The explosion of interest in non-fungible tokens over the past two months has taken some of the attention away from the decentralized finance sector but this doesn’t mean that some projects are not seeing bullish breakouts.

One project that has continued to work on expandin the capabilities of its ecosystem is the Kyber Network (KNC), an on-chain liquidity protocol that aggregates liquidity from multiple sources to enable instant token swaps on any decentralized application (DApp).

KNC/USDT 4-hour chart. Source: TradingView

KNC/USDT 4-hour chart. Source: TradingView

Data from Cointelegraph Markets and TradingView shows that the price of KNC surged 50% over the past 24-hours, climbing from a low of $1.93 on March 16 to an intraday high of $2.89 on March 16.

Optimism grows for Kyber 3.0

The main driving force behind the growing optimism in the Kyber community is the upcoming launch of Kyber 3.0 which will “transition Kyber from a single protocol into a hub of purpose-driven liquidity protocols that are catered to different DeFi use cases.”

The launch will be implemented in two phases which are dubbed Katana and Kaizen. The Katana phase is planned for Q1 and Q2 of 2021 and includes the launch of the Kyber dynamic market maker (DMM), a first for the young DeFi sector, along with a proposal for a KyberDAO and KNC upgrade.

This is a significant development for the Kyber ecosystem as the DMM will provide benefits to liquidity providers and it will also support permissionless liquidity contributions from anyone and grant access to this liquidity by any taker.

The KyberDAO and KNC upgrade proposal also aims to amplify KyberDAO’s governance power and create multiple sources of utility and value accrual for KNC as a way to enable additional liquidity and encourage innovation.

The Kaizen phase will help integrate all the pieces of the Kyber exosystem together to finalize Kyber 3.0 and is expected to be completed by late Q3.

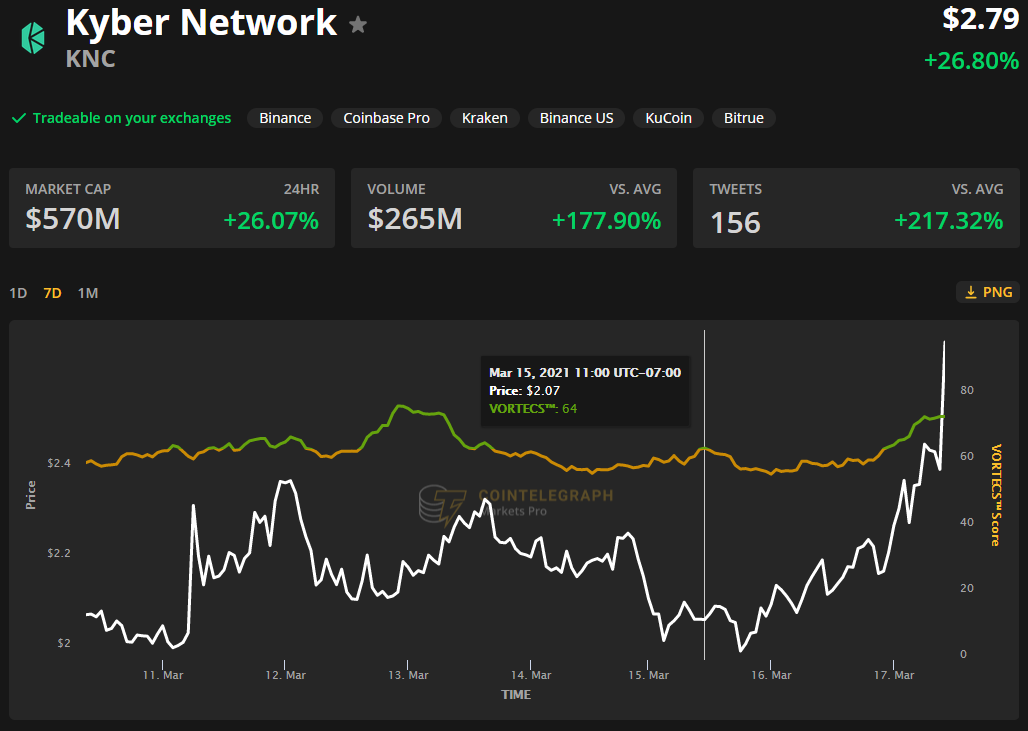

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for KNC on March 15, prior to the recent price rise.

The VORTECS™ score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. KNC price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. KNC price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ score for KNC began turning green on March 11 and hit a high of 77 on March 12 as a trading activity for KNC began to pick up. The VORTECS™ score then fell into the yellow zone over the next two days before increasing to a score of 64 on March 15. This was roughly seven hours before KNC price began a 40% price breakout over the next two days.

Sector rotation in the cryptocurrency markets can happen rapidly as evidenced by the NFT mania over the past two months. This refocus has given DeFi projects the opportunity to regroup and make plans for their next stage of development.

Upgrades to the Kyber Network that increase governance features while adding solutions to high gas fees have the project well-positioned for increased adoption once the focus of the cryptocurrency market returns to the burgeoning DeFi sector.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.