The transaction fees of Bitcoin and Ethereum have slumped to six-month lows as the markets cool after the recent crypto downturn.

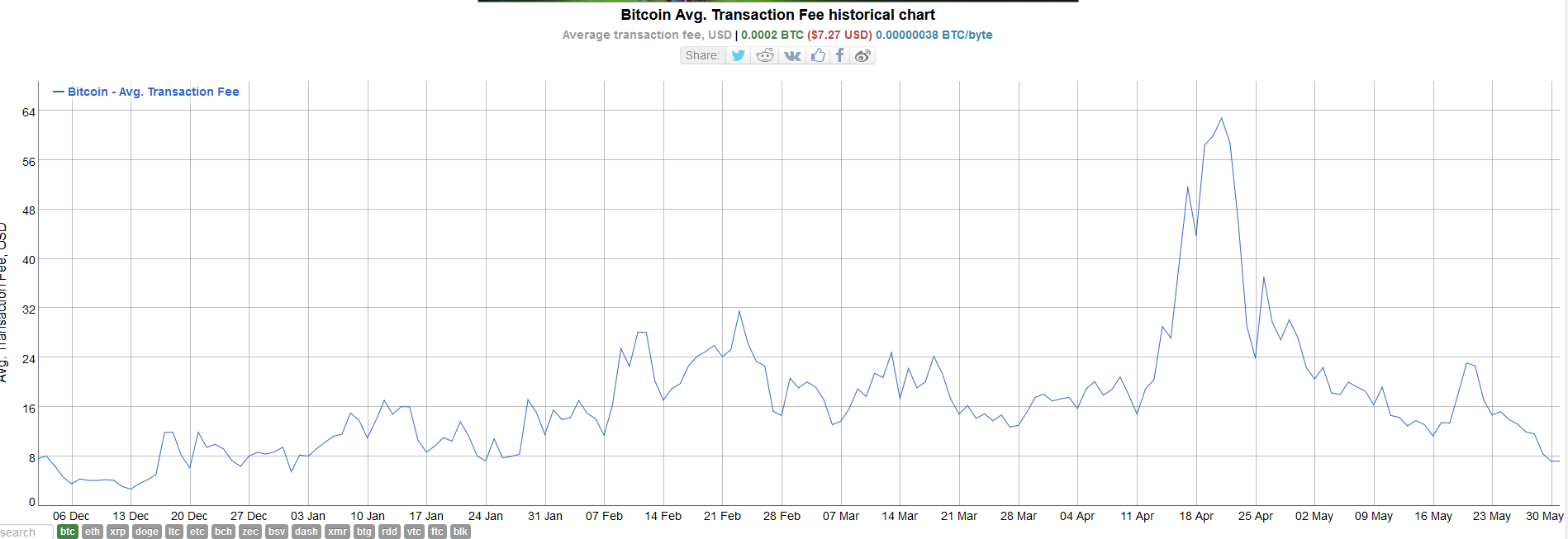

According to BitInfoCharts, the average price of performing a transaction using Bitcoin has fallen from an early-April all-time high of $62.77 to around $7.20 — an 88% drop over just six weeks.

Bitcoin average transaction fees – BitInfoCharts

Bitcoin average transaction fees – BitInfoCharts

The falling Bitcoin transaction fees appear to have been driven by a decline in overall market activity, with daily volumes evaporating from more than $67 billion on May 10 to $30 billion as of this writing, according to CoinGecko.

The meteoric 2021 crypto bull-run has seen the average transaction fees associated with using Bitcoin or the Ethereum mainnet frequently skyrocket to unprecedented levels in recent months.

In February 2021, Bitcoin’s fees nearly tripled in two weeks following a Feb. 8 announcement that Tesla added $1.5 billion worth of Bitcoin to its balance sheet.

The news sparked a surge in crypto speculation, with the price breaking its former high of $40,000 before topping out at $54,410. Data from CoinGecko shows that 24-hour volume for BTC increased by nearly double from $57 billion on Feb. 7 — the day before Tesla’s announcement — to $101 billion on Feb. 23.

The average price of Bitcoin fees again surged into a record high of $62.77 on April 21 after the price of BTC spike to tag a local top of $64,804 on April 14. Bitcoin’s fees peaked on April 21 sparked by an increase in market activity as the markets began showing weakness, as traders raced each other to cash out near the highs.

Bitcoin price chart – CoinGecko

Bitcoin price chart – CoinGecko

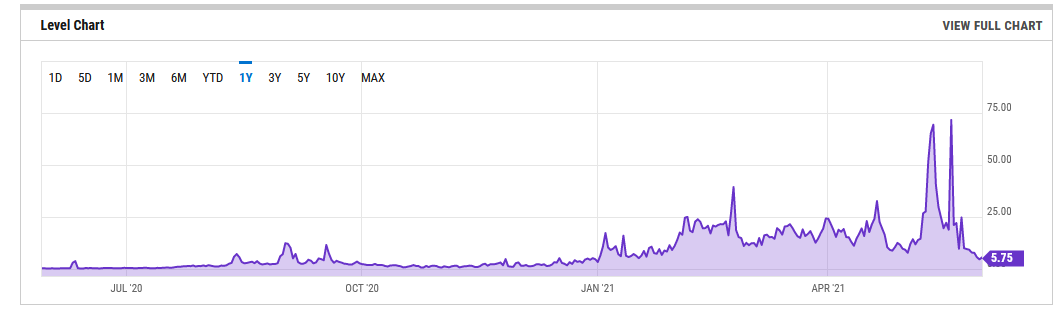

Data from YCharts also shows that average Ethereum fees have dropped from May 20’s record high of $72.21 to just $4.80, a 93% reduction in less than two weeks.

Ethereum average transaction fees – YCharts

Ethereum average transaction fees – YCharts

Increasing adoption of Ethereum-powered decentralized finance and nonfungible tokens saw average fees increase from $3.50 at the beginning of the year to new highs of nearly $40 by the end of February.

While developers sought to discipline the fee markets through April’s Berlin hard fork, a speculative frenzy surrounding Shiba Inu and other ERC-20 dog tokens drove further congestion on the Ethereum mainnet, again pushing fees to record highs last month.

Ethereum’s transaction fees last established a new all-time high of $71.21 on May 19, with Cointelegraph reporting that a rush of traders racing to exit leveraged positions on-chain amid plummeting crypto prices was responsible for the hike.

Complex smart contract transactions incurred fees of more than 10 times the average at the peak of the market turmoil, with CoinShares CSO, Meltem Demirors, reporting claiming to have paid more than $1,000 for a single transaction.