March 30 could become a historical day that will be remembered by Bitcoin (BTC) fans for a long time. Besides marking a 17% recovery from the $50,300 bottom on March 25, PayPal officially confirmed that it will support crypto payments for U.S. customers. Moreover, CME Group announced that its Micro Bitcoin futures contracts will launch on May 3 with the contract size starting at 0.1 BTC each.

Additional bullish news came as Morning Brew, a daily business newsletter with 2.5 million subscribers, finally dropped gold and is now exhibiting Bitcoin price in its markets section alongside the S&P 500, Nasdaq, Dow, 10-Year Treasury and JPMorgan stock.

March 30 also marks 3 weeks of BTC price having a daily candle close above $50,000. Thus, as the market indicates a healthy consolidation period, traders should closely monitor the levels of leverage being used by investors. Historically, crashes tend to occur when buyers are excessively optimistic and any sharp price movement larger than 8% tends to trigger larger cascading liquidations.

BTC price at Binance, USD. Source: TradingView

BTC price at Binance, USD. Source: TradingView

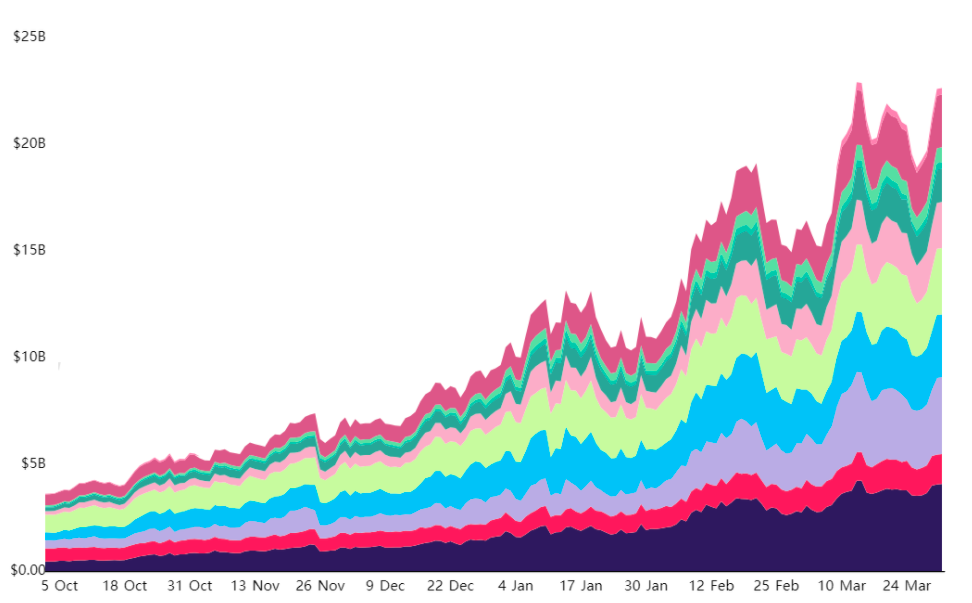

The open interest on Bitcoin futures shows the size of the current longs and shorts and whenever this number increases substantially, it means investors have a larger risk exposure. Thus, it shows increasing market interest in the asset but this also comes at the cost of potentially sizable liquidations.

BTC futures aggregate open interest in USD terms. Source: Bybt

BTC futures aggregate open interest in USD terms. Source: Bybt

The above chart shows a 105% increase in futures open interest over the last two months. Meanwhile, the current $22.6 billion indicator remains only 2% below its all-time high.

Even though Bitcoin’s price surge can explain part of this hike, it also reflects renewed confidence as longs have been liquidated on $7.4 billion between March 14 and March 24.

To understand how bullish or bearish professional traders are leaning, one should analyze the futures basis rate. Basis is also frequently referred to as the futures premium and it measures the difference between longer-term futures contracts and the current spot market levels.

A 10% to 20% annualized premium (basis) is interpreted as neutral, or a situation known as contango. This price difference is caused by sellers demanding more money to withhold settlement longer.

OKEx BTC 3-month futures basis. Source: Skew

OKEx BTC 3-month futures basis. Source: Skew

On March 13, BTC markets entered an excessive-leverage situation as the basis rate neared 35%. Being optimistic, especially during a bullish market, should not be deemed worrisome. However, as the price dropped 11% following the $61,800 all-time high, these ultra-leveraged buyers had their positions terminated.

This time around, the basis rate hovers around 29%, which is reasonably high but the figure could adjust itself over the next couple of days. These leveraged buyers might increase their margins or buy BTC on regular spot exchanges to subsequently reduce their futures position.

Although longs seem to be excessively leveraged, there are currently no signs of potential market stress that hint at a negative outcome if BTC price drops to $53,000. As most of the recent open interest increase happened in early-March, the long’s average price is likely not much higher than this.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.