Solana (SOL) bulls have largely ignored its overvaluation risks as the blockchain asset goes after another milestone price level.

The SOL/USD exchange rate almost reached $200 on Sept. 7 as investors continued to treat Solana as a long-term competitor to Ethereum, the world’s leading smart contracts platform.

More bullish evidence came on Monday after Sam Bankman-Fried (SBF), the CEO of crypto derivatives platform FTX, announced Solana’s integration into their upcoming nonfungible token (NFT) marketplace.

On Sept. 6, SBF revealed that the new marketplace would enable NFT creators and owners to trade their digital arts cross-chain using Solana and Ethereum. The platform would also make it possible to trade NFT collections from rivaling marketplace OpenSea on FTX.

The NFT marketplace went live on Monday and is hosted by FTX.US, a United States-regulated cryptocurrency exchange backed by FTX. That enables U.S. users to mint and trade NFTs via FTX.

NFT boom behind Solana rally

NFTs exist on blockchains, the public ledger technology that keeps track of who owns the digital assets. Therefore, performing tasks such as minting an NFT token or processing a digital asset transactions entail a fee.

Most NFT-related transactions take place on Ethereum; it happens even as the network issues suffer from higher congestion and inflated gas fees issues. Data fetched by EtherScan shows that Ethereum’s gas fees reached their highest levels since May last week.

“As NFT activity commands ecosystem attention, gas prices have risen to daily levels that price out many retail traders,” Luke Posey, a researcher at blockchain analytics firm Glassnode, wrote in a note Wednesday.

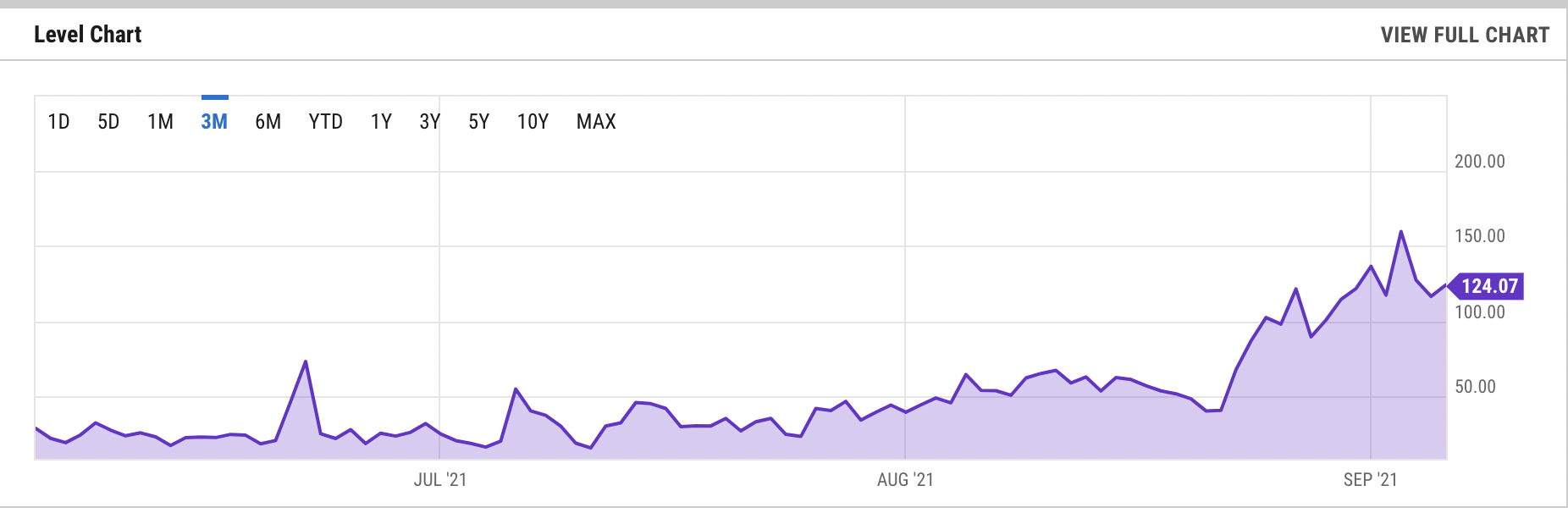

Ethereum gas fees (in Gwei) in the last three months. Source: YCharts

Ethereum gas fees (in Gwei) in the last three months. Source: YCharts

Solana’s public base-layer blockchain protocol proposes to do away with Ethereum’s performance bottlenecks. In addition, its lowered gas fees prospects have made it an emerging player in the NFT industry, backed by the launch of dedicated digital collectibles marketplaces such as Solanart, DigitalEyes, and its integration into music streaming platform Audius.

Major players in the crypto space have recognized Solana’s potential against Ethereum. In June, SBF-backed Alameda Research led a $314 million funding round for Solana backed by venture capital firm Andreessen Horowitz, Polychain Capital and CoinShares.

SOL to $500?

Greg Waisman, co-founder and COO at payment network Mercuryo envisioned exponential growth for the Solana ecosystem based on its growing adoption among the decentralized finance (DeFi) and NFT space.

He Solana’s boom appears similar to Ethereum and Binance Smart Chain, adding that it would boost SOL/USD exchange rate to as high as $500 in the second half of 2021. Excerpts from his statement:

“Solana is potentially a $500 digital coin, and the price growth of Solana in recent times points to the capacity of the token to receive enough boost to hit this mark before the end of H2 2021.”

SOL/USD daily price chart. Source: TradingView.com

SOL/USD daily price chart. Source: TradingView.com

On the flip side, analysts at JPMorgan & Chase warned clients about overvaluation risks in the altcoin and NFT space, stating that the recent rally is “more likely to be a reflection of froth and retail investor ‘mania’ rather than a reflection of a structural uptrend.”

Related: JPMorgan sounds alarm over ‘frothy’ crypto markets after August boom

On Tuesday, SOL/USD’s quarter-to-date returns reached a little over 450% as it established its all-time high at $196.78. Since then, the pair has already pulled back as traders take profits.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.