Finance was drained of $19 million in a flash loan attack. By recruiting the assistance of a DeFi security platform, Cream Finance has been able to recover most of the lost funds.