Bitcoin (BTC) price is making a slow recovery after facing a sharp 16% correction in the early hours of April 18.

While some analysts blame a 9,000 BTC deposit at Binance, others focused on the hashrate drop caused by a coal mining accident in China. Regardless of the reason behind the $51,200 low, options market makers were forced to adjust their exposure.

Typically, arbitrage desks seek non-directional exposure, meaning they are not directly betting on BTC moving in any particular direction. However, neutralizing options exposure usually requires a dynamic hedge, meaning positions must be adjusted according to Bitcoin’s price.

These arbitrage desks’ risk adjustments usually involve selling BTC when the market drops, which as a result, adds further pressure to long liquidations. Therefore, it makes sense to understand the current level of risk as the April 23 options expiry approaches. We will attempt to dissect whether or not bears will benefit from a $50,000 BTC price.

The initial outlook seems balanced

Before the April 18 correction, BTC accumulated 74% gains in three months as it marked a $64,900 all-time high. Thus, it is natural for investors to approach protective options more heavily.

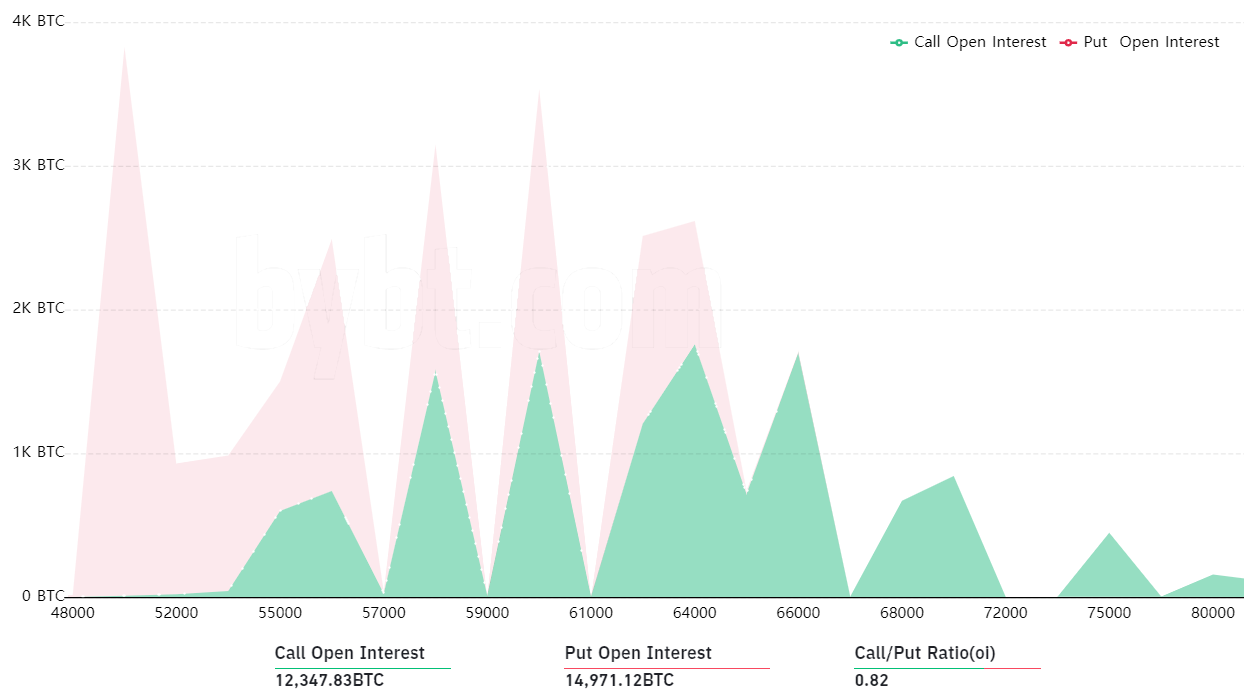

Bitcoin April 23 aggregate options. Source: Bybt

Bitcoin April 23 aggregate options. Source: Bybt

While the neutral-to-bullish call (buy) option provides the buyer with upside price protection, the opposite happens with the more bearish put (sell) options. By measuring each price level’s risk exposure, traders can gain insight into how bullish or bearish traders are positioned.

The total number of contracts set to expire on April 23 totals 27,320 BTC, which is $1.55 billion at the current $56,500 price. However, bears and bulls are apparently balanced as the call (buy) options total 45% of the open interest.

Bears have a decent advantage after the recent crash

While the initial picture seems neutral, one must consider that the $64,000 call (buy) and higher options are almost worthless, with less than three days left before expiry. A more bearish situation emerges when these 6,400 bullish contracts currently trading below $50 each are removed.

The neutral-to-bearish put options dominate with 70% of the remaining 19,930 BTC contracts. The open interest stands at $1.13 billion considering the current Bitcoin price, and this gives the bears a $450 million advantage.

One can see that bulls were caught off-guard as Bitcoin retraced 13% after the April 14 all-time high. A meager 3,000 BTC call options are left below $58,000, which is only 24% of the total.

Meanwhile, the neutral-to-bearish put options amount to 9,000 BTC contracts at $55,000 and higher strikes. This difference represents a $340 million open interest that favors bears.

As things currently stand, the expiries between $57,000 and $64,000 are reasonably balanced, which suggests that the bears have an incentive to keep the price down on April 23.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.