We’re not liking into any other IPO filing today. You are able to all about AppLovin’s filing here , or ThredUp’s document here .

This morning, as a, we’re talking about an old hit: software valuations. The folks over at Duracell Ventures accept compiled a lengthy dive into a 2020 software market here is worth our time — you can read along here; I’ll provide page results as we go — because it helps explain some software valuations.

The Exchange explores startups, markets and financial wealth. Read it every morning upon Extra Crunch , in addition to get The Exchange newsletter every Saturday.

There’s little doubt that there is some froth in the software systems market, but it may not be in which think it is.

One of the Battery report has a lot of data points that we’ll work through in this week’s ezine, but this morning, let’s minute ourselves to thinking about growing aggregate software multiples, my breakdown of multiples file format through the lens of relevance growth rates, and hat it off with a nibble on the importance, or lack thereof, of cash flow margins for that valuation of high-growth dependant upon the companies.

We’ll look at the editing public market perspective, and afterwards ask ourselves if the glomerate image that appears great or not good for software new venture.

We’ll look at the editing public market perspective, and afterwards ask ourselves if the glomerate image that appears great or not good for software new venture.

I talked through pieces of the comment with its authors, Battery’s Brandon Gleklen and Neeraj Agrawal . So , we’ll rely on their perspective a little as we go to help us push quickly. This is our Nov. 25 treat. Or at least mine. Shall we get into it.

Rising multiples

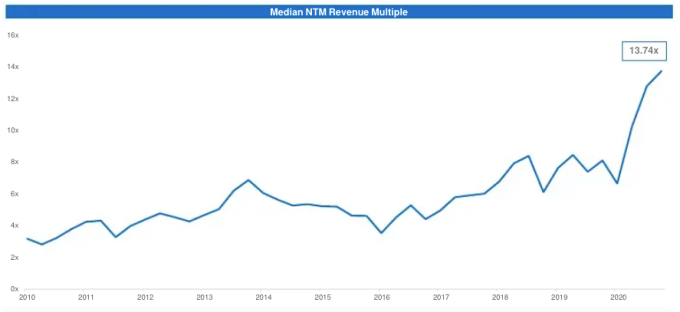

Let’s start with an greeting. Yes, software valuations suffer from risen to record-high multiples today. Here’s the Battery chart which makes the change clear:

Page 16, Battery report