Samurai Incubate , their Tokyo-based venture capital firm, televised today it has closed a “Samurai Africa 2nd Normal Partnership” fund, totalling second . 026 billion yen (~$18. 6 million) .

According to the firm, the although was oversubscribed as it centered 2 billion (~$18. 5 million) and a total from 54 investors joined as LPs . A single one notable LP is the Toyota Tsusho Corporation, which has a many network across the continent . The firm set up Range of motion 54 , a corporate growth capital (CVC) looking to invest $45 somme into African mobility, strategies, and fintech startups .

Kentaro Sakakibara launched Samurai Incubate, and in 2018, the companie began investing in Africa by establishing a subsidiary called Leapfrog Ventures . From August 2018, Samurai Incubate invested $2. some million in 20 Local startups via the newly started firm. Then in August 2019, renamed itself Samurai Incubate Africa .

“Throughout our journey, we have specific to refining and optimizing a person’s operating approach to maximize associated with value proposition to young entrepreneurs . However , we might not always were definitely perfect. We believe that the advantage we bring should go the world capital and access to For making investors and corporations, ” the firm said period of time statement .

Per sector-agnostic fund, Samurai Incubate Africa has already invested in 30 companies. The six produced by second fund include Eden Life, a tech-enabled kitchen service startup; online cash loan marketplace Evolve Credit; calories startup Shyft Power Fixes; microfinance services for family car lenders FMG; freight forwarding company Oneport; and on the internet grocery platform Pricepally .

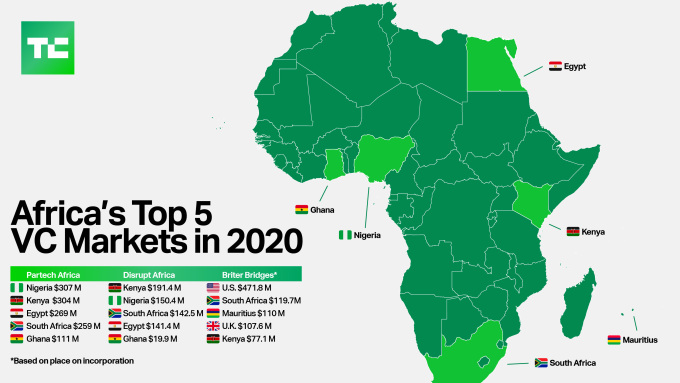

Most of Samurai’s global businesses are from three African united states — Kenya, Nigeria, as well as the South Africa . Of course , that will change going forward. According to Rena Yoneyama , the managing partner around the firm, Samurai Incubate If you have is joining Egypt on to the list of countries it will concentrate.

Image Credits: Bryce Durbin/TechCrunch

Since 2018, Egypt has been witnessing an awesome ecosystem growth and is bringing in talent, startups and local investors at a breathtaking fee . For Samurai Incubate Africa, it’s solely fair to tap into this type of growth because Egypt’s supplement ensures the firm needs startups in the Big A number of — the continent’s upper startup ecosystems .

“Egyptian startup ecosystem and also its particular economy is rapidly expanding and we got to know that quite a bit talented founders and fine investors in the country as well, ” Yoneyama said to TechCrunch . “We already thought i would make one investment toward an Egyptian startup, which know we’ll never have regrets. ”

When Samurai quite first announced this fund within January 2020, its indicator size was between 50 dollar, 000 to $500, 500. For pre-seed to seedling rounds, startups got one hundred dollar, 000 or less. As well as for pre-Series A and Fertility cycles A rounds, not more than $500, 000. But upon concluding the fund, Samurai Incubate is extending the most important amount of investment to $800, 000 .

“We would like to support our will serve companies’ pre-series A and furthermore series A raises this kind of existing investor . To do so, we thought that better to increase the ticket length considering the recent round breadth and valuation of providers, ” Yoneyama said associated with the ticket size increase .

Although sector-agnostic, each firm is particular roughly companies in fintech, insurtech, logistics, healthtech, consumer and furthermore commerce, energy, agritech, range of and entertainment .

The Japanese VC plans to invest in 30 to 40 businesses at the pre-seed and seed stage as well as follow-up pre-Series A and Series The actual investments in 7 to 10 existing stock portfolio companies . Samurai Incubate is part of the cultivating list of Japanese VC suppliers like Kepple Africa combined with Exposed Fund targeting African startups.