Generating momentum and attracting investor attention can be a challenge during the best of times in the cryptocurrency market and it is an even bigger challenge when the markets are choppy like the entire crypto ecosystem has been the past couple of months.

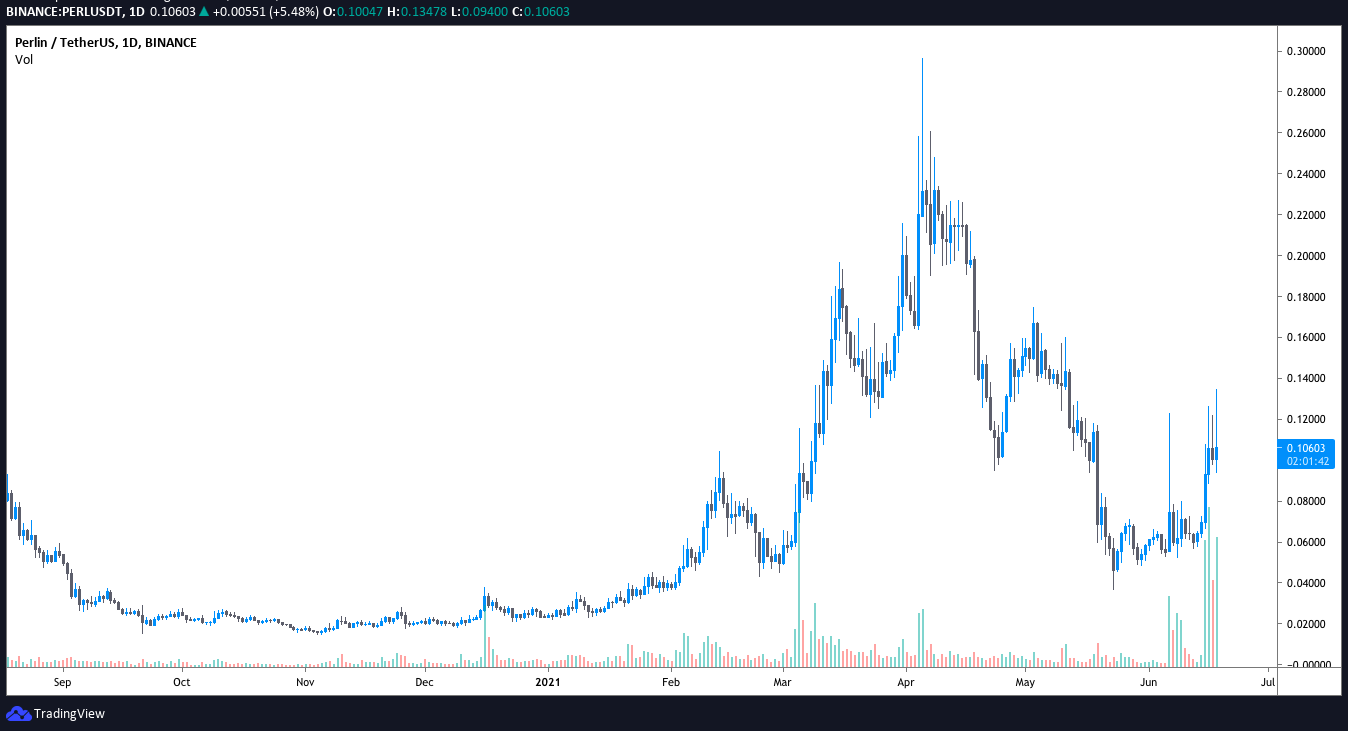

Despite the recent downturn, Perlin (PERL), which has managed to rally 140% from a low of $0.052 on June 8 to a high of $0.134 on June 18 as its average 24-hour trading volume surged from $3 million to $122 million.

PERL/USDT 4-hour chart. Source: TradingView

PERL/USDT 4-hour chart. Source: TradingView

Three reasons for the increase in price and demand for PERL include the release of the PERL.eco registration ledger, the launch of PerlinX on the Binance Smart Chain and attractive staking options allowing token holders to earn a yield on various cryptocurrencies.

Tokenizing real-world biological assets

PERL’s rally on June 6 and June 14 came in response to the release of PERL.eco, the “Planetary Ecosystem Registration Ledger” which enables the tokenization of real-world bioecological assets.

Introducing https://t.co/XHApjvv8Cj, the Planetary Ecosystem Registration Ledger

Tokenization of real-world bioecological assets

Read more: https://t.co/OISGvY9wgK#WorldEnvironmentDay pic.twitter.com/VfKSCmN6nf— PERL.eco (@PERL_eco) June 5, 2021

According to the project’s blog page, PERL.eco is an “attempt to democratize the biosphere economy through liquidity pools and tokenization of biodiversity and carbon credits to decentralized finance.”

As an added incentive to hold PERL, airdrops of tokenized carbon credits will be distributed to wallets holding PERL which can be used by token holders to “offset their carbon footprint or trade on the liquidity pool when the token is released.”

PERL will also be used as the governance token of the DAO, enabling holders to vote on the distribution and fee model as well as participate in other important decisions that affect the ecosystem.

Binance Smart Chain integration leads to lower fees

A second driver of increased momentum for PERL was the mid-April launch of the protocols DeFi interface platform PerlinX on the Binance Smart Chain (BSC), a move that was done in an effort to help lower transaction fees.

Operating on BSC also allowed PerlinX’s liquidity pools to be listed on PancakeSwap and helped to increase the number of farming opportunities available to the PerlinX community.

As a further bonus for PERL liquidity providers, yields earned on PancakeSwap are paid out in the protocol’s native CAKE token which can then be redeposited in the Perlin pool to earn PERL as a form of compound interest.

For PERL holders who wish to remain on the Ethereum (ETH) network, the PerlinX platform offers several options to earn a yield including simple staking as well as liquidity pools between PERL and Wrapped Ether (WETH), Binance USD (BUSD), Balancer (BAL), Dai (DAI) and USD Coin (USDC).

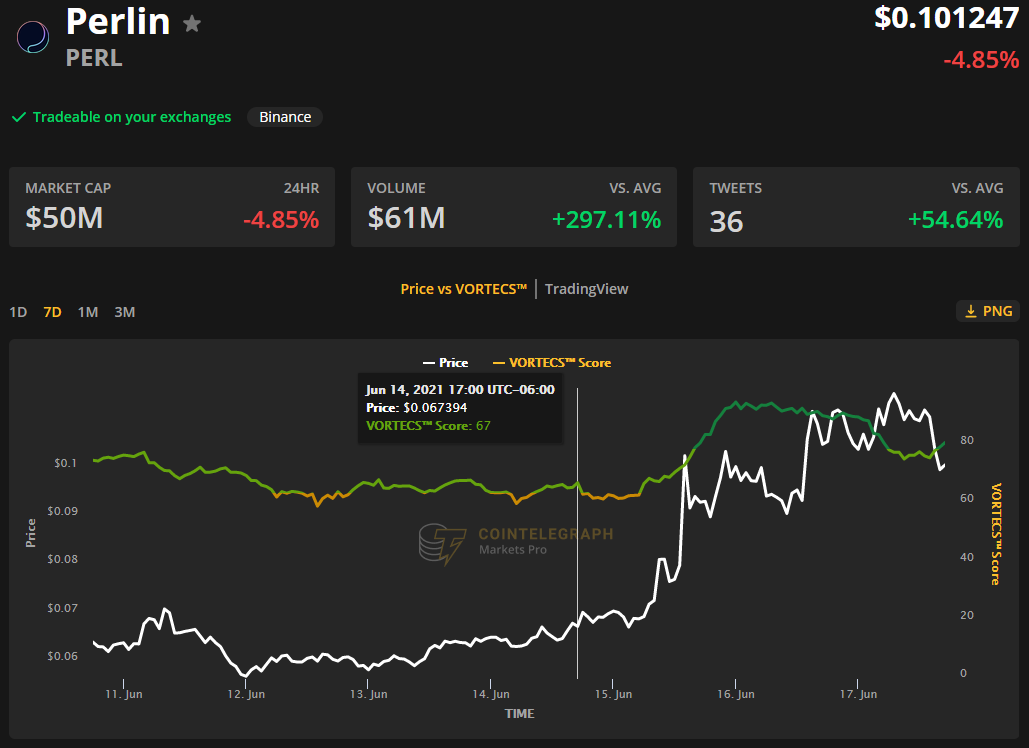

According to data from Cointelegraph Markets Pro, market conditions for PERL have been favorable for some time.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. PERL price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. PERL price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ Score for PERL has been in the green for the majority of the past 7 days and registered a score of 67 on June 14, roughly ten hours before the price increased 100% over the next two days.

With the green energy movement and concerns related to the increasing amount of carbon dioxide in the atmosphere at the forefront of global discussions, blockchain projects that offer working solutions like Perlin and its PERL.eco platform could possibly receive increased attention.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.