Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend.

Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021.

Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain.

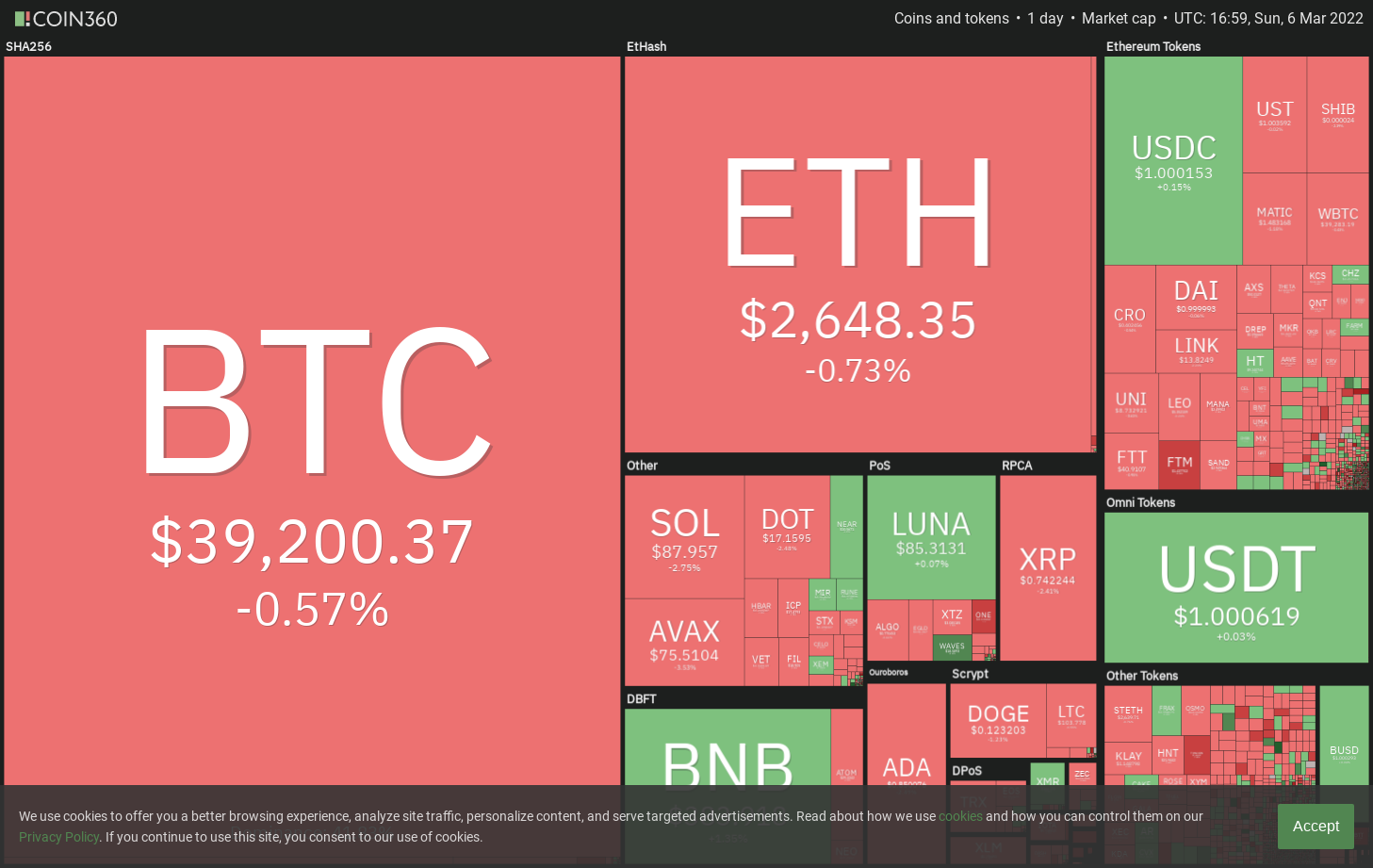

Crypto market data daily view. Source: Coin360

Crypto market data daily view. Source: Coin360

Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to come out ahead. On the other hand, if the stock market recovers, then Bitcoin could “rise at a greater velocity” if past patterns repeat.

Although crypto markets are facing strong headwinds, select altcoins are showing signs of life. Let’s study the charts of the top-5 cryptocurrencies that could benefit from a rebound in Bitcoin.

BTC/USDT

Bitcoin broke below the moving averages on March 4, suggesting that bears are attempting to gain the upper hand. The bulls tried to trap the aggressive bears by pushing the price back above the moving averages on March 5 and March 6 but they failed.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingView

If the price sustains below the moving averages, the bears will try to pull the BTC/USDT pair to the support line of the ascending channel. The bulls are likely to defend this level aggressively. A strong rebound off this support will suggest that the pair could extend its stay inside the channel for a few more days.

This short-term bearish view will invalidate if the price turns up from the current level and breaks above the 20-day exponential moving average ($40,474). That will indicate strong buying at lower levels. The bulls will then attempt to push the price toward the resistance line of the channel. The next trending move is likely to begin after the pair breaks above or below the channel.

BTC/USDT 4-hour chart. Source: TradingView

BTC/USDT 4-hour chart. Source: TradingView

The 20-EMA on the 4-hour chart has turned down and the relative strength index (RSI) is in the negative zone, indicating that bears have the upper hand. If the price breaks below $38,000, the pair could drop to $37,000 and then to $35,500.

Contrary to this assumption, if the price turns up from the current level and rises above the 20-EMA, it will suggest strong buying at lower levels. The bullish momentum could pick up after the pair breaks and closes above the 50-simple moving average. That could open the doors for a possible rally to $45,000.

XRP/USDT

Ripple (XRP) has been attempting to rise above the downtrend line for the past few days but the bears have held their ground. A minor positive is that the bulls have not given up and are trying to defend the 50-day SMA ($0.72).

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingView

The flattish moving averages and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. If bulls push and sustain the price above the downtrend line, the momentum is likely to pick up and the XRP/USDT pair could rally to $0.91.

A break and close above this level could clear the path for a possible retest of the psychological resistance at $1. Conversely, if the price slips and sustains below $0.69, it will suggest that bears are back in control. The pair could then drop to $0.62.

XRP/USDT 4-hour chart. Source: TradingView

XRP/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the pair is currently range-bound between $0.80 and $0.70. If buyers push the price above the downtrend line, the pair could challenge the overhead resistance at $0.80. A break and close above this level could signal that bulls have the upper hand. The pair could first climb to $0.85 and then to $0.91.

Contrary to this assumption, if the price turns down from the moving averages, it will suggest that bears are selling on rallies. The pair could then drop to $0.70. If this level cracks, the selling could accelerate and the pair could drop to $0.62.

NEAR/USDT

NEAR Protocol (NEAR) is sandwiched between the moving averages for the past few days. This shows that bears are selling on rallies to the 50-day SMA ($11) while bulls are buying on dips to the 20-day EMA ($10).

NEAR/USDT daily chart. Source: TradingView

NEAR/USDT daily chart. Source: TradingView

The RSI is near the midpoint and the 20-day EMA has flattened out, indicating a status of equilibrium between the bulls and the bears. If the price rebounds off the current level and breaks above $12, it will suggest that bulls are on a comeback. The NEAR/USDT pair could then rally to $14 where it may again encounter strong resistance from the bears.

Contrary to this assumption, if the price breaks and sustains below the 20-day EMA, it will suggest that the bears have the upper hand. The pair could then drop to the strong support at $8.

NEAR/USDT 4-hour chart. Source: TradingView

NEAR/USDT 4-hour chart. Source: TradingView

The pair picked up bullish momentum after breaking above the downtrend line but the relief rally is facing strong resistance at $12. The bears pulled the price below the 20-EMA but the bulls have managed to defend the 50-SMA.

If buyers push and sustain the price above the 20-EMA, the bulls will again try to clear the overhead hurdle at $12. Alternatively, if the price breaks below the 50-SMA, the selling could intensify and the pair could slide to $9.50.

Related: Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

XMR/USDT

Monero (XMR) has been correcting inside a descending channel for the past several weeks. The bulls are buying the dips to $134 and attempting to form a basing pattern.

XMR/USDT daily chart. Source: TradingView

XMR/USDT daily chart. Source: TradingView

This has resulted in a consolidation between $134 and $188 for the past few days. The 20-day EMA ($164) has flattened out and the RSI is close to the midpoint, indicating a balance between supply and demand.

This equilibrium will shift in favor of the buyers if they push and sustain the price above $188. That will complete a double bottom pattern, which has a target objective at $242. However, the rally is unlikely to be easy as the bears are expected to mount a strong defense at the resistance line of the channel.

Contrary to this assumption, if the price turns down and slips below $155, the bears will attempt to pull the XMR/USDT pair to $134.

XMR/USDT 4-hour chart. Source: TradingView

XMR/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the bulls pushed the price above the downtrend line, but could not sustain the higher levels. This indicates that the bears are aggressively defending this level. The moving averages are flattening out and the RSI is just below the midpoint, indicating a balance between supply and demand.

If the price turns down and slips below $155, the short-term trend could turn in favor of the bears. Conversely, a close above the downtrend line could improve the prospects of a possible rise to the overhead resistance at $188.

WAVES/USDT

Waves (WAVES) formed a double bottom pattern at $8 and rallied sharply to $21. The moving averages have completed a bullish crossover and the RSI is in the overbought zone, indicating that bulls have the upper hand.

WAVES/USDT daily chart. Source: TradingView

WAVES/USDT daily chart. Source: TradingView

The bears are posing a stiff challenge near $20 but a positive point is that bulls have not given up much ground. If the price turns up from the current level, it will suggest that bulls are buying on dips. That will increase the possibility of a retest at $21.

If bulls push and sustain the price above $21, the WAVES/USDT pair could pick up momentum and rally toward $24 and then $27. This positive view will invalidate in the short term if bears pull and sustain the pair below $16.

WAVES/USDT 4-hour chart. Source: TradingView

WAVES/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the correction from $21 pulled the RSI from deeply overbought levels to just below the midpoint. The bulls purchased the dip to the 38.2% Fibonacci retracement level at $16 and have pushed the price back above the 20-EMA.

If the price sustains above the 20-EMA, the bulls will attempt to drive the pair above the overhead resistance at $21.

Contrary to this assumption, if the price turns down from the current level and breaks below the moving averages, it will suggest that the short-term traders may be rushing to the exit. That could pull the pair to $14 and then $13.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.