Is This the Ultimate Way to Play the $2.5 Trillion Crypto “Gold Rush”?

With multiple product offerings, TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) has built a portfolio with unstoppable momentum

On January 24, 1848, the California Gold rush officially began.

Over 300,000 prospectors flooded into the state – the equivalent of over 3 million today.

But who really got rich?

Research has proven it was the merchants who really “struck gold”[1].

They made far more money than the miners (about half of whom made nothing but a “modest” profit).

One of these merchants, Samuel Brennan, even became the richest man in California for a time.

And all he did was open a shop that supplied miners with the needed equipment – such as picks and shovels.

Today, that strategy is called a “pick-and-shovel” play. And it could be:

The Perfect Way for Ordinary Investors to Profit From a Highly Popular but Volatile and Insecure Commodity – Like Cryptocurrencies

Between November 2020 and May 2021, over a trillion dollars has flooded into the crypto markets…

The market soared from under $400 billion to over $1.5 trillion by end-May – with a peak of over $2.5 trillion[2].

But as the recent selloff has shown, crypto is still highly volatile.

Many crypto investors also admit they understand very little about the technology behind crypto, which places their crypto holdings at risk[3].

So it’s no wonder that crypto scams have surged by over 1,000% since October[4].

Because in crypto, there is absolutely no recourse if you lose your money.

Unless you have the technical know-how to set up cold wallets, secure seed phrases, and verify transaction addresses, your crypto may be at risk.

This has kept more conservative investors away from crypto – but at the painful cost of missing out on massive gains.

But what if you could have:

A Safe Way of Amplifying Crypto’s Gains – Without Excessive Risks

That’s what a fast-growing company TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) could do.

The company acquires and invests in high-potential companies that each help investors better access the cryptocurrency markets – from fiat-to-crypto payment technology gateways and digital wallets to cryptocurrency exchanges.

In other words, investing in a company like this is similar to investing in a carefully selected variety of “pick-and-shovel” companies.

Which could make TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) the ultimate pick-and-shovel play to safely capitalize on the ongoing crypto gold rush that could break out quicker than you can blink.

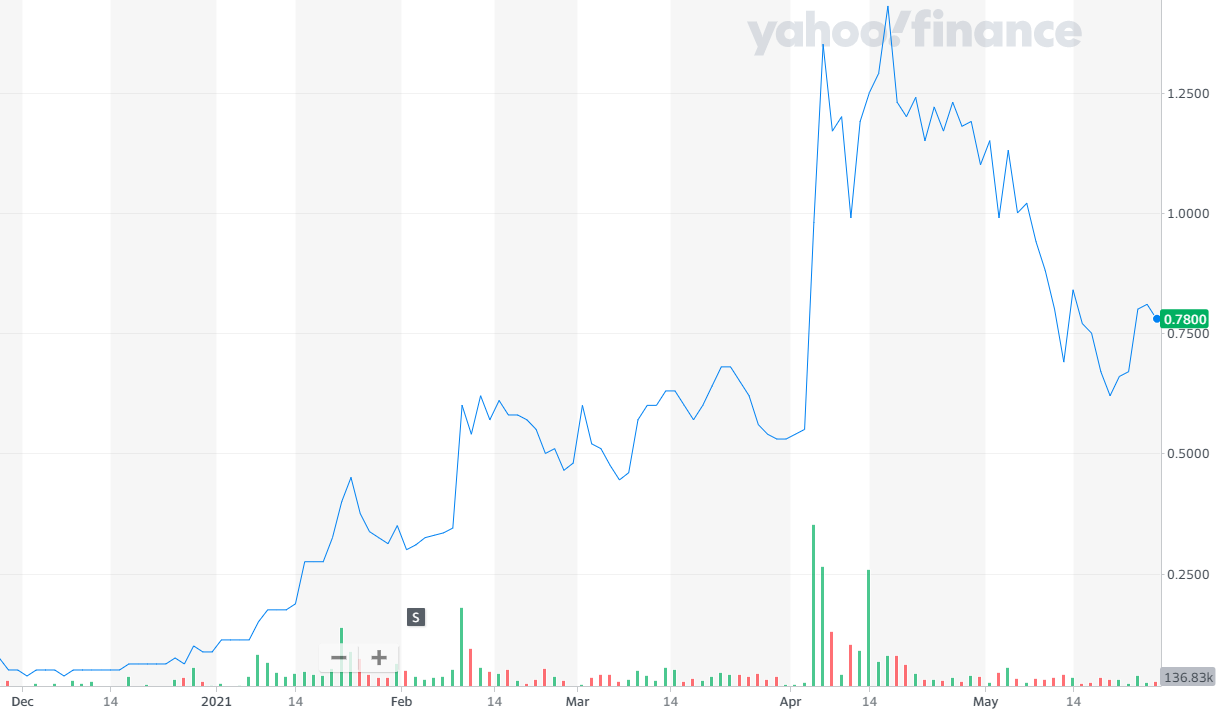

And as its recent price action shows, it could deliver better returns when the crypto markets are rising – without taking on extra losses when it falls.

Take a look:

From Dec 1, 2020 to April 16, 2021 (its most recent peak) TechX Technologies Inc.’s (CSE:TECX) (OTC:TECXF) stock price increased from C$0.0375 to C$1.43[5].

Even accounting for its 2.5-to-one share consolidation on Feb 1,2021[6], that equates to an astounding 1,425% gain.

In contrast, Bitcoin went from $19,775 on Dec 1 to a peak of $64,529 on April 14[7] – a gain of “only” 226%.

And the entire crypto market increased from $581.33 billion on Dec 1 to $2.57 trillion on May 7[8] – a 341% gain.

In other words, TechX Technologies Inc.’s (CSE:TECX) (OTC:TECXF) delivered almost 5x the returns of crypto and 7x the return of Bitcoin during the uptrend.

But what about the downside – how did the company’s stock fare in the recent selloff?

As the table below shows, the company delivered tremendously higher returns on the upside while having roughly the same downside impact.

| TechX Technologies Inc. | Bitcoin | Overall Crypto Market | |

| Maximum Gain (Dec 1, 2020 to Recent Peak) | 1,425% | 226% | 341% |

| Selloff Losses (Recent Peak to May 28, 2021) | -45% | -45% | -38% |

| Total Gain (Dec 1, 2020 to May 28, 2021) | 732% | 80% | 176% |

TechX Technologies Inc. stock consolidationfully accounted for

And we know that despite the recent selloff, crypto is here to stay for the long term[9].The result? The company’s overall stock performance has absolutely crushed that of crypto.

This means the company could be an easy vehicle for investors to potentially earn multiple times the upside of crypto – without taking on additional downside risks.

But this is only one of many reasons why TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) is the ultimate crypto pick-and-shovel play.

7 Reasons TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) is the Ultimate Pick-and-Shovel Play for the Crypto Gold Rush

- Extremely Low Market Cap Compared To Its Peers (for now): With a market cap of C$85 million as of June 4, 2021, the company is still highly accessible to investors – making it an attractive opportunity with the potential of growth still ahead after the numerous investments and acquisitions it has made.

- Recent Stock Price Performance is Almost 5x Better Than Crypto: As we have shown, the company’s stock has performed almost 5x better than crypto overall and over 9x better than Bitcoin.

- Diversified Exposure to Multiple High-Potential Pick-and-Shovel Crypto Companies: TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) gives investors diversified exposure to crypto-fiat payment processors, digital wallets, and crypto exchanges.

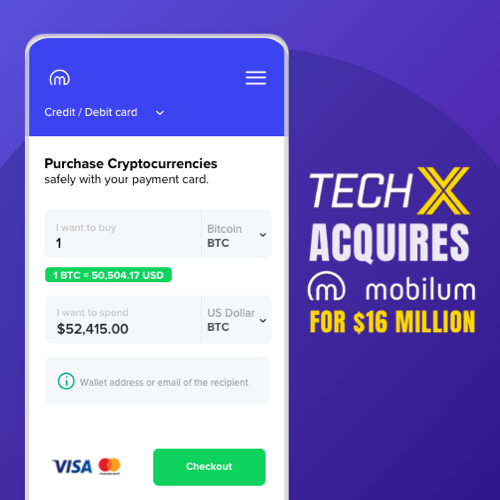

- Newest Wholly-Owned Subsidiary Mobilum Looks Like It Could See a Massive Growth Surge: TechX acquired Mobilum for C$16m, a fiat-to-crypto credit card and crypto payment gateway and digital wallet. Its growth had been previously held back by a lack of liquidity but the acquisition removes this barrier.

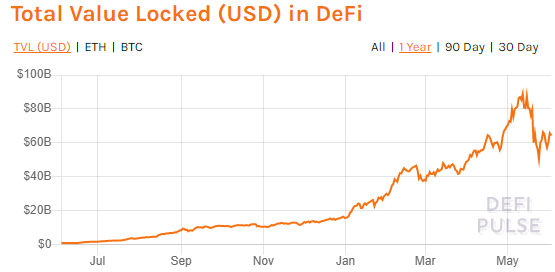

- It’s Soon-to-be-Launched uBUCK Wallet Will Allow Millions to Easily Access the Red-Hot DeFi Space: Decentralized finance has grown exponentially, with the total value of crypto tokens “locked” growing from just over $1 billion in June 2020 to almost $65 billion at end-May 2021[10]. The reason? DeFi offers the ability to earn yields dozens of times higher than the so-called “high-yield” savings accounts at traditional financial institutions. And the company’s uBUCK Wallet gives retail users easy and almost instant access to this lucrative space, where they can earn yields up to 16% APY – 3.5% higher than the closest competitor.

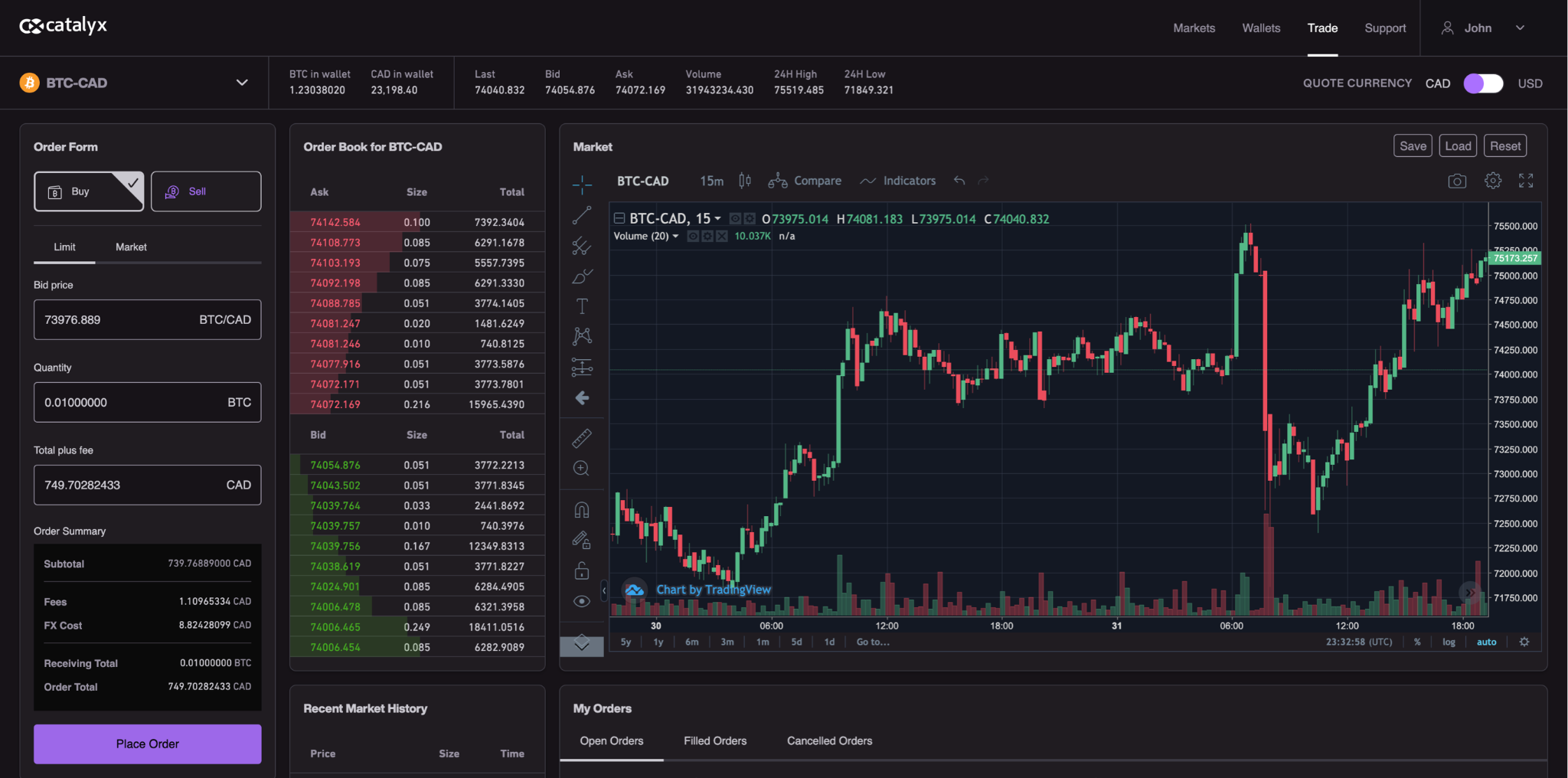

- Catalyx Investment Gives it an Entry Point in the Lucrative Crypto Exchange Market: The company owns a 19% stake in Catalyx, Canada’s premier cryptocurrency exchange. Catalyx is growing fast, hitting a 1,542% quarterly increase in trading volume from Q4 2020 to 1Q 2021, alongside a 545% increase in revenues[11]. In May, these continued to shoot up, with a monthly trading volume and revenue growth of 73% and 97%[12]. CADX stablecoin to be listed any day now on Bittrex Global, the 15th largest exchange in the world.

- Multiple Revenue Streams from its Future Growth Roadmap: The company has been rapidly acquiring and investing in companies, with five deals in 2021 alone. But that’s just the beginning. The company is planning to expand into multiple other areas, such as arbitrage trading, tokenized equities, and lending. And it already has a war chest of C$10m to fund such an expansion.

With Visa and Mastercard Joining the Crypto Race, TechX Technologies Inc’s. (CSE:TECX) (OTC:TECXF) Subsidiary Mobilum is Well-Positioned to Ride the Incoming Wave

On Feb 10, 2021, Mastercard announced that it would soon start supporting select cryptocurrencies directly on its network[13].

Less than two months later, Visa announced it will allow the use of cryptocurrency USD Coin – a stablecoin whose value is pegged to the USD – on its payment network[14].

To put that into perspective, Visa and Mastecard hold a combined 90% market share of the credit and debit card market[15] – which accounts for over $7 trillion in payment volume in the US alone[16].

Once this happens, we can expect a massive wave of new users to enter the crypto market – many of whom will be using their credit cards to purchase crypto.

This means that cryptocurrency businesses – such as exchanges – must quickly integrate the ability to process credit card payments and convert them into crypto.

That’s great news for TechX Technologies Inc’s. (CSE:TECX) (OTC:TECXF) newest subsidiary, Mobilum.

Mobilum is a plug-and-play fiat-to-crypto credit card payment processing gateway that enables cryptocurrency businesses to quickly and easily integrate Visa and Mastercard.

With a zero chargeback guarantee, coupled with the highest acceptance rates and lowest transaction fees in the industry of 2.99%, Mobilum is poised for major growth.

It already processes between C$100,000 to C$250,000 in transactions a day and has major customers such as KuCoin – the sixth largest cryptocurrency exchange in the world with over 8 million global users[17].

But the best part? Mobilum’s main challenge was not getting new business, but obtaining liquidity to support a rapidly increasing transaction volume.

“With very few exchanges offering credit card processing, we’ve seen an exponential increase in demand from exchanges and cryptocurrency businesses to utilize our on-ramp solution. The recent crypto correction has actually increased our processing volume because investors want to get in on the price dips. By merging with TechX, Mobilum will be able to increase its liquidity, giving us the ability to process millions of dollars in transactions per month.”

~Wojtek Kaszycki, CEO, Mobilum

You’ve probably noticed their direct competitor, Banxa Holdings Inc. rocketing from C$1.58 on January 28th to a high of C$8.30 on March 18th. Banxa is currently sitting at a market cap of C$182 million, almost $100m more than TechX.

With the acquisition by TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) and the added liquidity, we can expect Mobilum’s processing volume to surge rapidly and compete head to head with Banxa on more exchange platforms.

TechX Technologies Inc’s. (CSE:TECX) (OTC:TECXF) uBUCK Wallet Could Soon Provide Millions With Easy Access to the Red-Hot DeFi Space

With Mobilum now part of the TechX family, the company can use its fiat-to-crypto gateway solution as a powerful onboarding ramp for its uBUCK digital wallet – which will be making its debut in late Q2 or early Q3 this year.

But the uBUCK wallet is no ordinary crypto wallet that is not only used for storing, receiving, and sending crypto, but it’s also a portal that people can use to easily access the $60+ billion DeFi (decentralized finance) space, which has grown by 62x in the past year alone[18].

Why is DeFi such a big deal?

Because people are tired of the big banks who keep piling risks onto our centralized financial system – while never suffering any major consequences.

They’re tired of the banks paying out sub 1% interest rates (or sub 0.10% even!) while continuing to reap billions in profits as the average citizen is slowly crushed between rising costs of living and stagnant wages.

So it’s only natural that they’re drawn to a decentralized financial system – free of the value-sucking financial middlemen – that can also pay double-digit yields.

The uBUCK digital wallet allows users to stake their tokens and earn up to 16% APY on select cryptocurrencies.

On top of that, users can buy and sell over 237 cryptocurrencies using any of the 82 supported fiat currencies.

In short:

Once Launched, the uBUCK Digital Wallet Will Further Increase Mobilum’s Liquidity to Process Even More Credit Card Transactions For the Payment Processing Business

Because again – why bother with paltry sub 1% yields when you can just open a simple app on your phone, input a few credit card details (or connect your bank account to make a deposit), and immediately earn multiple times that amount?

Earning passive income like this without lifting a finger is music to our ears.

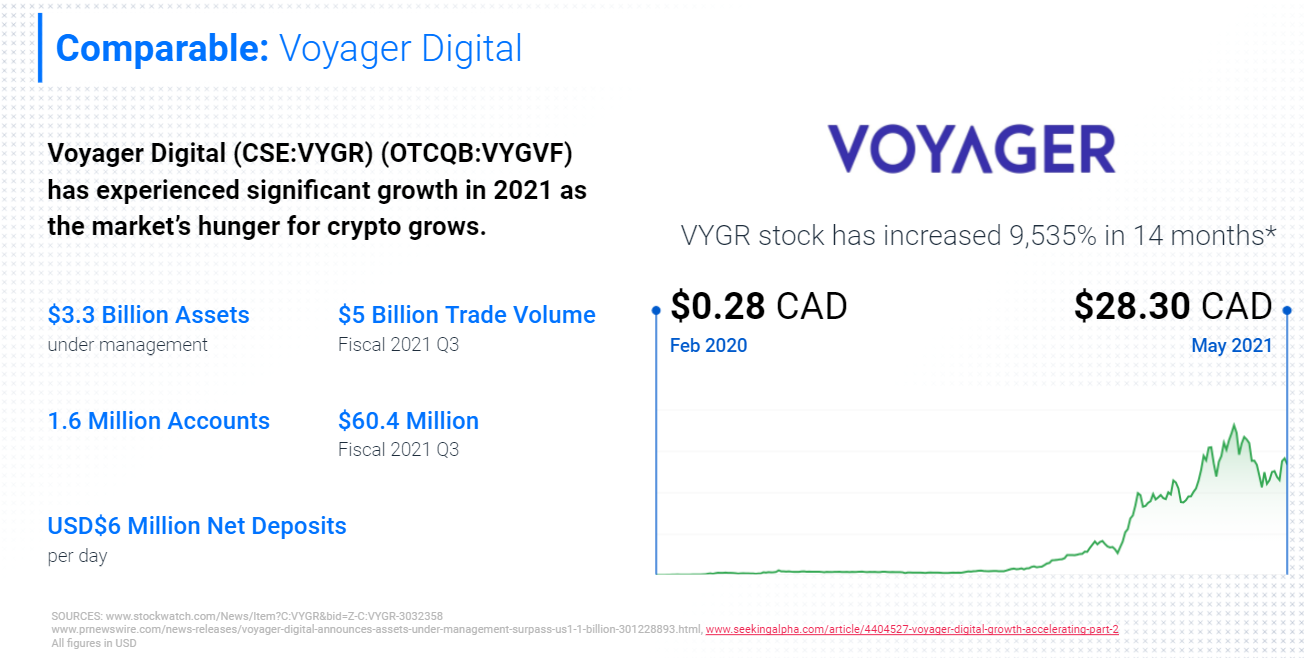

We’ve already seen how Voyager Digital, which offers interest rates of up to 9%[19], has attracted over multi-billions of dollars from people sick of what the banks are offering.

It reached $100 million in assets under management in the beginning of November 2020[20]. Just six months later, this had swelled to over $3.3 billion[21] – a 3,200% increase.

And with the uBUCK wallet enabling users to earn a higher interest of up to 16% APY (3.5% higher than the closest competitor), it might not be a stretch to say that:

Voyager Digital, which commands a market cap of over C$3.5 billion as at end-May 2021[22] has had incredible growth over the past 14 months.

Companies like Riot Blockchain, Marathon Digital Holdings, and Voyager Digital have all reached multi-billion dollar valuations while delivering huge returns to early investors.

But these companies are competing in the increasingly crowded market of crypto miners and exchanges. Their high valuations also mean that newer investors may have to accept more normal returns, with most of the mega gains having gone to the early investors.

On the other hand, TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) is still trading at a valuation of $85 million, with most of its growth potential still ahead.

On top of that, it seems clear that one of its pick-and-shovel plays – fiat-to-crypto on ramping – may be the next growth frontier for publicly-listed blockchain companies.

- As previously mentioned, fiat-to-crypto payment gateway provider Banxa began trading in January on the TSX Venture with a market cap of C$50 million. Two months later, the company listed on the OTC and its stock price skyrocketed from C$1.58 to a high of C$8.30[23].

- Simplex, another fiat-crypto payment gateway provider, was acquired by Nuvei – Canada’s largest private and non-bank payment processor – for $250 million[24]. Nuvei itself has a market cap of over C$12 billion[25].

| Company | Symbols | Market Cap (CAD) | Stock Price (CAD) |

| TechX Technologies Inc. | CSE:TECX OTC:TECXF | $80 Million | $0.69 |

| Banxa Holdings | TSXV:BNXA OTC:BNXAF | $182.4 Million | $4.05 |

| Voyager Digital | CSE:VYGR OTC:VYGVF | $3.32 Billion | $23.48 |

| Mogo | TSX:MOGO OTC:MOGO | $542.6 Million | $9.11 |

| Hive Blockchain | TSXV:HIVE OTC:HVBTF | $1.13 Billion | $2.99 |

*** As at June 4, 2021

This is great news for TechX Technologies Inc.’s (CSE:TECX) (OTC:TECXF) subsidiaries Mobilum and XPort Digital (another fiat-crypto payment processor it acquired shortly before Mobilum[26]).

But again, this is still just a small part of the company’s full potential.

Catalyx Trading Volume and Revenues Increasing

There’s the 19% stake in fast-growing Canadian (and fully FINTRAC-compliant) crypto exchange Catalyx – which has just signed Mobilum as its fiat-crypto payment gateway. Catalyx.io, achieved substantial growth in trading volume, revenue, transaction numbers and average daily active users.

The exchange has seen a 545% increase in revenues and a 1,542% increase in trading volume between the Q4 2020 and Q1 2021[27]. These numbers have continued to shoot up, with May recording a monthly trading volume and revenue growth of 73% and 97%, respectively[28].All this was achieved purely from organic traffic, with zero paid media.

Catalyx reports the following key metrics from May 2021:

- Trading volume increased 73% from C$22.02 million in April 2021 to C$38.04 million in May 2021.

- Revenue increased by 97% from C$174,001.91 to C$343,367.15

- The number of transactions jumped 34% from 3,901 to 5,242

- Daily average number of active users increased by 51%

“We’re very pleased with our ongoing growth, especially seeing our trading volume increase by 73% during May’s crypto market crash. Instead of turning investors away, the reduced crypto prices created an attractive buying opportunity that clearly enticed more users to trade even more as the market became more volatile. It’s very encouraging to see Catalyx not only overcome, but thrive during market downturns.”

Catalyx CEO, Jae Park

Catalyx is also eagerly anticipating the launch of its CADX stablecoin on the 15th largest cryptocurrency exchange in the world, Bittrex Global. After its announcement on April 6th, TechX Technologies Inc.’s (CSE:TECX) (OTC:TECXF) stock rocketed up from C$0.55 to C$1.23 that day and hit a high of C$1.68 on April 14th.

We could see some more fireworks once it actually lists!

So, if you’re tired of watching from the sidelines as thousands of people “get lucky” with crypto and walk away with triple-digit gains for doing nothing, but you don’t want to directly invest in one of the 10,000 different cryptos out there (and risk getting your capital hacked or stolen)…

Then TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) could be a better and safer way to potentially earn even big profits than directly investing in crypto – just like how the merchants did during the California Gold Rush.

And instead of having to rely on the judgments of untrustworthy promoters shilling fantasy crypto coins, you can trust in a skilled and experienced management team with proven track records running real businesses.

TechX Technologies Inc.’s (CSE:TECX) (OTC:TECXF) Veteran Management Team

Peter Green – Chairman and CEO

Green has over 25 years of experience of building high performance teams in the international ICT marketplace. At Cable & Wireless Communications, he led the major transition of the UK and Ireland business. As President of Business Solutions at TELUS, he initiated and led the largest contract in the company’s history – a billion dollars over a 10-year period with the British Columbia government. Green transformed TELUS’ Small and Medium Business segment from a division in decline to a $100 million growth in just two years.

Wojtek Kaszycki – Founder & CEO, Mobilum

A pioneer in the area of Ecommerce and Mcommerce solutions, Kaszycki has over 24 years of experience creating and managing innovative technologies. From the beginning of his professional career, he has engaged in the implementation of innovations that change everyday life. Between 1996 and 2001, Kaszycki managed the first Ecommerce agency in Poland, AGS NewMedia, created the first Ecommerce portal in Poland Empik.com (Polish Amazon). Kaszycki is also the Founder and Chairman of BTC Studios, a publicly traded video gaming company listed on the Warsaw stock exchange.

Aaron Carter – Founder & CEO, Xport Digital

Mr. Carter has an extensive background in the financial industry and has worked with various fortune 500 companies in investment banking, online brokerage, market data and a prominent US equity exchange. At AlphaPoint, Mr. Carter played a pivotal role in building their whitelist exchange platform and developed a cohesive customer onboarding process that allowed sales to optimize their deal flow and exceed their target goals.

Michael Vogel – Independent Director

Michael Vogel is a well-known leader and pioneer in the Bitcoin world. He founded Netcoins in 2014, rapidly scaled the company as CEO & CTO to thousands of customers and millions in revenue, before leading the company to public listing in 2018. This made it the first crypto company of its type to be publicly listed. Netcoins, which was acquired by BIGG Digital Assets Inc. in 2018, is now one of the largest and longest operating Bitcoin exchanges in Canada. Michael is also the CEO of Coinstream, a Bitcoin company aimed at the US market, as well as founder and CEO of Encore Ventures.

Jae Park – Strategic Advisor

Jae Park is the CEO of Catalx Exchange, Canada’s premier cryptocurrency exchange. Jae is also the CEO for Innofoods, a global confectionery producer and distributor that generates $230+ million USD per annum and is Costco’s largest organic snack food supplier in the world. Jae also has successfully launched Innolifecare, the first blockchain-backed N95 masks approved by Health Canada. The platform traces where every piece of material was sourced from via a QR code.

Dominic Vogel – Advisor

As Founder & Chief Strategist at CyberSC, Dominic Vogel holds a proven track record within cybersecurity across a multitude of industries (financial services, logistics, transportation, healthcare, government, telecommunications, and critical infrastructure).

7 Reasons To Put TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) On Your Radar

- The company could be the ultimate pick-and-shovel play to capitalize on the ongoing crypto gold rush

- The company’s diversified business model means it has no true competitors

- Multiple powerful near-term growth catalysts from the Mobilum acquisition and the upcoming launch of the uBUCK wallet

- The company is just getting started with much of its growth still ahead and a clear roadmap to expand its revenue streams

- Its stock price performance has shown it could deliver many times the gains of crypto without taking on excessive risks

- Company still has a small market cap relative to its peers

- Despite the recent downturn, crypto and DeFi is here to stay, and this company could allow investors away to safely profit from this megatrend

- https://en.wikipedia.org/wiki/California_Gold_Rush#Profits ↑

- https://coinmarketcap.com/charts/ ↑

- https://www.cnbc.com/2021/03/04/survey-finds-one-third-of-crypto-buyers-dont-know-what-theyre-doing.html ↑

- https://www.cbsnews.com/news/bitcoin-cryptocurrency-investment-scams/ ↑

- https://finance.yahoo.com/chart/TECX.CN ↑

- https://www.prnewswire.com/news-releases/litelink-technologies-to-proceed-with-share-consolidation-301218734.html ↑

- https://coinmarketcap.com/currencies/bitcoin/ ↑

- https://coinmarketcap.com/charts/ ↑

- https://www.fnlondon.com/articles/weve-crossed-a-line-why-goldman-sachs-says-crypto-is-here-to-stay-20210316 ↑

- https://defipulse.com/ ↑

- https://www.prnewswire.com/news-releases/techx-announces-that-catalyx-achieved-a-1-542-quarter-over-quarter-increase-in-trading-volume-301268609.html ↑

- https://finance.yahoo.com/news/techx-announces-catalyx-achieved-97-113000136.html ↑

- https://www.mastercard.com/news/perspectives/2021/why-mastercard-is-bringing-crypto-onto-our-network/ ↑

- https://www.reuters.com/article/us-crypto-currency-visa-exclusive-idUSKBN2BL0X9 ↑

- https://www.reuters.com/article/us-visa-mastercard-stocks-idUSKBN1ZU0JA ↑

- https://www.fool.com/the-ascent/research/credit-debit-card-market-share-network-issuer/ ↑

- https://www.prnewswire.com/news-releases/techx-signs-definitive-agreement-to-acquire-mobilum-a-digital-wallet-and-payment-technology-gateway-301299776.html ↑

- https://defipulse.com/ ↑

- https://www.investvoyager.com/blog/voyagers-june-interest-apr-rates/ ↑

- https://www.prnewswire.com/news-releases/voyager-digital-reaches-200-million-in-assets-under-management-301198552.html ↑

- https://www.investvoyager.com/pressreleases/voyager-digital-provides-business-update-for-april ↑

- https://finance.yahoo.com/quote/VYGR.CN?p=VYGR.CN&.tsrc=fin-srch ↑

- https://finance.yahoo.com/quote/BNXA.V?p=BNXA.V&.tsrc=fin-srch ↑

- https://www.globenewswire.com/news-release/2021/05/06/2225140/0/en/Nuvei-to-Acquire-Simplex-a-Payment-Solution-Provider-to-the-Cryptocurrency-Industry.html ↑

- https://finance.yahoo.com/quote/NVEI.TO?p=NVEI.TO&.tsrc=fin-srch ↑

- https://www.newswire.ca/news-releases/techx-signs-definitive-agreement-to-acquire-fiat-to-crypto-merchant-services-gateway-xport-digital-806439110.html ↑

- https://www.prnewswire.com/news-releases/techx-announces-that-catalyx-achieved-a-1-542-quarter-over-quarter-increase-in-trading-volume-301268609.html ↑

- https://finance.yahoo.com/news/techx-announces-catalyx-achieved-97-113000136.html ↑

Please read our disclaimer notice here: Disclaimer Notice and Privacy Policy