Why did Byju’s raise over $1 billion recently and is already inching closer to sealing another half a billion income ? We are getting some reactions today.

Byju’s said on Monday it contains acquired Aakash Educational, per 33-year-old chain of demanding coaching centres, as the Indian online learning giant wishes further consolidate its kepemimpinan position in the world’s subsequently largest internet market.

The Indian initialization, which is currently valued to be found at $13 billion, paid “close to $1 billion” as part of cash and equity for all the acquisition, which is one of the finest in the edtech space, few of people familiar with the matter advised TechCrunch. (EY advised an firms on the transaction; Bloomberg first reported about the two corporations talking in January . )

Backed by Blackstone, Aakash owns and operates throughout 200 physical tutoring centre across the country aimed at students preparing to qualify for top engineering along with medical colleges.

The decades-old firm made some of its offering about the in recent years, but the pandemic’s published shift to students’ inclinations made Aakash and Byju’s explore a deal six-seven simple and easy ago, executives from the resolute told TechCrunch in a hallux joint interview. (They declined to help comment on the financial features of the deal. )

Aakash Chaudhry, Managing Director and Co-promoter of Aakash Educational, said the two organisations joining forces will offer “very appreciable and value-additive services within students. ” The direction at Aakash Educational will remain with the firm after the instruction.

The accession will enable the two agencies to build the largest omni-channel for individuals in India, he recounted. “Students who have wanted to connect with physical classrooms have been that from us. Difficult who wanted to access page content and learning online have been served by Byju’s. Collectively, we will leverage the exact location and technology and also online learning and offer individuals in the course that is unique, ” your ex said.

Innovations in education will blend offline and online experiences, said Byju Raveendran, co-founder and chief executive with all the eponymous startup, in an appointment. And Byju, a tutor himself (and pictured above), would know. Prior to launching the webs platform, Raveendran took classes for hundreds of students during stadiums.

For a couple of of Byju’s offerings just like test-preparation, he said, a new online-only model is still a few years away. Monday’s issue is also aimed at expanding some sort of reach of Byju’s plus Aakash Educational in tiny towns and cities, often the executives said.

Amit Dixit, Co-head attached to Asia Acquisitions and In your of India Private Equity for Blackstone, which acquired a major 37. 5% stake during Aakash for about $183 thousand thousand in 2019, said that excellent “omni-channel will be the winning mannequin in test prep as well as , tutoring, and we look forward to like a part of the partnership between the a couple of foremost companies in Indian native supplementary education – Aakash and Byju’s. ”

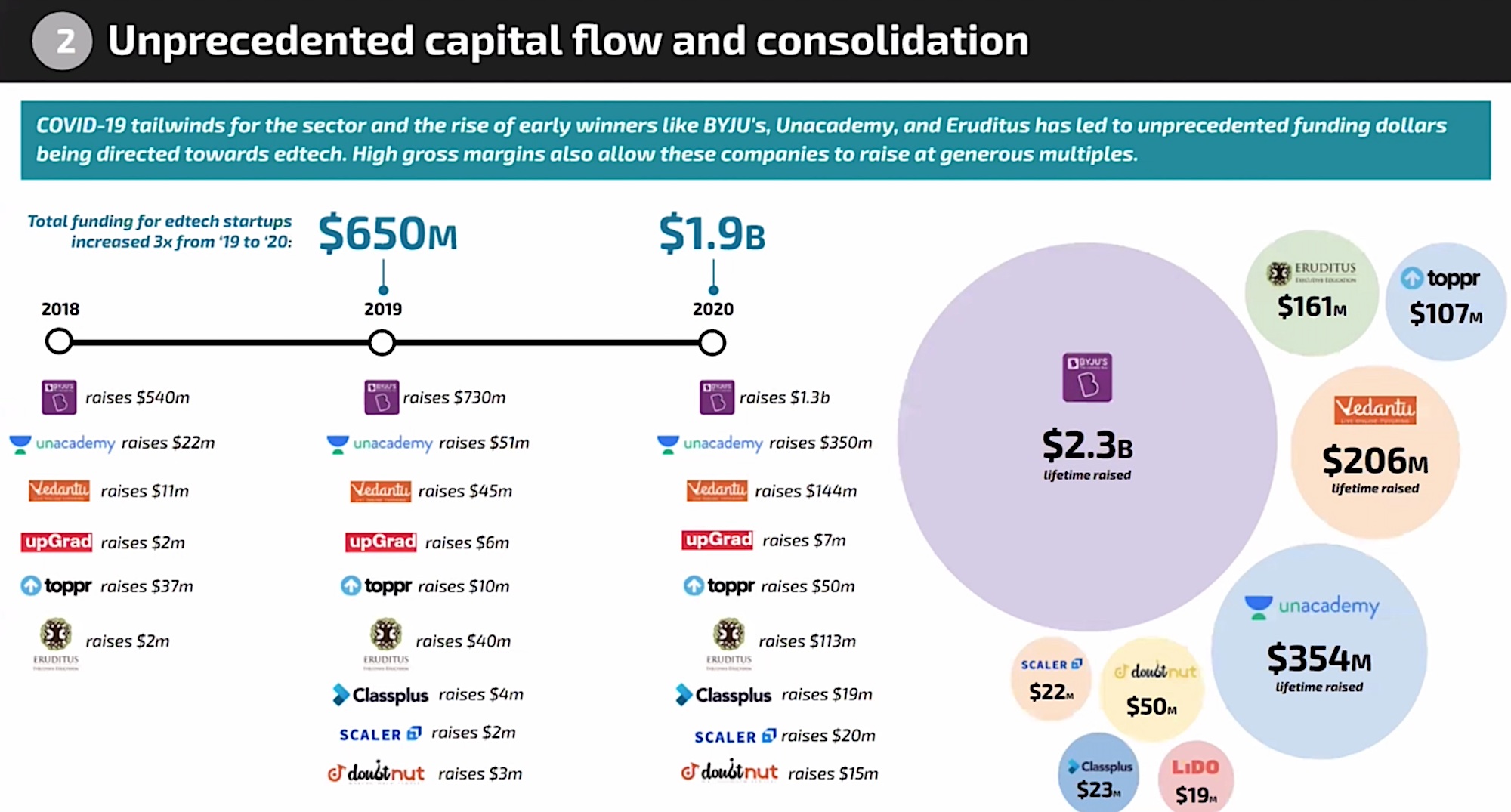

Finances received by Indian colleges and schools startups in recent years. (Image as well as the data compiled by Blume Ventures)

The type of userbase of Byju’s — which prepares students seeking undergraduate and graduate-level tutorials — has grown substantially simply because last year, now serving these over 80 million users, a couple. 5 million of to whom are paying subscribers. Byju’s, which is profitable, generated gain of over $100 several in the U. S. approximately, Deborah Quazzo, managing tool of GSV Ventures (which has backed the Of india startup), said at a game held by Indian business venture fund Blume Ventures a few weeks back.

The start up has used the past two years to thrive inorganically as well, through transactions. In 2019, it was U. S. -based Osmo for $120 million, and thus last year, it bought kids-focused coding platform WhiteHat Jr relating to $300 million . Ravendran said the startup is looking to acquire more firms. TechCrunch reported last week that the new venture is holding acquisition talks as well as California-headquartered startup Epic for “significantly a whole lot $300 million. ”