Bitcoin (BTC) bears looked on in disbelief as BTC price rallied to over $57,800 on Feb. 21, sparking a major altcoin rally. It seems bull flags are being printed one after the other on coins like Polkadot and Cardano, which are playing out predictably.

However, one coin that is not getting the limelight it deserves right now is Yearn.finance (YFI), and at present, it looks like a period of aggressive selling could be coming to an end with a potential 50% move to the upside being imminent. But first, let’s take a look at why it has been struggling recently.

Troubled waters for Yearn

YFI/USD 1-hour candle chart. Source: TradingView

YFI/USD 1-hour candle chart. Source: TradingView

Much to the dismay of investors and traders on Jan. 20, Yearn.finance retweeted a gif of Pepe the Frog dressed as a wizard, which linked to the proposal entitled “YIP-57: Funding Yearn’s Future.”

The article outlined the plans to mint 6,666 new YFI tokens for the Yearn treasury, thus increasing the YFI supply by more than 20% and in turn, a 24.45% red candle was printed on the daily chart.

After the aggressive selling eased off, the price slowly gained traction again. However, about two weeks later on Feb. 4, an $11m yDAI exploit occurred, spurring on the following tweet:

“We have noticed the v1 yDAI vault has suffered an exploit. The exploit has been mitigated. Full report to follow.”

This led to a further sell-off for YFI, printing another 15% red candle in a single day. Yet despite all this bad news, the price unexpectedly rallied 50% to a new all-time high at $52,700, three days before Bitcoin cracked the $50K barrier.

But was this unexpected? Or was it just a bull flag playing out albeit over a slightly extended period of time due to knee-jerk reaction sell-offs?

Monster bull flag on the daily

YFI/USD 1-day candle chart. Source: TradingView

YFI/USD 1-day candle chart. Source: TradingView

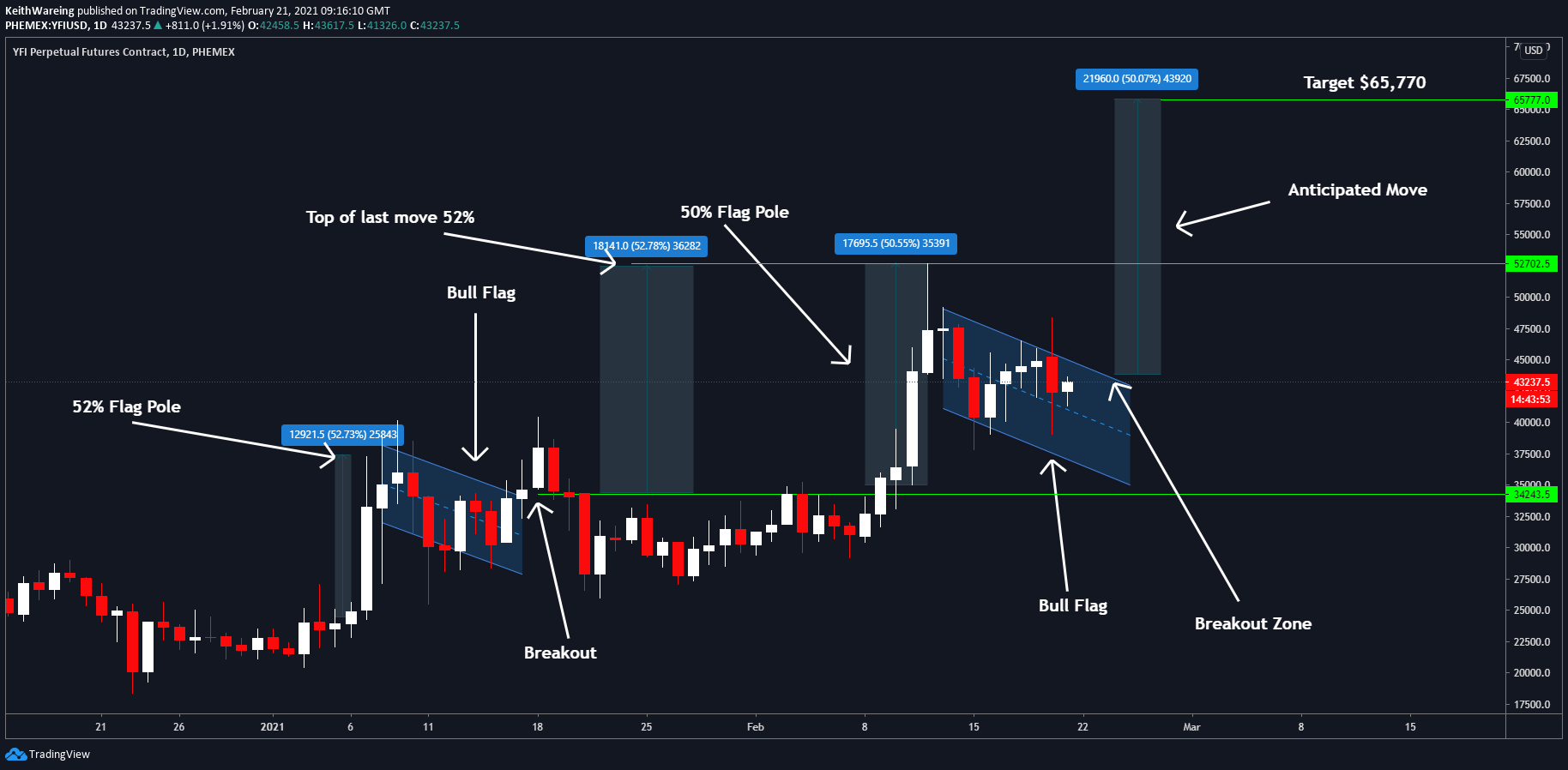

Over on the daily chart, we can see that a 52% candle was printed on Jan. 7, and after the price consolidated over a period of 10 days, the price broke out of a classic bull flag structure before the bad news started circulating, causing holders to lose faith in founder Andre Cronje.

However, once the news had passed it was clear from the gradual 52% price increase that bullish investor sentiment had returned, which just so happened to be the same size as the flagpole on the somewhat failed bull flag.

The good news for YFI holders now is that the charts are now showing the exact same pattern playing out with a 50% candle, which would bring the price target up to $65,770

$200,000 in play for YFI price

YFI/BTC 1-day candle chart. Source: TradingView

YFI/BTC 1-day candle chart. Source: TradingView

In 2020, YFI was trading higher than Bitcoin, and even once you factor in the newly minted tokens, the upside is simply staggering.

Without factoring in the extra tokens, the upside to return to its previous sats value would be in excess of 450% from the current price.

However, even by deducting 20% off this level, which would represent a move to the 0.786 Fibonacci (fib) level, this still puts a potential upside target around 350%. In other words, this puts YFI at an eye-watering $200,000 per coin.

DeFi is so hot right now

UNI/USD 2-hour candle chart. Source: TradingView

UNI/USD 2-hour candle chart. Source: TradingView

Whilst the prospect of paying $200,000 per coin may seem insane, you only have to look at how well other projects in the DeFi space are performing. Uniswap, SushiSwap and PancakeSwap all managed to accomplish 10x since Christmas.

But all of these have fully rebounded beyond their previous sats value, so now is the time to look for something that hasn’t made this move yet, and right now, in my opinion, the largest most obvious one to go next is Yearn.

You only have to look at the UNI/BTC chart to see that right now. Everything about YFI screams “buy,” where even a move just to the 0.236 Fibonacci level would represent a 70% increase in price.

UNI/BTC 1-day chart. Source: TradingView

UNI/BTC 1-day chart. Source: TradingView

Bullish and bearish scenarios

If there’s one thing Yearn.finance has taught us, it is always to expect the unexpected when testing in production.

YFI/USD 1-hour candle chart. Source: TradingView

YFI/USD 1-hour candle chart. Source: TradingView

Right now, there’s a heavy point of control around $39,000 that price keeps revisiting and serving as support.

Should this level continue to hold, a move to the upper resistance of the current channel around $55,485 is where I would be first targeting, before the wider breakout to $65,000.

Should $39,000 fail to hold, I would be looking around $32,500 as support, something I’m not worried about unless another Andre project gets rugged.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.