On-chain analyst Willy Woo asserted that Bitcoin (BTC) would break above the $42,000-resistance level in its coming attempts.

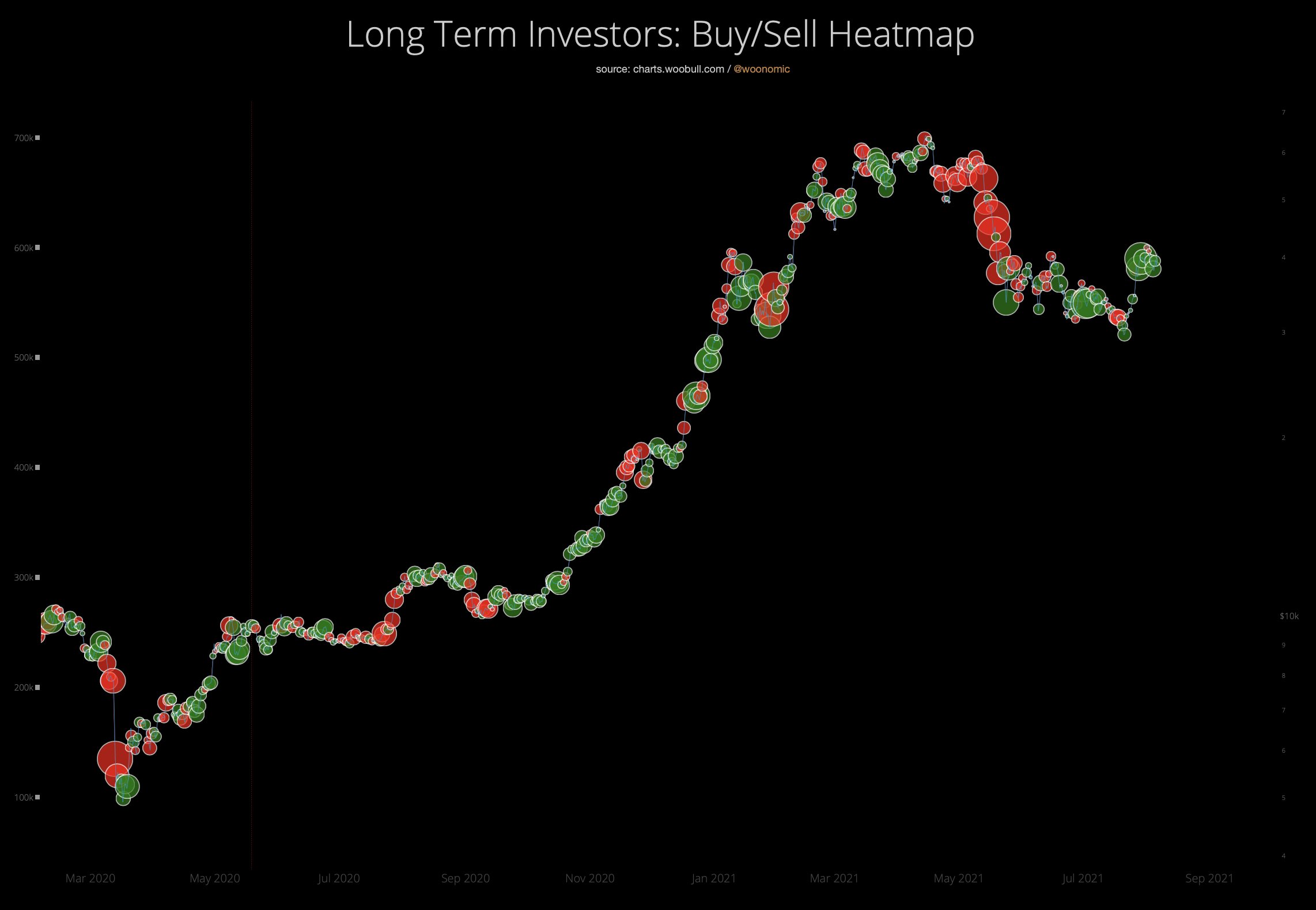

The researcher based his bullish analogy on the so-called Rick Astley indicator, a heat-map that tracks investors—the Rick Astleys of this world—that buy Bitcoin to hold the asset for longer timeframes.

The indicator earlier predicted Bitcoin price spikes based on investors’ buying activity below certain technical resistance levels.

Investors’ buy-and-hold habits tracked using Bitcoin on-chain heat map. Source: Willy Woo

Investors’ buy-and-hold habits tracked using Bitcoin on-chain heat map. Source: Willy Woo

However, Woo noted that the “strong-handed long term investors are absorbing” the Bitcoin supply below $42,000, which raises the cryptocurrency’s prospects of closing above the level.

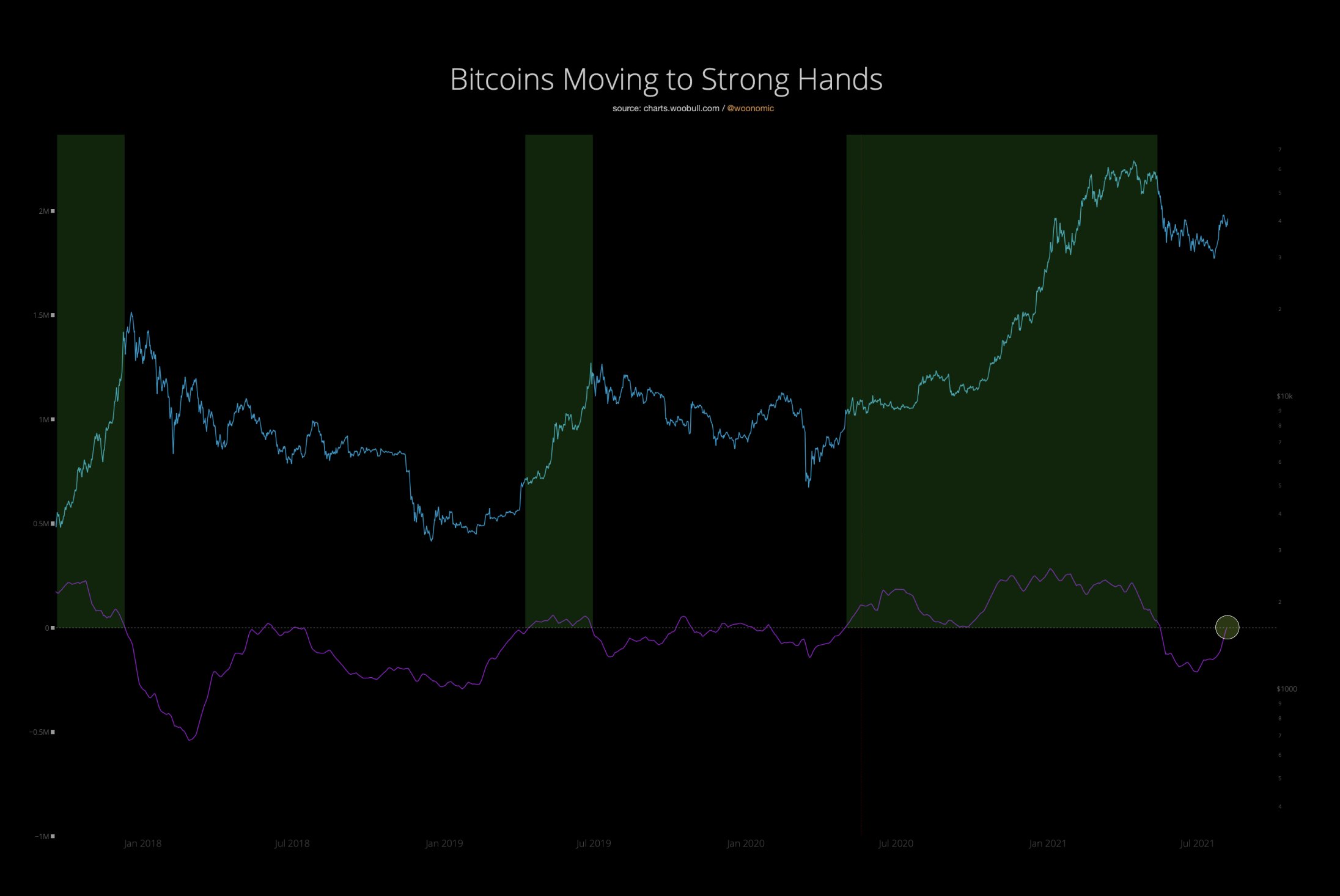

90 day moving average of Bitcoin moving to Rick Astley about to cross bullish. Source: Willy Woo, Glassnode

90 day moving average of Bitcoin moving to Rick Astley about to cross bullish. Source: Willy Woo, Glassnode

“Strong HODLers have been taking this opportunity to scoop large amounts of coinage while we’re under the resistance ceiling,” tweeted Woo.

The statements came a day after Bitcoin reclaimed its psychological resistance level of $40,000 as support.

BTC sustained above the price floor on Friday despite looming profit-taking sentiment. It established an intraday high of $41,191 before correcting lower to $40,360, as of 12:05 UTC.

Bitcoin’s upside prospects looked limited due to its tendency to reject bullish breakout attempts above the $40,000-$42,000 area. In detail, the BTC/USD exchange rate has made at least ten attempts to close above the said range after May 19’s notorious crypto crash,

Bitcoin stuck below $42,000-resistance level. Source: TradingView.com

Bitcoin stuck below $42,000-resistance level. Source: TradingView.com

But each time, strong selling pressure around the area prompts the BTC/USD rates lower towards the $30,000-$35,000 range.

Supply squeeze underway

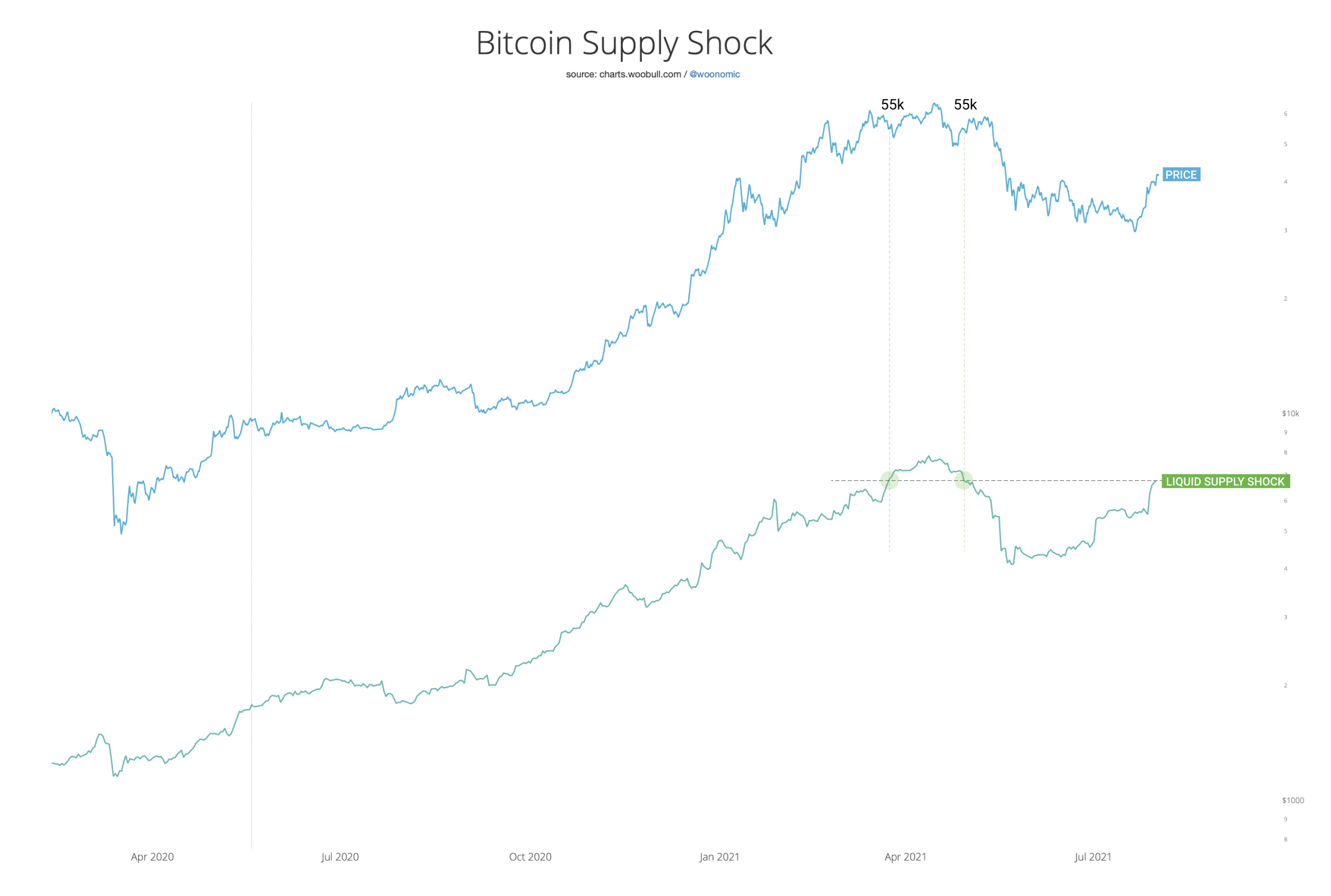

Woo’s upside predictions also carried the supply squeeze undertones—a situation wherein the number of available Bitcoin supply falls below its spot market demand, leading to higher bids.

Related: This bullish Bitcoin options strategy targets $50K without risk of liquidation

Woo applied his own “Liquid Supply Shock” indicator to conclude that markets ran out of Bitcoin.

Bitcoin supply shock with respect to its price. Source: Willy Woo

Bitcoin supply shock with respect to its price. Source: Willy Woo

In detail, Liquid Supply Shock is the ratio of coins that traders cannot buy versus the coins that they can buy. Woo calculates the supply shock by dividing the coins held by strong-handed investors with the coins held by speculative investors.

“Coins are rapidly disappearing from the available market as strong holders continue to lock them away for long-term investment,” said Woo, adding that the supply squeeze could send Bitcoin to $55,000.

“I’ve not seen a supply shock opportunity like this since Q4 2020 when BTC was priced at $10k only to be repriced at $60k in the months thereafter. Our supply shock is still in play with higher prices expected.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.