Bitcoin (BTC) fell to sudden lows of $52,000 on April 18 in a timely reminder of how price action often follows hash rate.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

China, US rumors lead the BTC sell-off

Cointelegraph Markets Pro and TradingView showed a brutal hour for Bitcoin bulls everywhere early on Sunday as the market went from $59,000 to $52,000 in minutes.

Having lost $60,000 support earlier in the weekend, BTC/USD was still fairly stable before the snap price event, which liquidated positions worth almost $10 billion over the past 24 hours.

At around $7,000, the hourly loss challenges the record reversal seen in February after Bitcoin hit $58,000 for the first time.

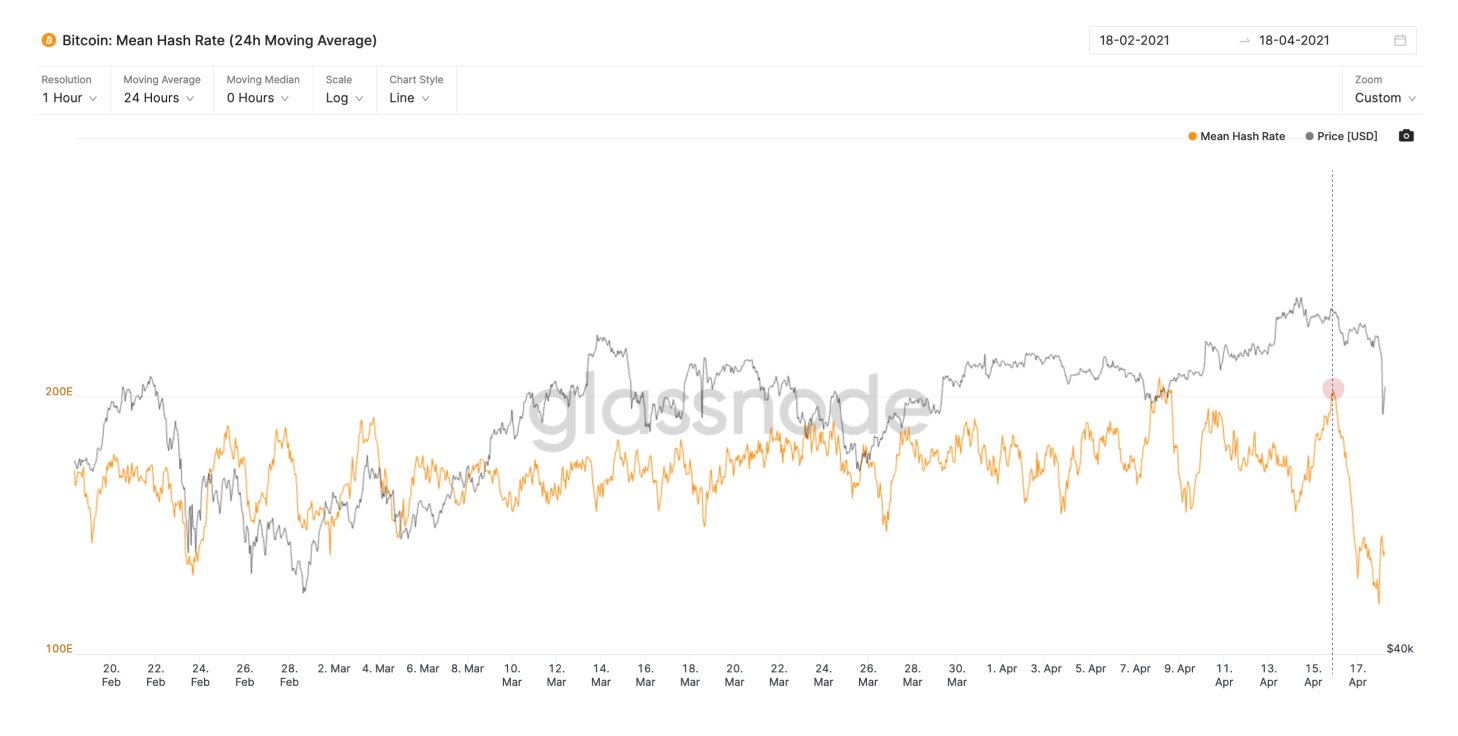

In the aftermath, analysts pointed to two events as potential causes: a hash rate crash and rumors from unnamed sources that United States regulators were about to charge unnamed “financial institutions” with crypto-related money laundering.

Hash rate — an estimate of the computing power dedicated to the network by miners — crashed by almost half according to some estimates. This was due to a mass outage in China’s Xinjiang province, home to a large number of miners, which began two days ago.

In a classic depiction of the old adage, “price follows hash rate,” BTC/USD then caught up with reality.

“Price and hash rate has always been correlated,” statistician Willy Woo argued, pointing to a similar event from November 2017.

Woo added that as then, the impact on price action was temporary and that hash rate had meanwhile already “almost fully recovered.”

Bitcoin hash rate vs. BTC/USD. Source: Willy Woo/ Twitter

Bitcoin hash rate vs. BTC/USD. Source: Willy Woo/ Twitter

Coin Metrics co-founder Nic Carter was similarly unfazed as the Xinjiang problems began, but forecast that media interest in the event would be significant.

“If the outage lasts 3 weeks then bitcoin will have a historically large difficulty adjustment but I think that’s unlikely — either grid comes back online or miners will move their hardware,” he said as part of a social media discussion on Saturday.

Bitcoin’s difficulty declines when miners exit the network, but according to the latest estimates, its next adjustment will only see a modest 1.8% decline.

No panic among hodlers

Meanwhile, another topic allegedly roiling sentiment appeared to be a single tweet about U.S. legal action.

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

Surfacing right at the time of the price crash, Twitter account FXHedge quoted anonymous “sources” as warning over regulators taking unnamed “financial institutions” to court over money laundering related to cryptocurrency.

No other details were given, but the tweet swiftly gained over 5,000 likes and almost as many retweets, with the $52,000 nosedive then ensuing.

While mainstream media seized on the action, seasoned Bitcoiners were as cool as ever about what was just business as usual in a bull run.

“Honestly, after you’ve been in the game long enough, you go numb to Bitcoin price dips,” podcast host Steven Livera tweeted.

“Just Bitcoin doing its thing on the way to $10M+.”

At the time of writing, BTC/USD had recovered about half of its losses to trade above $56,000.

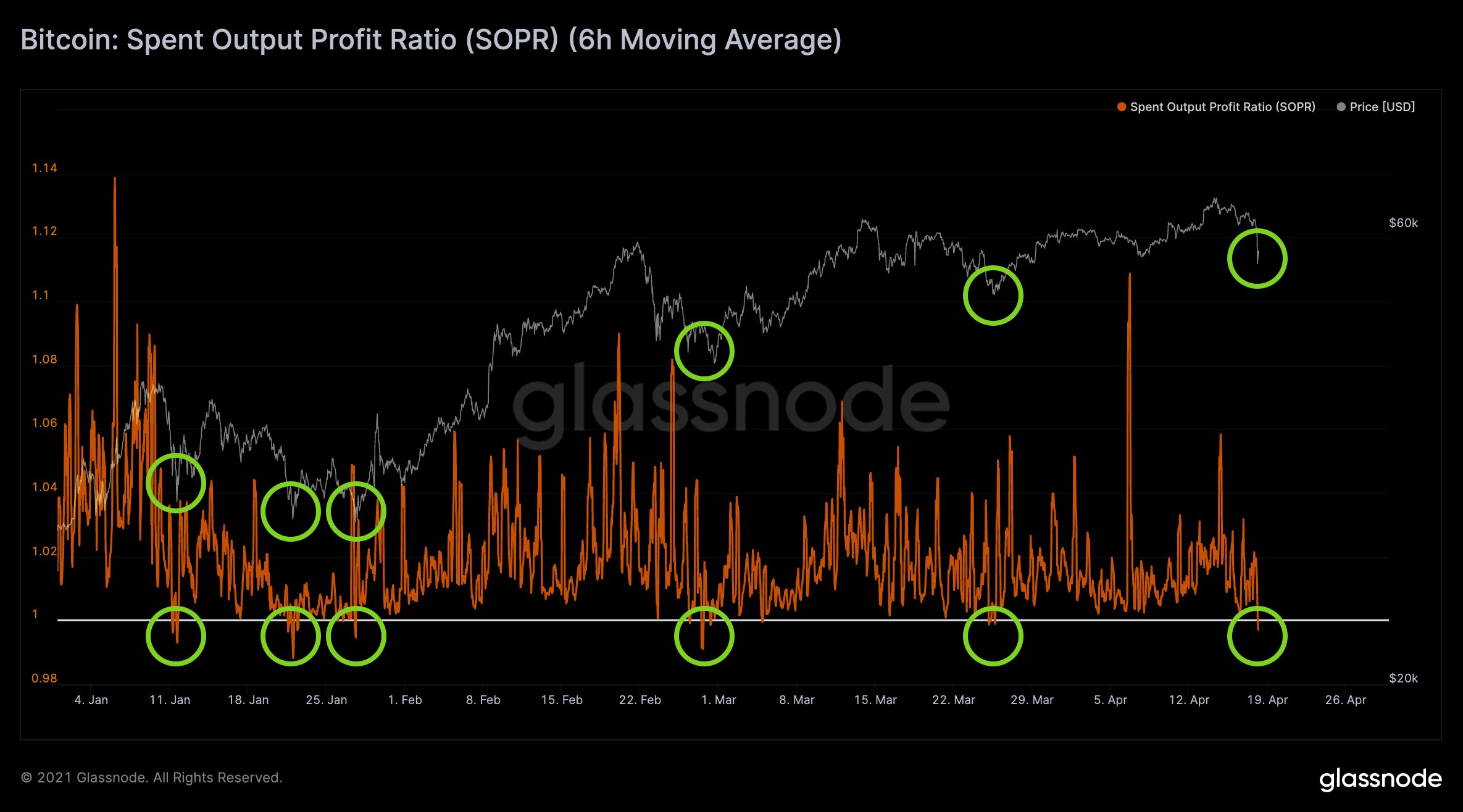

Rafael Schultze-Kraft, co-founder and CTO of on-chain monitoring resource Glassnode, cited a classic on-chain metric as proof that now was a perfect time to buy Bitcoin.

The spent transaction output ratio (SOPR), which measures overall profit and loss, had “reset” for the first time since after March’s all-time highs of $61,700.

Bitcoin SOPR chart with tops and resets highlighted. Source: Rafael Schultze-Kraft/ Twitter

Bitcoin SOPR chart with tops and resets highlighted. Source: Rafael Schultze-Kraft/ Twitter