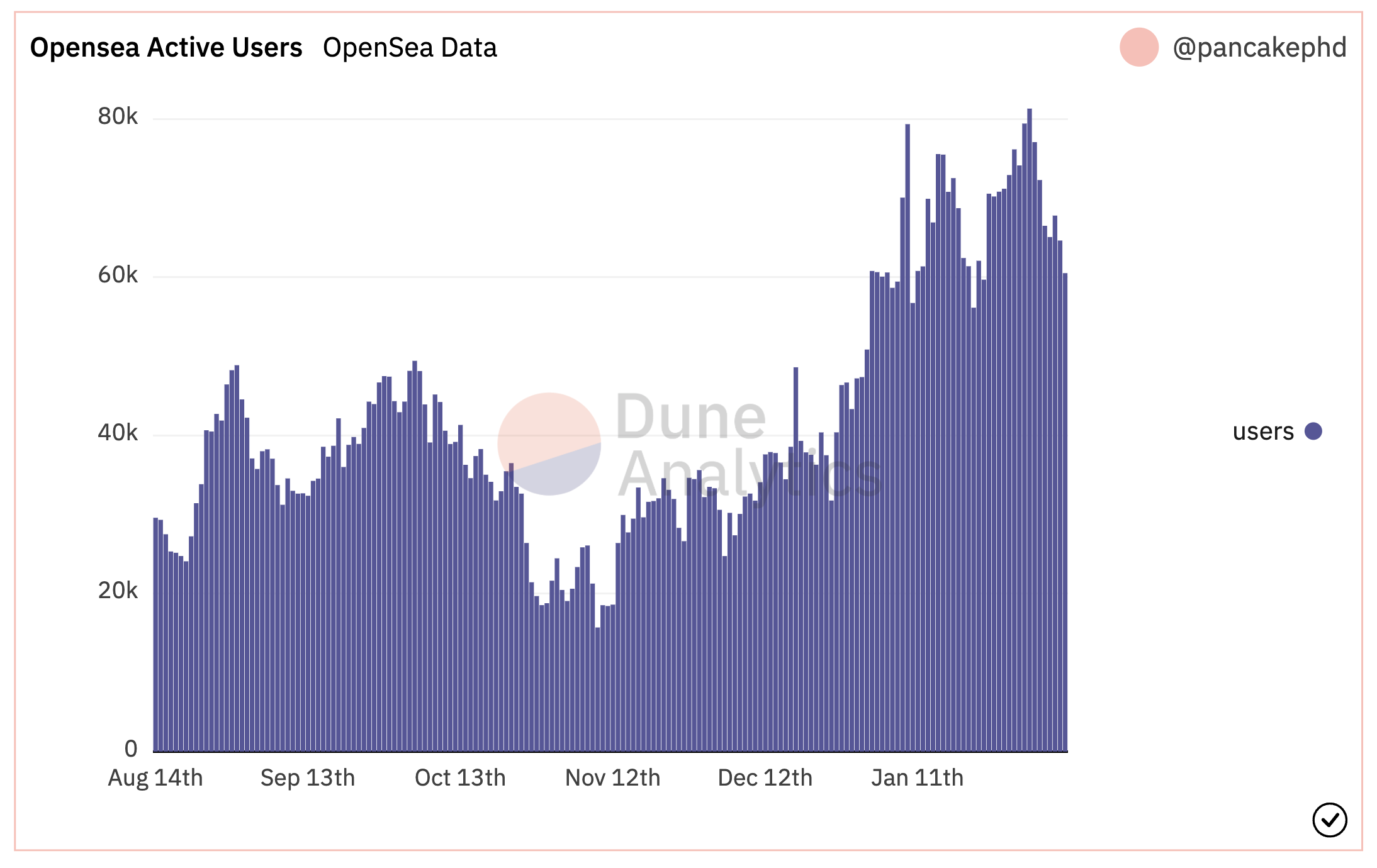

While it seems OpenSea is keeping pace with January’s total volume of $5 billion by generating over $1.3 billion in total volume the last 7 days, the number of active users has decreased by more than 30% according to data from Dune Analytics.

Are we beginning to see a lull in trader activity as a sign of an impending market pullback or are investors and collectors taking their trading activity elsewhere?

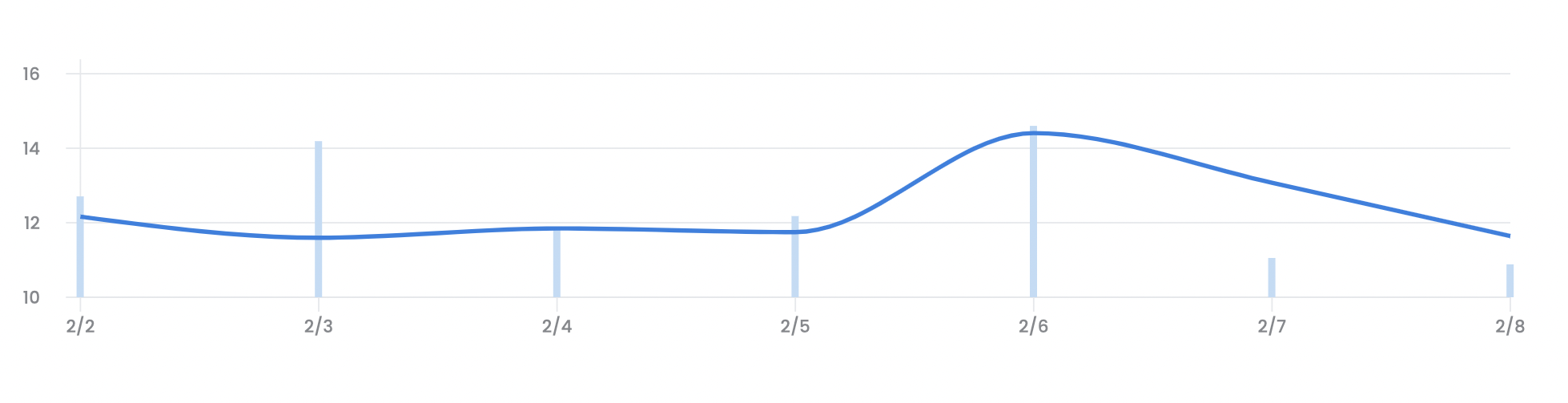

OpenSea daily active users. Source: Dune Analytics

OpenSea daily active users. Source: Dune Analytics

The closest rival to the market-place is LooksRare has generated approximately $3.49 billion in the last 7 days, but persistent issues of wash-trading have also decreased its active trader count by 3%.

There are a few factors that could be influencing OpenSea’s overall decrease in volume and drop-off in active traders. After all, nothing lasts forever. However, the NFT market doesn’t fail to surprise either.

Hape Prime snatched the top spot

Hape Prime, a collection of 8,200 3D fashion-forward apes, entered the scene and took the top spot in the last 7 days for total volume transacted. The project netted over $13.6 million in total sales and has made quite an impression on investors. Whether this impression was good or bad is another story.

The collection quickly reached meme status but still managed to increase its 7-day total volume sales by nearly 80%. During the same time, other notable collections, including Azuki and CloneX, decreased their total volumes by at least 50%.

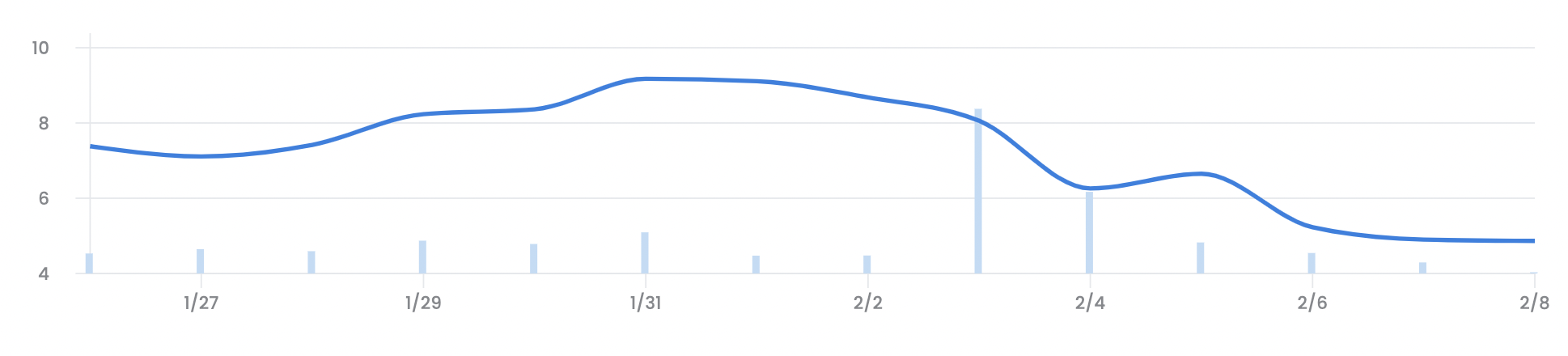

On Jan. 31 the daily average price of Hape Prime was 9.17 Ether and has since fallen over 55% since the reveal, suggesting traders may have bought into the hype. An interesting fact to note is that there are nearly 6,000 unique owners.

Hape Beast 14-day average price and volume. Source: OpenSea

Hape Beast 14-day average price and volume. Source: OpenSea

Wavering anticipation impacts KaraFuru’s price

Since its launch on February 4th, KaraFuru has steadily maintained an average 4 Ether floor ($12,506.36) and the small collection of 5,555 has 4,000 owners according to data from cryptoslam.

Holders seem to be awaiting its reveal on February 10, which could be why the daily average price of sales have been seeing a recent uptick.

☀️ KARAFURU REVEAL ☀️

Save the date as we will all finally meet our Karafurus!

• Thursday 3pm UTC February 10, 2022

LFG FURUS #KarafuruNFT pic.twitter.com/JTmUPKeukB

— Karafuru NFT (@KarafuruNFT) February 6, 2022

KaraFuru has generated over $44.8 million in total sales volume with some in the community sweeping the floor over beliefs that the project has huge potential.

Drops, on drops, on drops for CloneX holders

CloneX currency ranks third in total sales with the all-time price of one avatar being 10 Ether ($31,000.) RTFKT studios airdropped one NFT for each CloneX and Space Pod held by a collector.

CloneX all-time average price / volume: OpenSea

CloneX all-time average price / volume: OpenSea

RTFKT is delivering on its airdrop season by dropping holders a MNTHL and Loot Pod NFTs. MNTHL’s current floor price is nearly 5 Ether and has been wavering a bit as collectors have received notice that the Nike-marked NFT will not reveal itself until it is triggered.

info on D.A.R.T X

and how it affects MNLTH reveal→ Reveal is not based on a date, but triggers

→ Triggered by the community

→ Triggered by the blockchain.Quest and clues will be given weekly, if you, RTFKT community, achieves those missions,

the MNLTH will react — RTFKT Studios (@RTFKTstudios) February 7, 2022

Between the MNLTH and Loot Pod NFTs, holders were essentially dropped at least 6 Ether ($18,500) at the current floor of each NFT. This doesn’t account for the range in price, but it seems it is just the beginning with more opportunities for entrants into the ecosystem.

HypeBears Official claws its way closer to the top

The HypeBears collection sold out on Feb. 3, with no apparent public mint available and many hopefuls were very frustrated by the process. Minting a HypeBear didn’t come cheap at 0.4 Ether ($1,240).

HypeBears seems to have gained the attention of traders with its rather vague but desirable roadmap touting 50% royalties, a prospective governance token and access to other blue chip projects.

As a self-proclaimed blue-chip driven project, HypeBears has amassed over $40 million in total sales volume since its launch on Feb. 2, However hot its sales have been, its contract revealed vulnerabilities and potential exploits for holders.

A word of caution on Hype Bears: The contract is safe to mint from; you won’t get drained. However, your bears may not be safe. Read on (this is short, I promise) pic.twitter.com/nMMVUXb2xh

— quit (@0xQuit) February 2, 2022

Despite falling nearly 49% from its highest daily average sale price of 1.37 Ether, HypeBears briefly took Azuki’s place in the charts.

Azuki dropped in total volume and average daily sales

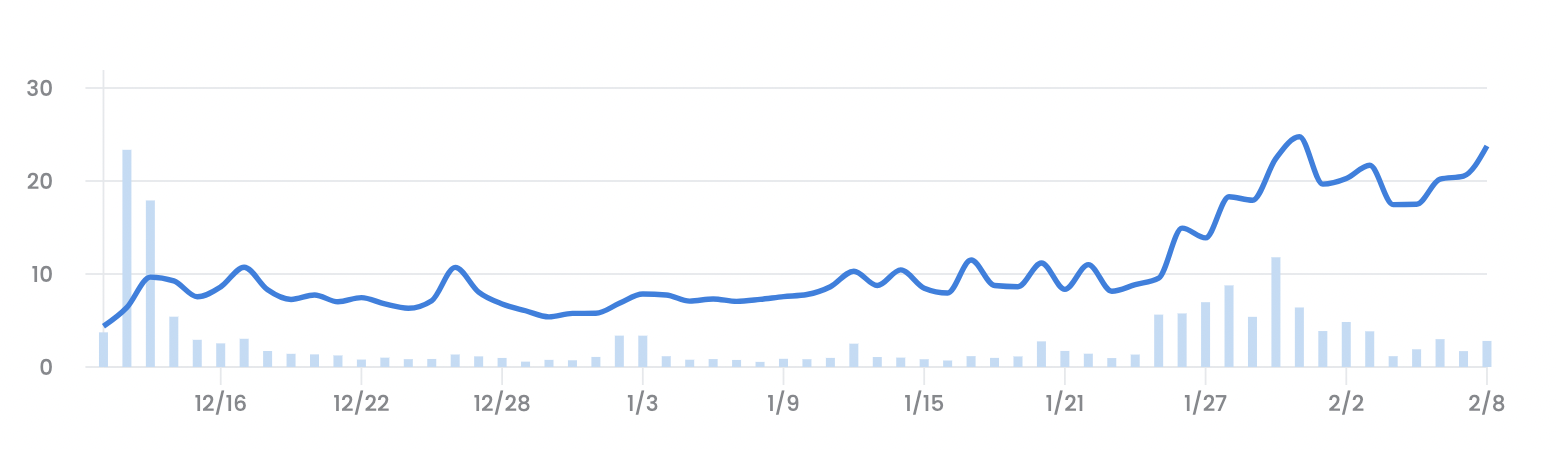

Since its launch on Jan. 11, Azuki has closed out over $313 million in total volume according to OpenSea. In the last 7 days alone, it generated over $33 million, but the average number of sales per day has declined by nearly 66%

7 day average price / volume: OpenSea Azuki

7 day average price / volume: OpenSea Azuki

Despite the decreasing number of average sales and volume, Azuki has increased its average sales price significantly, rising approximately 40% in nearly one month. This suggests many collectors are willing to pay handsomely to hold these anime-inspired NFTs,

The floor price chart from OpenSea shows that Azuki’s floor price has dipped slightly below the coveted 10 Ether mark, but on LooksRare, buyers are happily forking out at least 11 Ether per NFT.

By trading in a $3,000 discount for trading rewards, users are opting to purchase pieces on LooksRare, and perhaps continue to stand their ground against OpenSea.

It seems new NFT collections are entering in full-force and are determined to claim their spot on the charts, knocking other top contenders from their place.

OpenSea has clearly closed out a record breaking start to the new year, but are these types of gains sustainable when the market is seeing a drastic cut in active traders and daily volume?

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.