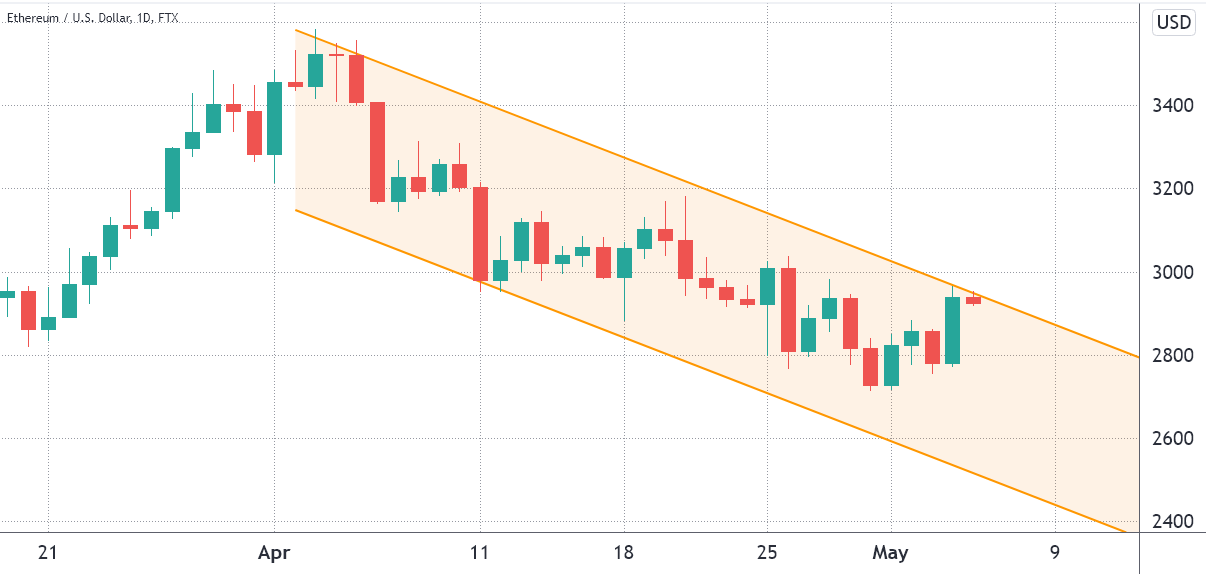

Despite bouncing from a 45-day low on April 30, Ether (ETH) price is still stuck in a descending channel and the subsequent 9% gain over the past four days was just enough to get the altcoin to test the pattern’s $2,870 resistance.

Ether/USD price at FTX. Source: TradingView

Ether/USD price at FTX. Source: TradingView

Federal Reserve monetary policy continues to be a major influence on crypto prices and this week’s volatility is most likely connected to comments from the FOMC. On May 4, the United States Federal Reserve raised its benchmark overnight interest rate by half a percentage point, which is the biggest hike in 22 years. Although it was a widely expected and unanimous decision, the monetary authority said it would reduce its $9 trillion asset base starting in June.

Chairman Jeremy Powell explained that the Federal Reserve is determined to restore price stability even if that means hurting the economy with lower business investment and household spending. Powell also dismissed the importance of the gross domestic product decline over the first three months of 2022.

Even though Ether’s price has corrected by 14% over the course of a month, the network’s value locked in smart contracts (TVL) increased by 7% in 30 days to 25.2 million Ether, according to data from DefiLlama. For this reason, it is worth exploring if the price drop below $3,000 impacted derivatives traders’ sentiment.

ETH futures show traders are still bearish

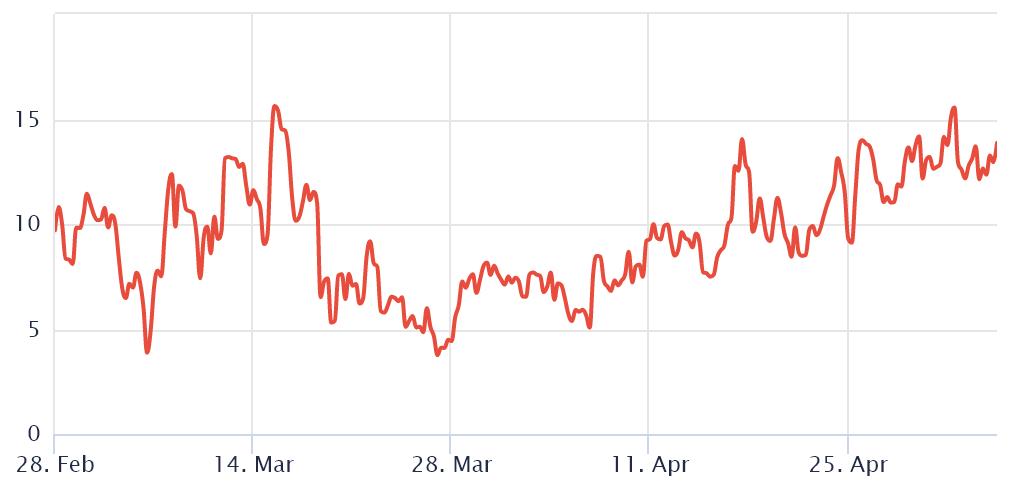

To understand whether the market has flipped bearish, traders must analyze the Ether futures contracts’ premium, also known as the basis rate. Unlike a perpetual contract, these fixed-calendar futures do not have a funding rate, so their price will differ vastly from regular spot exchanges.

One can gauge the market sentiment by measuring the expense gap between futures and the regular spot market.

Ether 3-month futures premium. Source: Laevitas.ch

Ether 3-month futures premium. Source: Laevitas.ch

To compensate for traders’ deposits until the trade settles, futures should trade at a 5% to 12% annualized premium in healthy markets. Yet, as displayed above, Ether’s annualized premium has been below such a threshold since April 5.

Despite a slight improvement over the past 24 hours, the current 3.5% basis rate is usually deemed bearish as it signals a lack of demand for leverage buyers.

Related: Fed hikes interest rates by 50 basis points in effort to combat inflation

Sentiment in options markets worsened

To exclude externalities specific to the futures instrument, traders should also analyze the options markets. For instance, the 25% delta skew compares similar call (buy) and put (sell) options.

This metric will turn positive when fear is prevalent because the protective put options premium is higher than similar risk call options. The opposite holds when greed is prevalent, causing the 25% delta skew indicator to shift to the negative area.

Ether 30-day options 25% delta skew. Source: Laevitas.ch

Ether 30-day options 25% delta skew. Source: Laevitas.ch

A 25% skew indicator range between negative 8% and positive 8% is usually considered a neutral area. However, the metric has been above such a threshold since April 16 and is currently at 14%.

With option traders paying higher premiums for downside protection, it is safe to conclude that the sentiment has worsened in the past 30 days. Presently, there is a growing sense of bearish sentiment in the market.

Of course, none of this data can predict if Ether will continue to respect the descending channel, which currently holds a $2,950 resistance. Still, considering the current derivatives data, there is reason to believe that an eventual pump above $3,000 will likely be short-lived.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.