Bitcoin (BTC) begins another week below $40,000 but with two major new landmarks under its belt.

After falling over continued FUD from China over the weekend, Bitcoin adoption has also seen an unexpected first — from El Salvador and Paraguay.

With the world potentially about to greet its first two “Bitcoin nations” in history, there’s plenty to be bullish about, but can BTC price action catch up?

Cointelegraph takes a look at five things which may change the status quo in BTC/USD over the coming days.

Higher interest rates “good” says Yellen

A cursory look at the wider macro climate delivers an interesting mixture for Bitcoin traders and hodlers.

Inflation is still the talk of the town in the United States, with Treasury Secretary Janet Yellen revealing that she would be in favor of higher rates.

Speaking to Bloomberg over the weekend, Yellen voiced support for President Joe Biden’s latest giant spending package, and argued that this should be given credence even if it resulted in inflation.

“If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” she told the publication.

Higher interest rates tend to improve Bitcoin’s appeal as a deflationary asset, but coming hand in hand with them is a surging U.S. dollar this month — something which traditionally pressures BTC/USD.

After bouncing off 90, the U.S. dollar currency index (DXY) is now busy making up lost ground, bucking a downtrend which began in mid March.

U.S. dollar currency index (DXY) 1-day candle chart. Source: TradingView

U.S. dollar currency index (DXY) 1-day candle chart. Source: TradingView

El Salvador, Paraguay fail to flip Bitcoin bullis

Within Bitcoin, the word on everyone’s lips is “El Salvador.”

After payment gateway Strike began making serious inroads in the country, President Nayib Bukele formally announced that he would send a bill to parliament to make Bitcoin legal tender.

Should it succeed, El Salvador would be the first nation on Earth to do so, effectively adopting something akin to a “Bitcoin standard.”

Bukele confirmed his plans during a video address at last week’s Bitcoin Conference 2021 event in Miami at which Strike CEO, Jack Mallers, outlined the plans.

Markets, however, were practically unmoved by the revelation — something which continued as a congressman from Paraguay took to social media to hint at plans for Bitcoin integration in a second world economy.

“As I was saying a long time ago, our country needs to advance hand in hand with the new generation. The moment has come, our moment,” Carlitos Rejala tweeted on Monday.

“This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon.”

Rejala additionally thanked Bukele for his “example.”

As Cointelegraph reported, however, El Salvador’s embrace of Bitcoin may come at a price. Reacting, commentators touched on Bukele’s authoritarian leadership, along with potential teething troubles resulting from an economy which uses the U.S. dollar doing so.

For Caitlin Long, founder and CEO of Avanti Bank, there may be bigger forces at play.

“Bitcoin is hacking dictatorships, just like it’s hacking big tech,” she wrote in one of many tweets about the move.

“Bitcoin doesn’t care WHY El Salvador’s president wants to make BTC legal tender—it doesn’t matter.”

Shorts mount in classic bear signal

Look at immediate price action and anyone would be forgiven for having cold feet over Bitcoin on Monday.

For all the excitement of the conference, BTC/USD is firmly rangebound and minus a run of higher highs and higher lows which could signal a breakout.

Recent attempts at doing so — by escaping a narrowing “compression” wedge where volatility trends to almost zero — have all stalled.

At the time of writing, Bitcoin traded at just above $36,000.

With funding rates lessening, positive signs were just about visible in some areas of the market, but others are already sounding the alarm.

Causing concern are short trades on major exchange Bitfinex. As popular Twitter account Fomocap noted on Monday, a rise in shorts has historically coincided with major volatility — usually to the downside.

“Bitfinex sudden move in shorts always means something. From Nov 25 drop to May 19 rise,” he warned.

“It’s rising again.”

Bitfinex shorts vs. BTC/USD annotated chart. Source: Fomocap/ Twitter

Bitfinex shorts vs. BTC/USD annotated chart. Source: Fomocap/ Twitter

This would cement existing fears that Bitcoin is not yet done with its bearish retreat. Opinion is split, as Cointelegraph reported — some are waiting for a return to $20,000, while others are convinced that such levels are out of reach for good.

Ethereum eyes “parabolic” move versus BTC

Bitcoin’s pain could yet be altcoins’ gain.

With some cryptocurrencies scoring sustained upside despite a declining crypto market cap, hopes remain that an opportunist “alt season” can still emerge.

Of particular interest this week is Ether (ETH), which against Bitcoin is approaching its recent local highs of 0.081 from last month.

Currently at 0.076, ETH/BTC could be primed for a further breakout. Kyle Davies, CEO of Three Arrows Capital, even went as far as to describe the incoming move as “parabolic.”

“If we hit .2 without making usd all time highs on both assets I’m just gonna not bother with crypto anymore,” Blockfolio’s UpOnly chat show host Cobie replied, capturing the general sense of frustration with current price action among traders.

ETH/BTC hit its all-time high of 0.123 in early 2018 and has since failed to approach those levels again.

ETH/BTC 1-week candle chart (Bitstamp). Source: TradingView

ETH/BTC 1-week candle chart (Bitstamp). Source: TradingView

On Monday, the majority of the top fifty cryptocurrencies by market cap saw modest gains as Bitcoin dithered, while some outperformed, including Solana (SOL) with 10% returns and Tezos (XTZ) with 12%.

“Could see some more upside here especially if Eth/BTC holds,” trader Josh Rager forecast on Sunday about SOL’s prospects.

Miners stage highest outflow of 2021

Bitcoin’s hash rate is showing signs of recovering, with a modest uptick from 125 exahashes per second (EH/s) to 134 EH/s in recent days.

Difficulty is still due to decrease by around 8% at the next automated readjustment in five days’ time, compensating for a miner shake-up which accompanied recent volatility.

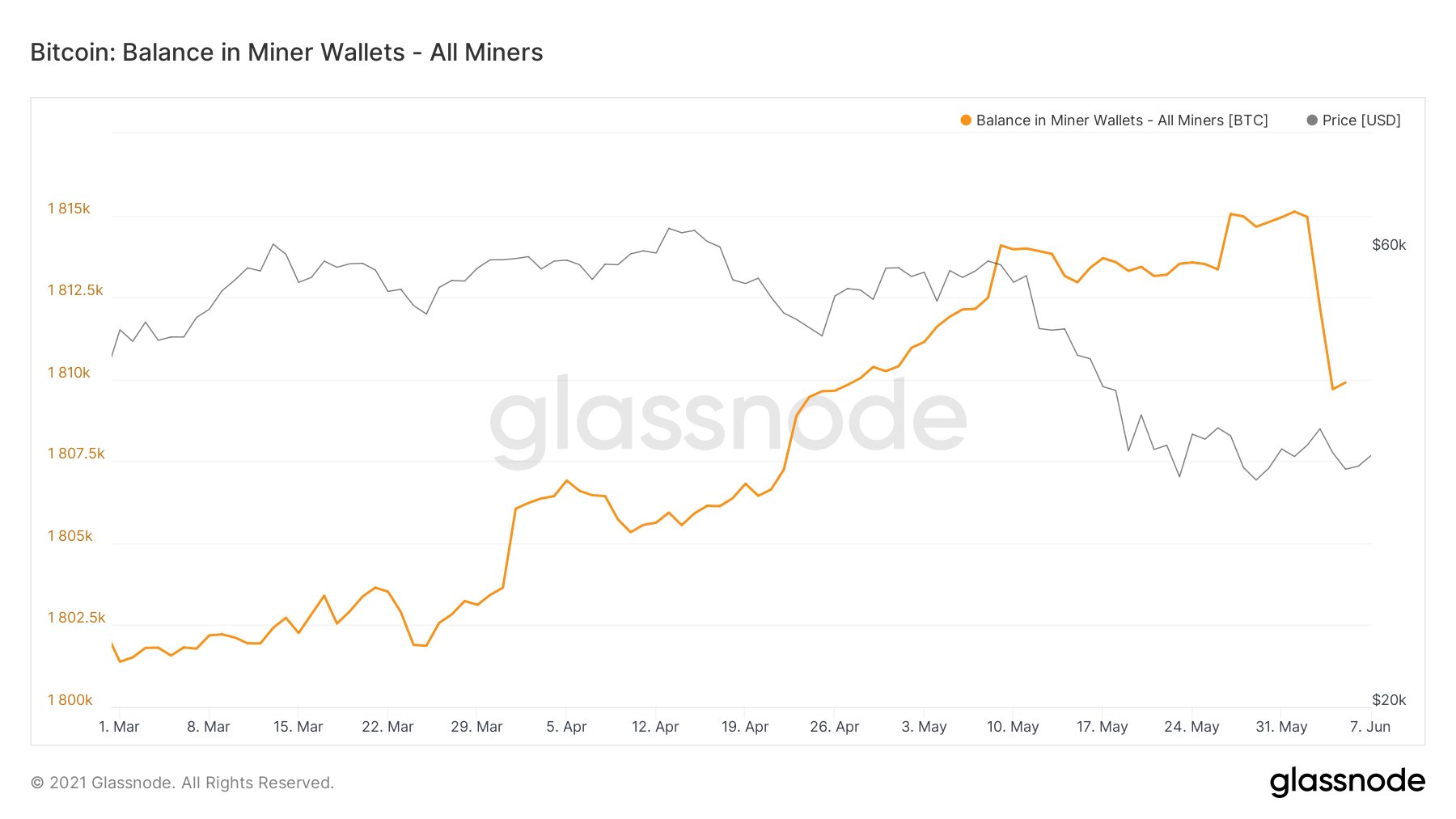

Nonetheless, once confident miners who had held through the dip decreased their holdings en masse last week, data shows.

As noted by analyst William Clemente, miner balances are down by 5,000 BTC compared to one week ago — a major turnaround.

On June 3, 3,012 BTC left largest mining pool Poolin in what was the largest single outflow of 2021. Another 2,501 BTC moved a day later.

Commenting, however, analyst Lex Moskovski acknowledged that the funds may not have ended up being sold.

“This isn’t a sing for selling even if this day sees 3x of the outflows like this,” he tweeted.

Miner BTC balance chart. Source: William Clemente/ Twitter

Miner BTC balance chart. Source: William Clemente/ Twitter