The price of Solana’s SOL (SOL) experienced a 20% gain between Sept. 28 and Oct. 6, but is the rally a tandem move with Bitcoin (BTC), or is it being driven by other factors? Prior to the price breakout — or perhaps, its recovery — SOL faced a turbulent period after a U.S. court approved the sale of $1.3 billion in SOL from the bankrupt exchange FTX.

The bankruptcy court has taken measures to ensure that the liquidation of FTX assets won’t become a burden for the crypto market, demanding the sale to occur through an investment adviser in weekly batches in accordance with preestablished rules.

Following the initial impact, which drove SOL’s price down to a two-month low of $17.34 on Sept. 11, some degree of confidence among bulls emerged as it reestablished the $20 support on Sept. 29. This movement coincided with a successful upgrade to version 1.16, boosting SOL by 16% over the next seven days.

SOL’s rally was also supported by growth in the usage of decentralized applications (DApps) and increased nonfungible token (NFT) volumes on Solana. SOL’s price is now attempting to establish a $23 support and consolidate its position as the fifth-largest cryptocurrency (excluding stablecoins) by market capitalization, surpassing ADA’s (ADA) $9.22 billion.

Solana’s DApp and NFT market activity surges

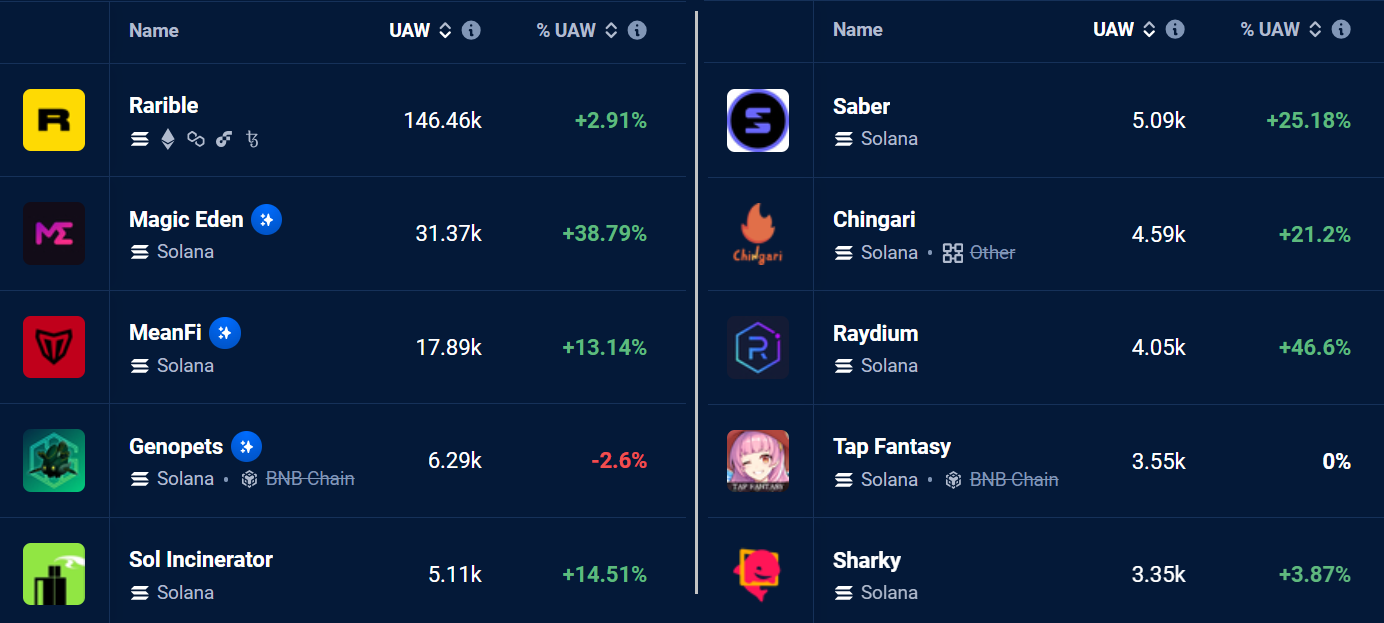

When analyzing networks focused on DApp execution, the number of active users should be a top priority. Therefore, one should begin by quantifying the addresses involved with smart contracts, which serve as a proxy for the number of users.

Notice that the increase in activity was consistent across all sectors, including NFT marketplaces, decentralized finance, collectibles, social and gaming. Furthermore, Solana’s active addresses engaging with DApps exceeded those of Ethereum in the same period, which were capped at 55,230.

Solana has been gaining traction in the NFT market due to its cost-efficient and scalable solution, as data is compressed and stored off-chain. This allows for more viable production in larger quantities, as they require lower minting fees, enabling creators to reach wider audiences.

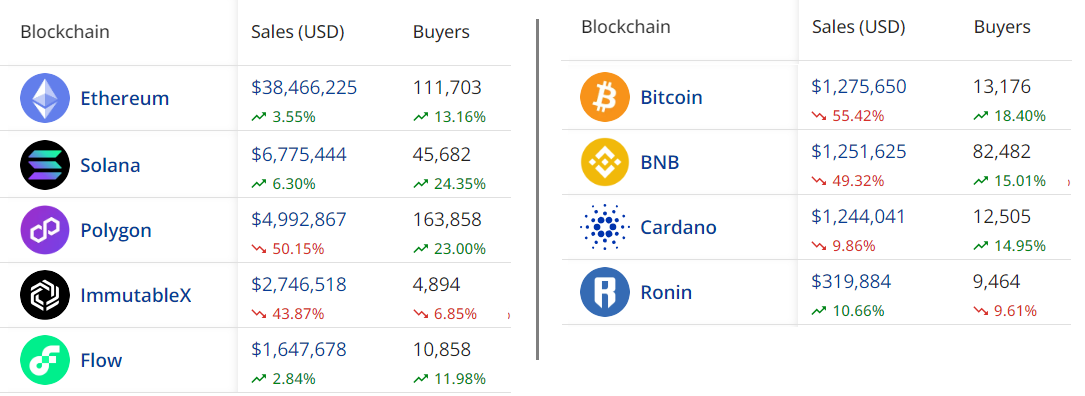

Over the past seven days, the Solana network surpassed Polygon in NFT sales, accumulating $6.8 million in value, according to CryptoSlam. In September, the situation was reversed, with Solana totaling $23.9 million, while the Polygon network achieved $31 million in NFT sales.

Network upgrade enhances privacy and eases the stress on validators

A potential driver behind SOL’s recent 20% price gains was the network upgrade to version 1.16 on Sept. 28, which introduced a “gate system” to ensure the gradual activation of new features on the network. This process helps maintain network stability and prevents issues caused by sudden changes.

Another notable change in this update is “confidential transfers,” which use zero-knowledge proofs to encrypt transaction details, enhancing user privacy. The release also includes improvements in RAM usage for validators, resizable data accounts and a mechanism to identify corrupted data.

Overall, this update brings improved efficiency, privacy and security to the Solana blockchain, marking a significant milestone in its development.

Stiff competition from Ethereum layer-2 solutions

Despite Solana’s competition with other blockchain networks, there is no doubt that Ethereum layer-2 solutions have gained more traction in terms of total value locked (TVL) and activity. For instance, Arbitrum holds $1.73 billion in TVL, and Optimism holds another $637 million, according to DefiLlama —both vastly superior to Solana’s $326 million.

Even as Solana continues to make progress in terms of privacy, scaling and security, external factors are at play beyond the FTX bankruptcy drama, making the $23 resistance harder to breach than anticipated.

Ultimately, investors remain largely focused on the Ethereum ecosystem, as it remains the leader in terms of developers and consolidated decentralized applications.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.