reader comments

127 with 75 posters participating

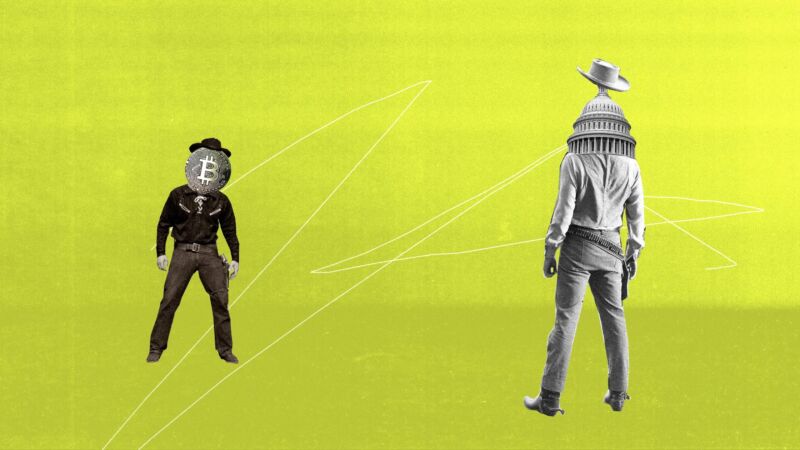

If you have paid casual attention to crypto news over the past few years, you probably have a sense that the crypto market is unregulated—a tech-driven Wild West in which the rules of traditional finance do not apply.

If you were Ishan Wahi, however, you would probably not have that sense.

Wahi worked at Coinbase, a leading crypto exchange, where he had a view into which tokens the platform planned to list for trading—an event that causes those assets to spike in value. According to the US Department of Justice, Wahi used that knowledge to buy those assets before the listings, then sell them for big profits. In July, the DOJ announced that it had indicted Wahi, along with two associates, in what it billed as the “first ever cryptocurrency insider trading tipping scheme.” If convicted, the defendants could face decades in federal prison.

On the same day as the DOJ announcement, the Securities and Exchange Commission made its own. It, too, was filing a lawsuit against the three men. Unlike the DOJ, however, the SEC can’t bring criminal cases, only civil ones. And yet it’s the SEC’s civil lawsuit—not the DOJ’s criminal case—that struck panic into the heart of the crypto industry. That’s because the SEC accused Wahi not only of insider trading, but also of securities fraud, arguing that nine of the assets he traded count as securities.

This may sound like a dry, technical distinction. In fact, whether a crypto asset should be classified as a security is a massive, possibly existential issue for the crypto industry. The Securities and Exchange Act of 1933 requires anyone who issues a security to register with the SEC, complying with extensive disclosure rules. If they don’t, they can face devastating legal liability.

investigating Coinbase itself for allegedly listing unregistered securities. That’s on top of a class-action lawsuit against the company brought by private plaintiffs. If these cases succeed, the days of the crypto free-for-all could soon be over.

To understand the fight over regulating crypto, it helps to start with the orange business.

The Securities and Exchange Act of 1933, passed in the aftermath of the 1929 stock market crash, provides a long list of things that can count as securities, including an “investment contract.” But it never spells out what an investment contract is. In 1946, the US Supreme Court provided a definition. The case concerned a Florida business called the Howey Company. The company owned a big plot of citrus groves. To raise money, it began offering people the opportunity to buy portions of its land. Along with the land sale, most buyers signed a 10-year service contract. The Howey Company would keep control of the property and handle all the work cultivating and selling the fruit. In return, the buyers would get a cut of the company’s profits.

The Securities and Exchange Act of 1933, passed in the aftermath of the 1929 stock market crash, provides a long list of things that can count as securities, including an “investment contract.” But it never spells out what an investment contract is. In 1946, the US Supreme Court provided a definition. The case concerned a Florida business called the Howey Company. The company owned a big plot of citrus groves. To raise money, it began offering people the opportunity to buy portions of its land. Along with the land sale, most buyers signed a 10-year service contract. The Howey Company would keep control of the property and handle all the work cultivating and selling the fruit. In return, the buyers would get a cut of the company’s profits.

In the 1940s, the SEC sued the Howey Company, asserting that its supposed land sales were investment contracts and therefore unlicensed securities. The case went to the Supreme Court, which held in favor of the SEC. Just because the Howey Company didn’t offer literal shares of stock, the court ruled, didn’t mean it wasn’t raising investment capital. The court explained that it would look at the “economic reality” of a business deal, rather than its technical form. It held that an investment contract exists whenever someone puts money into a project expecting the people running the project to turn that money into more money. That’s what investing is, after all: Companies raise capital by convincing investors that they’ll get paid back more than they put in.

Applying this standard to the case, the court ruled that the Howey Company had offered investment contracts. The people who “bought” the parcels of land didn’t really own the land. Most would never set foot on it. For all practical purposes, the company continued to own it. The economic reality of the situation was that the Howey Company was raising investment under the guise of selling property. “Thus,” the court concluded, “all the elements of a profit-seeking business venture are present here. The investors provide the capital and share in the earnings and profits; the promoters manage, control, and operate the enterprise.”

The ruling laid down the approach that the courts follow to this day, the so-called Howey test. It has four parts. Something counts as an investment contract if it is (1) an investment of money, (2) in a common enterprise, (3) with the expectation of profit, (4) to be derived from the efforts of others. The thrust is that you can’t get around securities law because you don’t use the words “stock” or “share.”

Which brings us to Ripple.