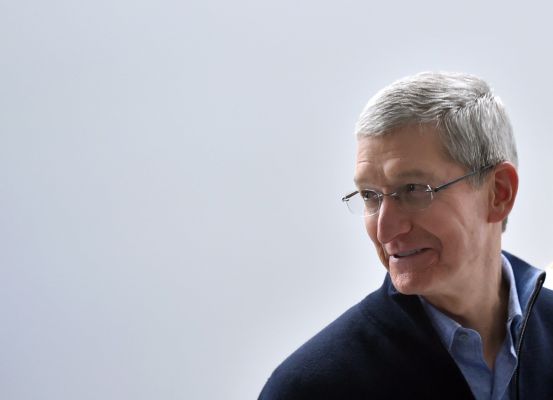

Apple CEO Tim Cook took his first turn in the witness chair this morning in what is probably the most anticipated testimony of the Epic v. Apple antitrust case. But rather than a fiery condemnation of Epic’s shenanigans and allegations, Cook offered a mild, carefully tended ignorance that left many of the lawsuit’s key questions unanswered, or unanswerable.

This anticlimax may not make for exciting reporting, but it could serve to defang the dangerous, if somewhat dubious, argument that Apple’s App Store amounts to a monopoly.

After being called by Apple’s own attorneys, Cook took the stand, Law360’s Dorothy Atkins, one of two media members allowed in the court, reported in her comprehensive live tweeting of the testimony. The quotes from Cook are as reported and not to be considered verbatim; the court transcript will follow when the document is compiled and public. Incidentally, Atkins’ stage-setting descriptions are appealing and humanizing, though Epic CEO Tim Sweeney comes off as a bit weird:

The questioning of Cook by his own company’s counsel was gentle and directed at reiterating the reasons why Apple’s App Store is superior and sufficient for iOS users, while also asserting the presence of stiff competition. He admitted to a handful of conflicts with developers, such as differing priorities or needing to improve discovery, but said the company works constantly to retain developers and users.

The façade of innocent ignorance began when he was asked about Apple’s R&D numbers — $15-20 billion annually for the last three years. Specifically, he said that Apple couldn’t estimate how much of that money was directed toward the App Store, because “we don’t allocate like that,” i.e. research budgets for individual products aren’t broken out from the rest.

Now, that doesn’t sound right, does it? A company like Apple knows down to the penny how much it spends on its products and research. Even if it can’t be perfectly broken down — an advance in MacOS code may play into a feature on the App Store — the company must know to some extent how its resources are being deployed and to what effect. The differences between a conservative and liberal estimation of the App Store’s R&D allocation might be large, in the hundreds of millions perhaps, but make no mistake, those estimations are almost certainly being made internally. To do otherwise would be folly.

But because the numbers are not publicly declared and broken down, and because they are likely to be somewhat fuzzy, Cook can say truthfully that there’s no single number like (to invent an amount) “App Store R&D was $500 million in 2019.”

Not having a hard number removes a potential foothold for Epic, which could use it either way: If it’s big, they’re protecting their golden goose (enforcing market power). If it’s small, they’re just collecting the eggs (collecting rent via market power). Apple’s only winning move is not to play, so Cook plays dumb and consequently Epic’s argument looks like speculation (and, as Apple would argue, fabulation).

He then deployed a similar strategy of starving the competition with a preemptive shrug about profits. He only addressed total net sales, which were about $275 billion at a 21% profit margin, saying Apple does not evaluate the App Store’s income as a standalone business.

Certainly it is arguable that the App Store is very much a tightly integrated component of a larger business structure. But the idea that it cannot be assessed as a standalone business is ludicrous. It is again nearly certain that it, like all of Apple’s divisions and product lines, is dissected and reported internally in excruciating detail. But again it is just plausible that for legal purposes it is not straightforward enough to say “the income and profits of the App Store are such and such,” thus denying Epic its datum.

However, the point is important enough that Epic thought it warranted independent investigation. And among the first things Epic’s attorney brought up, when the witness was turned over to him, was the testimony from earlier in the trial by an expert witness that Apple’s App Store operating margins were around 79%.

It was not in Apple’s interest to confirm or deny these numbers, and Cook again pleaded ignorance. The mask slipped a tiny bit, however, when Epic’s attorney asked Cook to break down the confidential income numbers that combined the Mac and iOS App Stores. While Apple objected to this, saying it was privileged information and could only be divulged in a closed court, Cook offered that the iOS numbers are “a lot larger” than the Mac numbers.

What we see here is another piece of financial sleight-of-hand. By mixing the iOS and Mac income Apple gets to muddy the waters of how much money is made and spent in and on them. Epic’s attempt to unmix them was not successful, but the judge is no fool — she sees the same things Epic does, but just as dimly. Apple is attempting to deny Epic a legal victory even at the cost of looking rather shadowy and manipulative.

This was further demonstrated when Cook was asked about Apple’s deal with Google that keeps the search engine as the default on iOS. Cook said he didn’t remember the specific numbers.

If the CEO of one of the biggest tech companies in the world told you they forgot the specifics of a multibillion-dollar, decade-long deal with one of the other biggest tech companies in the world, would you believe them?

Little of the remaining testimony shed light on anything. Cook discussed the complexities of operating in places like China where local laws have technical and policy repercussions, and minimized the assertion that Apple had expanded the scope of in-app purchases and from which transactions the company gets a 30% cut. A bit more testimony will take place in a closed court, but we likely won’t hear about it as it will concern confidential information.

The trial, which is winding down, has held few surprises; both sides laid out their arguments at the start, and much of this will come down to the judge’s interpretation of the facts. There were no dramatic surprise witnesses or smoking guns — it’s simply a novel argument about what constitutes monopolistic behavior. Apple is adamant that competition is present and fierce in Android, and that in the gaming world it competes with Windows and consoles as well.

It seems almost inevitable that whatever the judgment is, the case will be appealed and brought to a higher court, but that judgment will also be a strong indicator of how well Epic’s arguments (and Apple’s obfuscations) have been received. That said, Epic and other critics of Apple’s App Store fees, which are immensely profitable however the company chooses to obscure it, have arguably already accomplished their goals. Apple’s lowered 15% fee for the first million dollars is plainly a response to developer unrest and bad press, and now it is put in the position of defending how the sausage gets made.

Tarnishing Apple’s anodized aluminum tower was always at least partly the intent, and win or lose Epic may feel it has gotten its money’s worth. Besides, the rematch in Europe is yet to come.