According to a statement on Mar. 9, bank messaging platform Society for Worldwide Interbank Financial Telecommunications, or SWIFT, disclosed that the financial institution witnessed positive results related to its pilot test of linking different central bank digital currencies (CBDCs).

During a 12-week testing period, SWIFT simulated nearly 5,000 transactions between two different blockchain networks and existing fiat payment systems. Over 18 financial institutions worldwide participated in the study, including the Royal Bank of Canada, Banque de France, Société Générale, BNP Paribas, Monetary Authority of Singapore, HSBC, Deutsche Bundesbank, NatWest, and more. As told by SWIFT:

“Overall, the results of the sandbox testing found that Swift’s experimental interlinking solution can meet the needs of central and commercial banks for CBDCs interoperability, ensuring CBDCs can be successfully used in cross-border payments.”

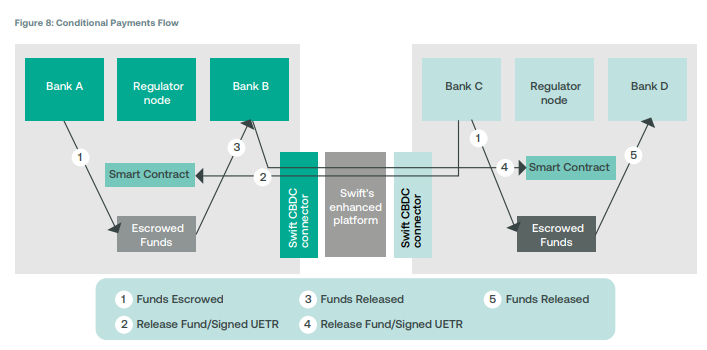

Furthermore, SWIFT said there was a “strong degree of alignment” between participants as to how CBDCs are likely to function in the future. For the next steps, SWIFT plans to run a second phase of its CBDC sandbox and develop its “CBDC interlinking solution into a beta version for payments with enhanced atomicity.”

Within the next couple of years, SWIFT expects 24% of central banks to develop a CBDC solution. Over 110 central banks around the world are currently investigating the use cases of CBDCs. Lewis Sun, Global head of domestic and emerging payments at HSBC, commented:

“Interoperability is key to realising the potential of CBDCs to deliver real-time cross-border payments. While interest in CBDCs is growing, so is the risk of fragmentation as a widening range of technologies and standards is being experimented with.”