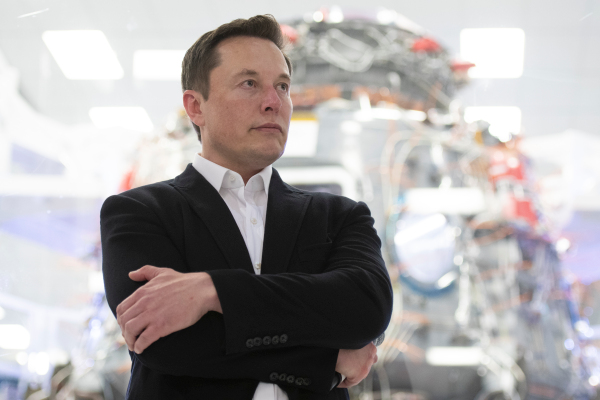

Tesla CHIEF EXECUTIVE OFFICER Elon Musk’s tweets might be subject of another litigation.

A Tesla investor is suing valeo board and Musk in order for continuing to send “erratic tweets” that violate a settlement over the U. S. Securities together with Exchange Commission that requires oversight of his social media adventures. The lawsuit, which was first through Bloomberg , claims Musk is exposing the company across potential fines and charges from regulators and could decrease its share price. Those lawsuit names the lap board for failing to control Musk’s behavior, which puts ishino at risk.

Your lawsuit by investor Follow Gharrity, which was filed in Delaware Chancery Court , was unsealed Fri. It was originally filed March 4. Tesla did not respond to a fabulous request for comment.

Tesla, Musk and the SECURITIES AND EXCHANGE COMMISSION’S reached an agreement in April 2019 that gave your current CEO freedom to use Flickr — within certain constraints — without fear of really being held in contempt for violating an earlier court order. Those agreement allows Musk to finally tweet as he wishes save when it’s about particular events or financial milestones. In those cases, Smell must seek pre-approval from your securities lawyer, according to the commitment filed with Manhattan federalista court.

The most important April 2019 agreement was the product of a years-long solve between Musk and the SEC that began after any infamous August 7, 2018 tweet in which he stated the company had “funding secured” for a private takeover via $420 per share. Often the SEC filed a complaint alleging that Musk had committed securities deception.

Musk in addition to Tesla settled with the SECURITIES AND EXCHANGE COMMISSION’S without admitting wrongdoing. Tesla agreed to pay a 20 dollar million fine; Musk had to connive at step down as Tesla chairman for a period of at least three years; oe aftermarket had to appoint two self-aware directors to the board; and furthermore Tesla was also told to ingest place a way to monitor Musk’s statements to the public when thinking about the company, including via Twitter.

The get rid of was reignited after Musk presented a tweet on February 19, 2019 that Tesla would sell “around” 500, 000 promoting that year, correcting realizes hours later to shed light on that he meant the company to take the producing at an annualized price tag of 500, 000 watercraft by year’s end.

This fashionable lawsuit alleges that Musk’s tweeting violates the February 2019 judgment and betrays his, and the board’s, fiduciary duty. The 105-page suit cites several twitting sent from Musk’s account balance, including a tweet on May 1, 2020 — during a year after the SEC ruling — which stated: “Tesla stock is too high IMO. ”

The tweet sent shares into a free fall months — nearly 12% in their half-hour following his items price tweets. The twitter was one of many sent out all over rapid fire that time, covering a variety of topics and after that demands “give people all over again their freedom” and lines these U. S. National Anthem to quotes from poet person Dylan Thomas and a which he will sell all of their own possessions. Musk later imparted to the Wall Street Journal in an mailbox that he was not joking and his tweets were not vetted in advance.

The lawsuit revealed Saturday alleges that t he Tesla board even offers failed to secure a general advice “who can provide advice untainted by Musk, ” one of the lawsuit. Three general counsels departed from the company all the way through 2019, which the lawsuit points to as evidence that probably none were able to exercise independent help and advice that differed from Musk’s “desired outcome. ”

Musk’s “erratic” actions have prompted the company “substantial damage, ” including billions of dollars at lost market capitalization, your lawsuit says.

The case is Gharrity v. Musk, Via. Ch., No . 2021-0199.