Being bullish on Ether (ETH) over the past four months did not pay off as its price dropped 44% from $4,600. The decentralized finance (DeFi) applications growth that fueled the rally faded away, partially due to network congestion and average transaction fees of $30 and higher.

The cool-off period can also be attributed to excessive expectations as the fee burn mechanism implemented in August 2021 with the London hard fork. After drastically reducing the daily net issuance, investors jumped to the conclusion that Ether would become “ultrasound money.”

The Ethereum network burned more ETH over the last 24 hours than was issued by both the PoW (eth1) and PoS (eth2) networks.

This is the first time this has happened since EIP-1559 went live less than 3 months ago.

ETH is ultra sound money

— sassal.eth (@sassal0x) October 28, 2021

Unfortunately, history shows that “hard money” requires multiple decades of reliable monetary policy. For example, the Euro currency was launched to the public in 2002 despite periods of negative issuing in 2014 and 2019. Yet, its purchasing power has failed to hold ground against hard assets like gold or real estate.

Case-Shiller U.S. Home Price Index/EUR (orange, left) & Gold/EUR (blue). Source: TradingView

Case-Shiller U.S. Home Price Index/EUR (orange, left) & Gold/EUR (blue). Source: TradingView

In light of the 4-month prolonged underperformance, one could buy some cheap ultra-bullish call (bull) $4,000 ETH options for May for $68. However, with 75 days left for expiry, odds of a 55% rally from the current $2,570 are slim.

It seems more prudent to bet on a positive price change, but be more selective of your target range. That is precisely how professional traders use the “iron condor” options strategy.

Reduced losses by limiting the upside

A total of 10.2 million ETH have been staked into the Eth2 (consensus layer) deposit contract and investors seem confident about the proof-of-stake migration. Furthermore, mitigating the Ethereum network’s biggest hurdle, i.e. scaling, could undoubtedly cause ETH price to skyrocket.

Finding a strategy that maximizes gains up to $3,600 by May 27 seems prudent. On the other hand, hedging for a negative 7% performance is also wise considering the uncertainty regarding United States President Joe Biden’s crypto regulatory efforts.

Even though the executive order signed on March 9 did not announce any restrictive measures, it undoubtedly laid the groundwork for a more focused federal oversight.

In that sense, the skewed “Iron Condor” options strategy perfectly fits such a slightly bullish scenario.

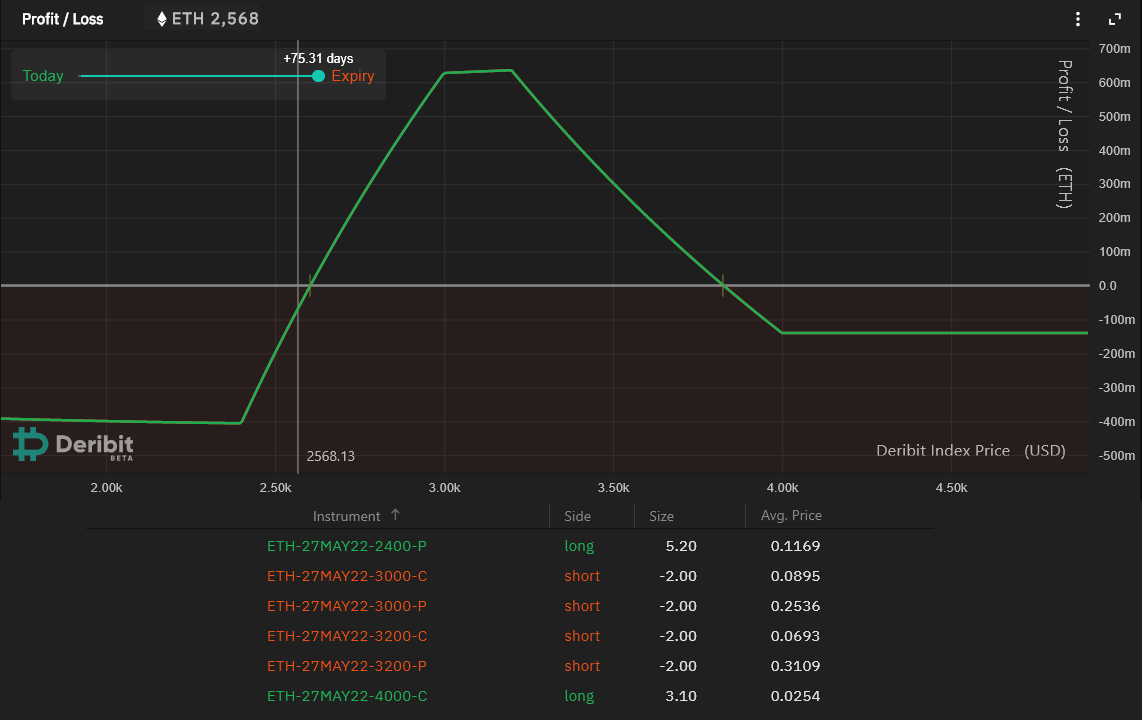

Ether options Iron condor skewed strategy returns. Source: Deribit Position Builder

Ether options Iron condor skewed strategy returns. Source: Deribit Position Builder

The “Iron Condor” sells both the call (bull) and put (bear) options at the same expiry price and date. The above example has been set using the ETH May 27 options at Deribit.

ETH profit zone is between $2,600 and $3,800

The investors should initiate the trade by shorting (selling) 2 contracts of the $3,000 call and put options. Then, the trader needs to repeat the procedure for the $3,200 options.

To protect from extreme price movements, a protective put at $2,400 has been used. Consequently, 5.20 contracts will be necessary depending on the price.

Lastly, just in case Ether’s price rips above $4,000, the buyer will need to acquire 2.10 call option contracts to limit the strategy’s potential loss.

The number of contracts on the above example aims for a maximum ETH 0.63 gain and a potential ETH 0.40 loss. This strategy yields a net profit if Ether trades between $2,600 and $3,820 on May 27.

Using the skewed version of the Iron Condor, an investor can profit as long as the Ether price increase is lower than 49% by expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.