Wejo, the interconnected vehicle data startup backed by GM and Palantir, blueprint to go public through a merger with special purpose acquiring company Virtuoso Acquisition Corp. The agreement, announced in any regulator filing Friday, can give the combined company some sort of enterprise valuation of $800 million, which includes debt.

The deal raises $345 million in proceeds to work with Wejo, including a $230 thousand thousand cash contribution from Inocente and a $100 million with private investment in public value, or PIPE. Previous level investors Palantir and GM anchored the transaction, principles Wejo. The company did not disclose the amounts of those investment funds. Current shareholders will usually upheld 64% ownership of the carrier}, according to its investor deck .

Once the transaction closes, which is expected to occur in the third quarter, Wejo will be listed on the Nasdaq public exchange.

Wejo works with automakers and tier 1 suppliers to collect data in real-time from sensors integrated in vehicles. The company’s cloud platform aggregates and normalizes data, and then shares those insights customers. By 2030, Wejo estimates a connected vehicle data market of $500 billion and a serviceable addressable market of $61 billion driven by projections of more than 600 million connected vehicles worldwide.

Wejo said the cash proceeds will fully from the transaction will fully fund its five-year plan and help it achieve several growth goals such as onboarding automakers and other OEMs more quickly, continuing to rollout services and expanding into new markets.

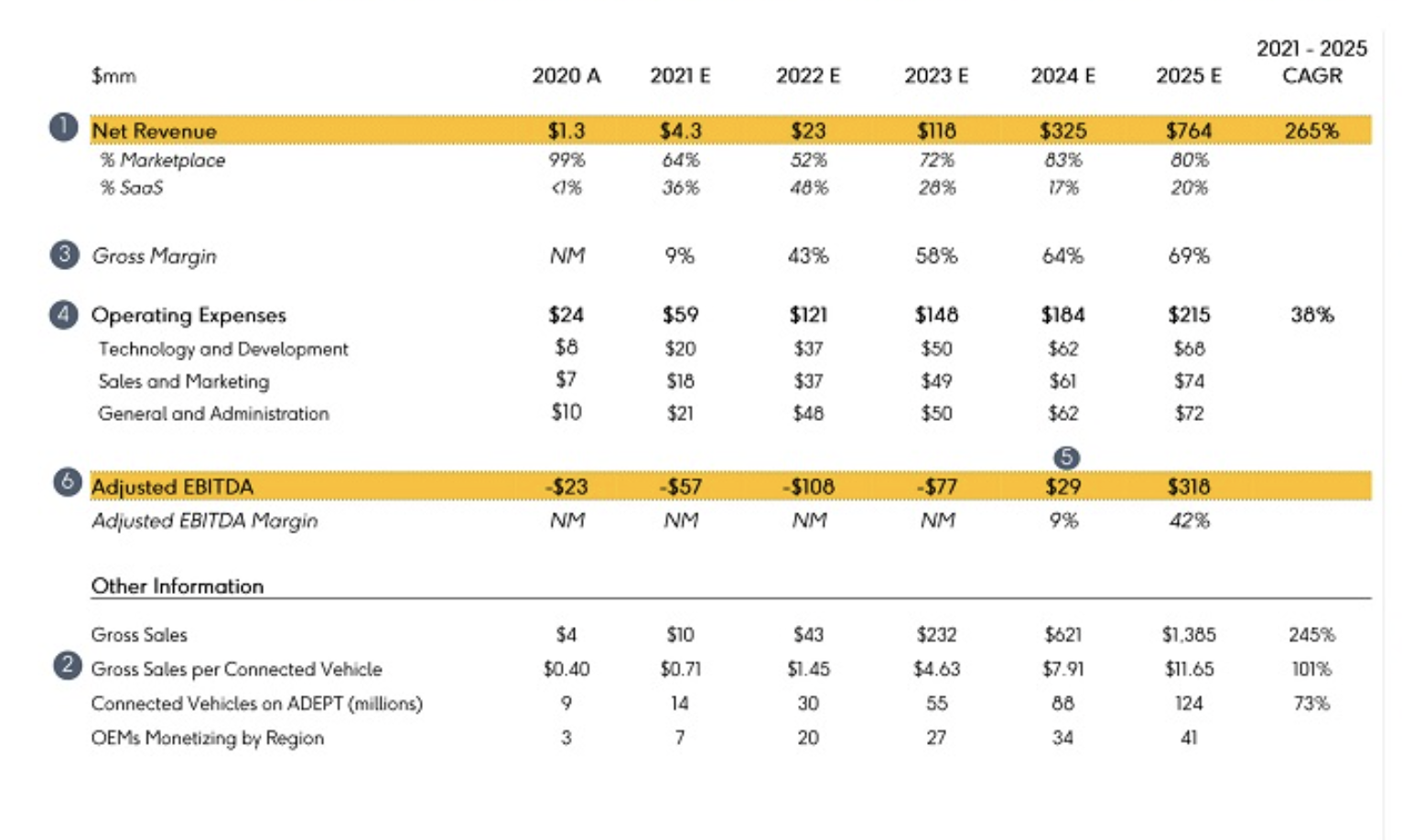

Image Credits: Screenshot/Wejo