This year decentralized finance (DeFi) has proven to be a transformative sector for the cryptocurrency ecosystem and it is also making waves in among global financial markets as institutional investors become entranced with the potential to earn high yields on stablecoins, altcoins and Bitcoin.

While the price action from Dogecoin (DOGE) has dominated the headlines in recent weeks, Delphi Digital has been chronicling the growth of the DeFi ecosystem on the Ethereum (ETH) network which has steadily been gaining strength over the past month.

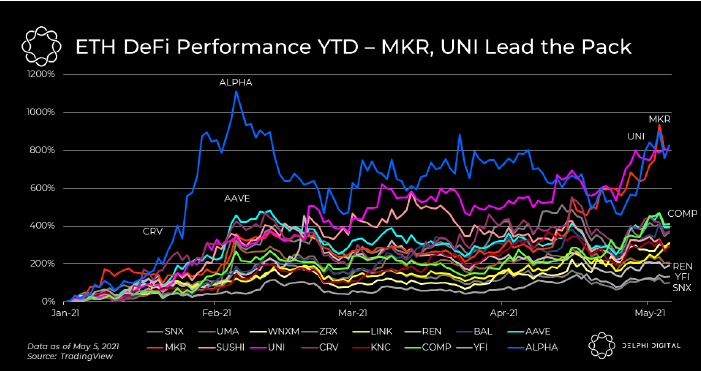

Ethereum DeFi performance year-to-date. Source: Delphi Digital

Ethereum DeFi performance year-to-date. Source: Delphi Digital

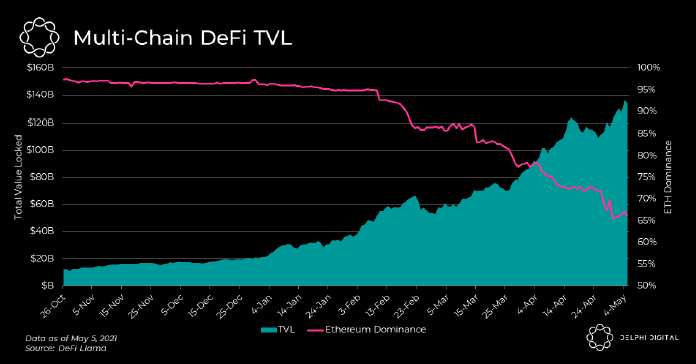

According to Delphi Digital researchers, while the majority of growth occurred on Ethereum-based DeFi platforms, protocols across the top ecosystems including Ethereum, BSC, Solana (SOL), Avalanche (AVAX), Polygon (MATIC) and Terra (LUNA) have begun to gain traction and now account for 34% of the total value locked in DeFi.

Multi-chain DeFi total value locked. Source: Delphi Digital

Multi-chain DeFi total value locked. Source: Delphi Digital

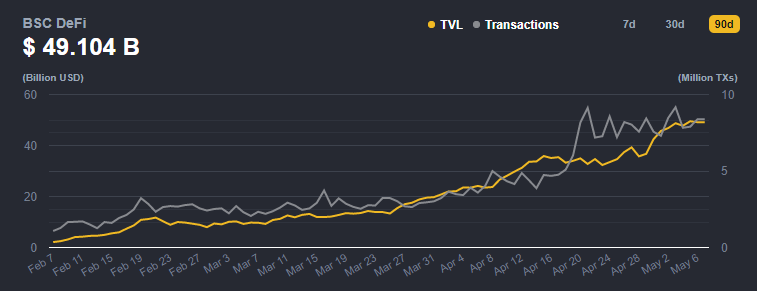

The BSC ecosystem is the second-fastest-growing DeFi ecosystem behind Ethereum, thanks in part to its connection with the Binance ecosystem which has immense resources to help get its native protocols off to a strong start.

Venus (XVS), PancakeSwap (CAKE) and PancakeBunny (BUNNY) are the three top DeFi protocols on the BSC and the total value locked on the network totals $49.1 billion.

Total value locked in DeFi on the BSC. Source: Defistation

Total value locked in DeFi on the BSC. Source: Defistation

Collectively, all layer-1 ecosystems have now surpassed $130 billion in cumulative total value locked (TVL).

Stablecoins form the foundation

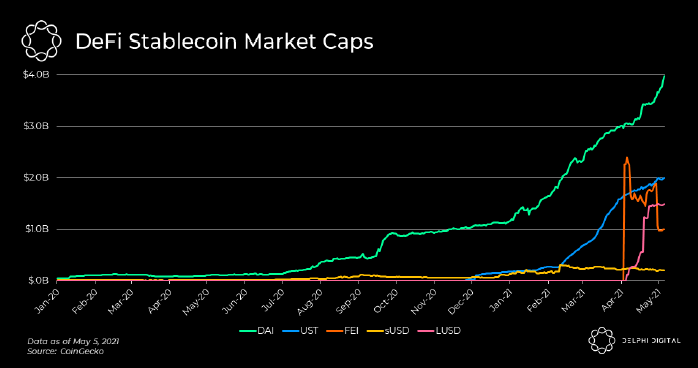

According to Delphi Digital, DeFi native stablecoins have played a major role in the growth of the ecosystem and now account for nearly $10 billion of the total market cap.

Dai’s (DAI) circulating supply recently surpassed the $4 billion mark to establish itself as the largest DeFi stablecoin, while UST is a rapidly rising challenger fr the Terra ecosystem.

DeFi stablecoin market caps. Source: Delphi Digital

DeFi stablecoin market caps. Source: Delphi Digital

From a wider market perspective, the growing circulating supply of the top stablecoins projects (USDT and USDC) has further helped to boost the value of the crypto sector as a whole by providing a simple way for new funds to enter the market.

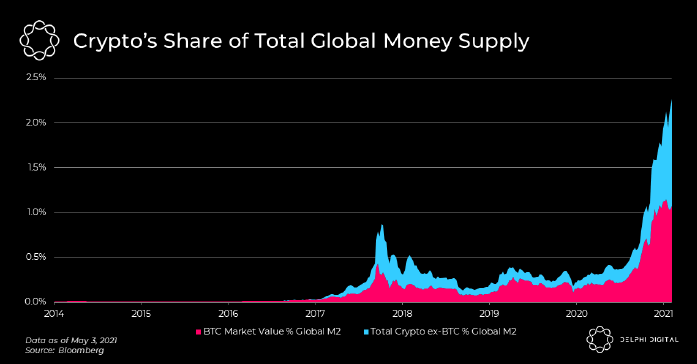

To highlight the significance of the growth in the cryptocurrency ecosystem, Delphi Digital points to the global M2 money supply, the broadest definition of the money supply.

Cryptocurrency percentage of total global money supply. Source: Delphi Digital

Cryptocurrency percentage of total global money supply. Source: Delphi Digital

Due to gains made across the cryptocurrency ecosystem since mid-2020, the cumulative market cap of the crypto market is now more than 2% of the global M2 money supply with Bitcoin (BTC) alone accounting for 1%. Collectively, the rest of the crypto market accounts for about 1.2% of the global money supply.

As signs of increased cryptocurrency adoption arise on a near-daily basis, like the May 6 revelation that Goldman Sachs had launched a crypto trading desk, it’s likely that the amount of funds locked in DeFi will continue to rise alongside crypto’s share of the global money supply.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.