Everyone might be a genius during a bull market, but the real stars begin to shine when the waters get choppy. The same can be said for crypto projects and developers and once the pump is over, it’s easier for investors to separate the pump and dump projects from those with good fundamentals.

Sometimes a bull market, sometimes a bear market, always a builder’s market.

— a a ron (@aaroneth_) February 2, 2022

Now that Bitcoin (BTC) price has found its place back in the $42,000 to $45,000 zone, the mood across the crypto ecosystem has once again flipped bullish and projects that have continued to release new updates are being rewarded with significant jumps in price.

Here’s a look at three projects that have continued to develop and draw investors despite the recent market weakness.

Render Network

Render Network is a distributed GPU protocol that operates on the Ethereum (ETH) network and helps connect artists and studios with the GPU computing power they need to create digital renderings.

Render has continued to fine-tune the capabilities of its network over the past few months of sideways trading in the crypto market in newly emerging sectors including 3D simulations and the real-time rendering for films, games and the Metaverse.

As a result of protocol improvements and a listing on Coinbase, the protocol’s native RNDR token increased 137% from $1.80 on Jan. 24 to a daily high of $4.26 on Feb. 2 as Coinbase traders got their first opportunity to purchase the token.

RNDR/USDT 4-hour chart. Source: TradingView

RNDR/USDT 4-hour chart. Source: TradingView

With NFTs and the Metaverse continuing to be two of the hottest trending topics in crypto, the need for computing power to render high-quality digital images presents a necessary use case opportunity for projects like Render Network,

NFTX introduces inventory staking

The popularity of NFTs has also led to an explosion in the price for several projects and it has created the possibility for NFTs to be used as collateral.

NFTX is a community-owned NFT marketplace and ecosystem that has benefited from filling this need through the development of inventory staking, which introduced decentralized finance capabilities by helping to transform NFTs into yield-generating assets without the typical risk involved in supplying capital and providing liquidity.

Since inventory staking went live on the network, the price of NFTX climbed 124% from a low of $57.66 on Jan. 21 to a daily high of $129.16 on Feb. 1.

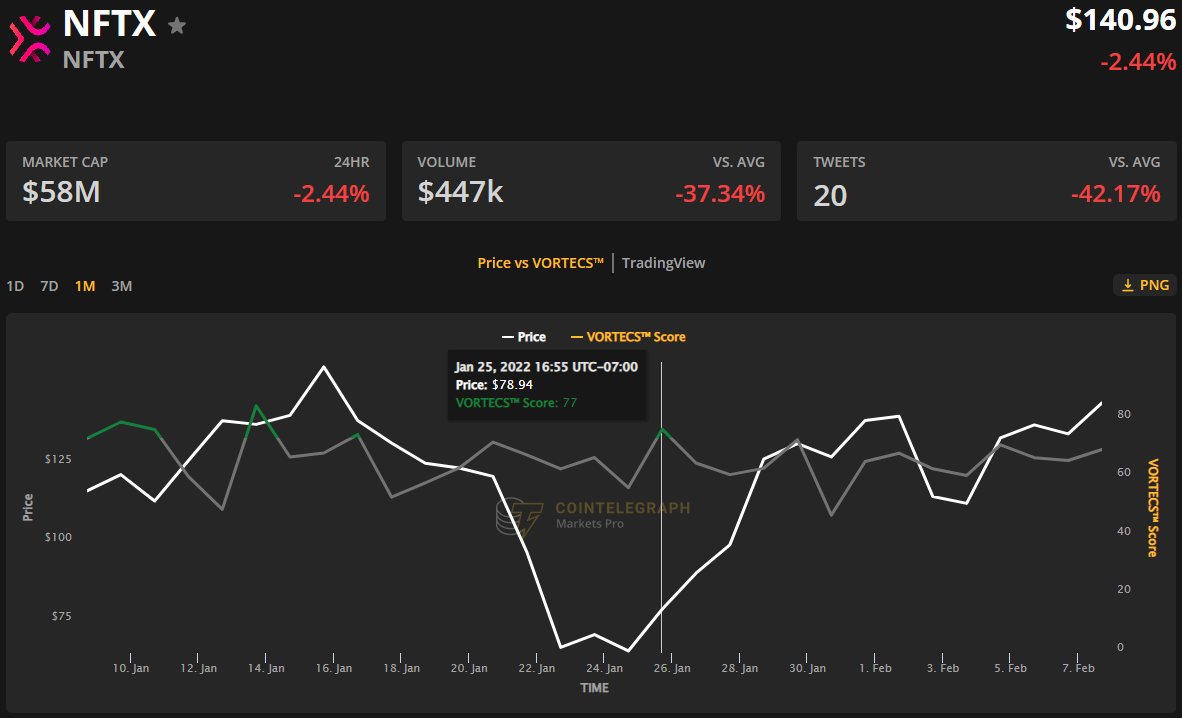

VORTECS™ Score (green) vs. NFTX price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. NFTX price. Source: Cointelegraph Markets Pro

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for NFTX on Jan. 25 when it hit a high of 77 at the same time as its price was in the process of increasing another 70% over the next six days.

Related: Crypto Biz: The crypto industry is more bullish than the Bitcoin charts, Jan. 27–Feb. 2

Yield Guild Games focuses on community building

Another project that is also benefiting from the momentum surrounding NFTs, the Metaverse and gaming is Yield Guild Games, a group focused on investing in virtual world NFTs and developing the world’s largest virtual economy capable of optimizing its assets to maximize utility and return on investment for token holders.

Over the past two months, the YGG ecosystem has been busy establishing partnerships and building out its scholarship program in an effort to help users from around the world earn income from play-to-earn gaming.

The project also showed its dedication to solving problems for people in the real world by launching a fundraising platform for the victims of typhoon Odette in the Philippines, which managed to raise a total of $1.45 million in aid as of Feb. 1.

This focus on creating developments that benefit the members of its community along with establishing new partnerships across the ecosystem has helped drive a 89% gain in YGG price from $2.17 on Jan. 24 to $4.11 on Feb. 7.

YGG/USDT 4-hour chart. Source: TradingView

YGG/USDT 4-hour chart. Source: TradingView

At the time of writing, YGG is trading at $3.63 with a 24-hour trading volume of $52.6 million and the overall cryptocurrency market cap stands at $1.7 trillion with a Bitcoin’s dominance rate at 41.6%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.