Meet the Crypto Payments Technology Startup That Strives to Become the Stripe and Citadel of Crypto

With a fast-growing fiat-to-crypto on-ramp solution that offers the lowest rates in the space, Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLM

F) has multiple hyper-growth catalysts ahead to propel it to the next level

Crypto has never looked more bulletproof.

Sure, there’s volatility.

But even major news items like China declaring all crypto transactions as illegal barely made a dent in the price[1].

In fact, as of Sep 27, 2021, the total market cap of all cryptos still stands at $1.95 trillion – 563% higher than it was just a year ago[2].

The reason today’s crypto markets are so resilient?

Crypto is Constantly Evolving – With New Drivers of Crypto Like DeFi and NFTs Now Powering Its Growth

Crypto used to be synonymous with Bitcoin. But no longer.

Today, things like DeFi and NFTs are capturing all the attention – sparking a new flood of investor money into the space.

The value of the crypto locked in DeFi protocols now stands at over $85 billion – more than quadrupling over the past year[3].

NFT tokens are now worth over $30 billion, with more than $7.7 billion in sales in the first 9 months of 2021 alone[4][5][6].

And it’s not just from retail investors – “smart money” institutional investors are jumping in with both feet at a rate we’ve never seen before.

All This Demand is Creating a Momentus Opportunity for Companies Like Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) Which Operate the “Bridges” Between the Fiat and Crypto Worlds

When people think of entering the crypto world, they often think of crypto exchanges and digital asset platforms that allow you to buy crypto in exchange for fiat currency.

But what most people don’t know is:

A lot of this fiat-to-crypto “on-ramping” by crypto exchanges and digital asset platforms is quietly handled in the background by companies like Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF).

The company’s cutting-edge fiat-to-crypto gateway solution allows users to seamlessly purchase crypto using their credit or debit cards.

Mobilum’s fiat-to-crypto on-ramp solution is quickly growing, which is why:

Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) Could Potentially Be Your Best Chance of Profiting from Crypto’s Rapid Evolution

Crypto is in a constant state of evolution.

But no matter what new innovation arises from the crypto space, one indisputable fact remains:

People will always need to move money from fiat to crypto.

And the smoother and more cost-effective that on-ramping gateway solution – the more traction it will get.

Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) currently offers the lowest rates in the industry at 2.99% – plus a zero chargeback guarantee[7].

For instance, Simplex’s fees[8] are 0.5% to 2% higher than Mobilum’s, meaning we could see a major pricing-based shift toward Mobilum Technologies’ solution very soon.

But Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) is not doing any kind of “loss leader” strategy.

Despite offering the lowest rates, it also maintains high profit margins – taking at least 2% on every transaction[9].

In August 2021, Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) had a transaction volume of C$7.7 million[10].

While that may not seem like much, that was a 44% monthly growth.

If that pace of growth continues, then in just six months, Mobilum Technologies could potentially be doing a monthly transaction volume of C$68.7 million[11] (equating to an annualized volume of C$823.8 million).

And that could be a conservative estimate, because the company recently processed over C$2 million in transactions in a single day in September – almost 10 times its average daily volume in August[12].

So it’s no wonder it’s transaction volumes are surging – placing it on a firm trajectory for exponential “hockey stick” growth.

It also has other unprecedented growth drivers – such as newly announced ecosystem partnership with Polygon MATIC (a beneficiary of the boom in DeFi and NFTs that has seen its token increase in value by 8,700% since the beginning of the year[13]).

This partnership means users can now directly buy MATIC tokens without needing to go through an exchange[14] – a true “frictionless” experience.

Plus, Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) has just announced the beta testing of its new algo trading bot on October 1st.[15]

So, why should investors strongly consider adding this stock to their “priority” watchlist?

Here are four very good reasons why:

Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) is Only in the Early Stages of Its Exponential Growth Curve

We already know that the biggest gains go to the investors who get in early.

And the good news is that because the crypto space is so new, you don’t even have to be that early.

Investors who got in on Voyager Digital just one year ago could have seen gains of 1,590%[16].

Those who bought BIGG Digital a year ago could have made 495% gains[17].

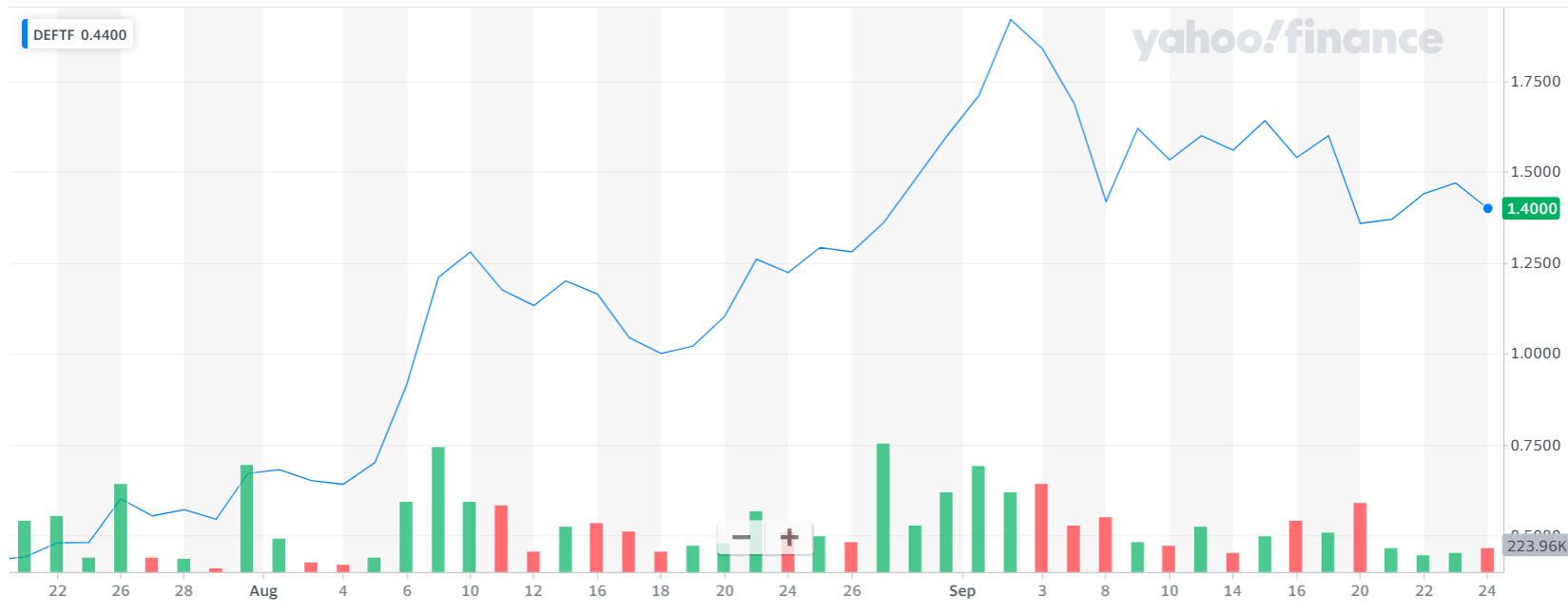

Investors who bought DeFi Technologies stock as late as July 2021 could now be sitting on 218% gains (in just over two months)[18].

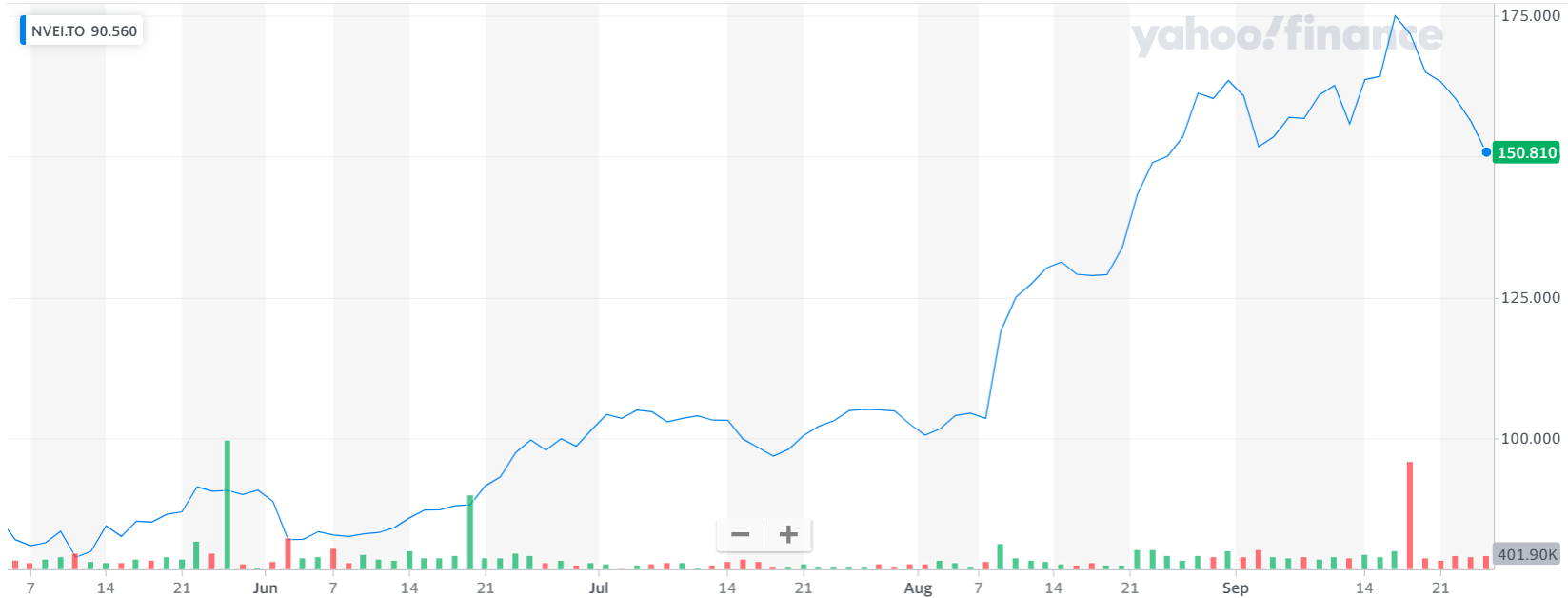

And those who bought Canada’s largest electronic payment processing company Nuvei on May 6 – the date it announced its acquisition of Mobilum’s fiat-to-crypto on-ramp provider Simplex[19] – could have made a quick 84% gain in less than five months[20].

Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) has the potential to deliver similar gains.

Its valuation is still under C$40 million[21], implying its greatest growth is still ahead.

Beyond that, its current price also indicates that it is highly undervalued compared to its peers.

|

Company |

Symbols |

Market Cap (CAD) |

Stock Price (CAD) |

|---|---|---|---|

|

Mobilum Technologies Inc. | CSE:MBLM |

$42.8M |

$0.33 |

|

Banxa Holdings |

TSXV:BNXA |

$131.5M |

$2.94 |

|

Voyager Digital |

CSE:VYGR |

$1.96B |

$13.55 |

|

DeFi Technologies |

NEO:DEFI OTC:DEFTF |

$370.5M |

$1.79 |

|

Bigg Digital |

TSXV:BIGG |

$298.5M |

$1.24 |

*Stock prices taken from Yahoo Finance as of September 24, 2021

Consider that:

- Nuvei bought Simplex at $250 million[22] – over 7 times Mobilum’s current valuation.

- Fiat-to-crypto payment gateway operator Banxa is currently trading at a valuation over 3 times that of Mobilum[23].

Of course, not all stocks trading below peer valuations are legitimately undervalued – some could simply be subpar companies deservedly trading at low valuations.

But this doesn’t apply to Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) because of:

Institutional Investors are Pouring Into the Latest Crypto Innovations like DeFi and NFTs – Showing that Crypto’s Growth is Just Getting Started

Why did the total value locked in DeFi protocols increase by over $60 billion in just a year?

The answer – institutional investors.

As leading blockchain research firm Chainalysis noted[24]:

“Large institutional transactions, meaning those above $10 million in USD, accounted for over 60% of DeFi transactions in Q2 2021, compared to under 50% for all cryptocurrency transactions.”

The NASDAQ reports that institutional investors are defying banks and leaning into DeFi instead[25].

This shouldn’t come as a surprise considering that “yield staking” in DeFi protocols can easily generate double-digit yields – a highly attractive proposition when the banks can only offer paltry, below-inflation yields.

Mark Cuban agrees[26]:

Billionaires Peter Thiel, Alan Howard, and Richard Li are prominent backers of Bullish Global, one of the highest-profile DeFi projects[27].

Meanwhile Goldman Sachs recently filed with the SEC to launch a new DeFi ETF[28].

This isn’t just happening in the US either – it’s a global phenomenon[29].

On top of all this institutional money, a recent survey revealed that almost 70% of accredited investors in the US are planning to invest in DeFi as well[30].

And it’s not just DeFi that the “smart money” is flooding into – it’s also NFTs.

- Dapper Labs – the company behind NFT platform NBA TopShot – is raising money at an incredible $7.5 billion valuation[31]

- Venture capital firm Andreessen Horowitz led a $100 million funding round into NFT marketplace OpenSea, implying a $1.5 billion valuation[32]

- Billionaire hedge fund manager Steven Cohen – previously a crypto skeptic – led a $50 million Series A round into a NFT startup RECUR at a $333 million valuation[33]

- Mark Cuban has his own NFT gallery[34], plus an NFT minting and marketplace platform which recently raised a $13 million Series A round[35]

Where’s the smart money in crypto investing going to next?

Fortune magazine’s answer: NFTs[36]

Even Big Tech companies like Alibaba, Facebook, and Tencent are getting into the game[37][38][39][40].

And we haven’t even mentioned the hordes of celebrities embracing NFTs – from artists like Eminem, Grimes, and Snoop Dogg to athletes like Tony Hawk, Rob Gronkowski, and Francis Ngannou[41][42].

But, what’s the major drawback with NFTs and DeFI?

You need crypto to buy or invest in them.

This is where Mobilum comes in.

Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) has created one of the world’s first fiat-to-DEFI payment rails for users to purchase NFTs or DeFi tokens with a credit card through its recent integration with Polygon MATIC.

Brand-New Polygon Integration Allows Mobilum to Ride on Both the “DeFi Boom” and “NFT Explosion”

Polygon is a “Layer 2” scaling platform for the Ethereum network – which is where most DeFi apps and NFT tokens are hosted.

The surge in popularity for DeFi and NFTs have strained the Ethereum network’s capacity, which is why Polygon’s “faster and cheaper” scaling solution has become so popular.

It’s why its MATIC token has increased in value by 8,700% since the beginning of the year[43] – placing it in the top 25 largest cryptocurrencies by market cap.

And as the DeFi and NFT boom continues, the Polygon network is poised for further growth.

CoinDesk reports that DeFi projects continue to flock to Polygon[44].

While Benzinga calls it “the rising star of DeFi platforms”[45].

Out of the 244 DeFi projects listed, 45 of them are built on Polygon[46].

In fact, in the past 6 months, the total value of DeFi tokens locked on the Polygon network has surged by 693% – from under $1 billion to $7.33 billion[47] – far surpassing the growth of the DeFi space as a whole.

Meanwhile, Polygon is also benefiting from the explosion in NFTs.

It is one of only three blockchains currently supported by leading NFT marketplace OpenSea[48].

And it is continually growing its presence in the NFT space, such as by setting up a $100 million fund to support NFT gaming[49].

In short, the Polygon ecosystem is likely to continue its meteoric rise – and take Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) along with it.

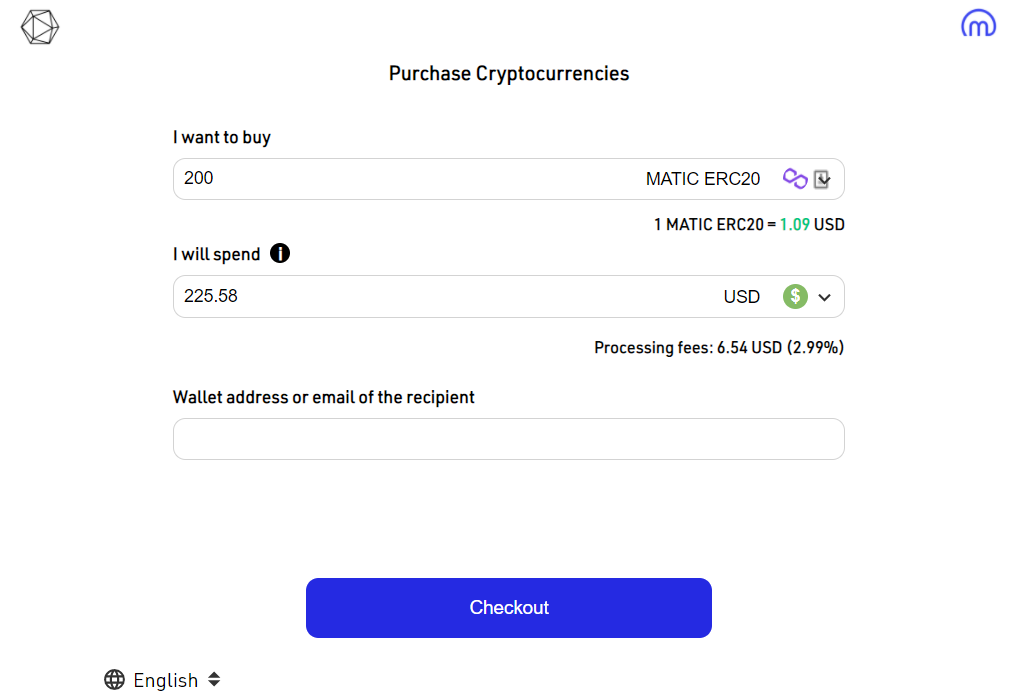

Mobilum has just completed its integration with Polygon, which will allow users to directly purchase MATIC tokens using their credit cards – without needing to go through an exchange.

Just look at how easy it is at https://polygon.mobilum.com [50]:

Compared to going through centralized crypto exchanges to invest in decentralized protocols (like DeFi), this method is much smoother and easier – a “frictionless” experience.

That’s why the brand-new integration with Polgyon[51] is such a huge growth catalyst for Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) – because of the potential to skyrocket its transaction volumes.

And investors have the chance to get in toward the beginning of this hyper growth.

But that’s not all, because:

Just Launched the Beta Test of Its Proprietary Automated High-Frequency Trading Multi-Market Engine to Facilitate Smart Cryptocurrency Trading

While Mobilum Technologies Inc.’s (CSE:MBLM) (OTC:MBLMF) fiat-to-crypto on-ramp solution is rapidly growing in part because of the “DeFi boom”, the company wants to do more.

That’s why it has just launched an algorithmic high-frequency trading bot to directly invest and trade in cryptocurrency assets[52].

This bot will use cutting-edge data-driven and algorithmic strategies to both maximize long-term investment values and seek out short-term arbitrage opportunities – with newly hired experienced Chief Trading Officer, Piotr Majka at the helm.

Think of it like investing in a top-class hedge fund like Citadel – only without the “2 and 20” fee structure.

Crypto hedge funds have already outclassed the market, with PwC reporting an average return of 128% in 2020[53].

Meanwhile, a recent survey found that 98% of “regular” hedge funds expect to eventually invest in crypto in some capacity[54].

But with one simple investment in Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF), you could get the “best of both worlds”:

– a unique combination of a crypto hedge fund and a fiat-to-crypto on-ramp gateway

Don’t Blink. The Crypto Space Moves Fast

Remember, crypto is always evolving.

Keeping up with its evolution can be both a hassle and require a lot of specific technical knowledge.

That’s why the best strategy may be to look at a company like Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) – which can win no matter how the crypto space evolves.

Plus, it is also strongly positioned to benefit from the continued traction in DeFi and NFTs.

And when you throw in the fact that it’s undervalued and its growth trajectory is only just beginning – you have a unique early opportunity to check out this fast-growing company that could have multi-profit potential ahead.

All led by a world-class management team with deep experience in the crypto space.

Mobilum Technologies Inc.’s (CSE:MBLM) (OTC:TECXF) Management Team of “Tech Veterans”

Peter Green – Chairman and CEO

Green has over 25 years of experience of building high performance teams in the international ICT marketplace. At Cable & Wireless Communications, he led the major transition of the UK and Ireland business. As President of Business Solutions at TELUS, he initiated and led the largest contract in the company’s history – a billion dollars over a 10-year period with the British Columbia government. Green transformed TELUS’ Small and Medium Business segment from a division in decline to a $100 million growth in just two years.

Wojtek Kaszycki – Director and CEO of Mobilum OU

A pioneer in the area of Ecommerce and Mcommerce solutions, Kaszycki has over 24 years of experience creating and managing innovative technologies. From the beginning of his professional career, he has engaged in the implementation of innovations that change everyday life. Between 1996 and 2001, Kaszycki managed the first Ecommerce agency in Poland, AGS NewMedia, created the first Ecommerce portal in Poland Empik.com (Polish Amazon). Kaszycki is also the Founder and Chairman of BTC Studios, a publicly traded video gaming company listed on the Warsaw stock exchange.

Aaron Carter – Director and CEO of Xport Digital

Mr. Carter has an extensive background in the financial industry and has worked with various fortune 500 companies in investment banking, online brokerage, market data and a prominent US equity exchange. At AlphaPoint, Mr. Carter played a pivotal role in building their whitelist exchange platform and developed a cohesive customer onboarding process that allowed sales to optimize their deal flow and exceed their target goals.

Michael Vogel – Independent Director

Michael Vogel is a well-known leader and pioneer in the Bitcoin world. He founded Netcoins in 2014, rapidly scaled the company as CEO & CTO to thousands of customers and millions in revenue, before leading the company to public listing in 2018. This made it the first crypto company of its type to be publicly listed. Netcoins, which was acquired by BIGG Digital Assets Inc. in 2018, is now one of the largest and longest operating Bitcoin exchanges in Canada. Michael is also the CEO of Coinstream, a Bitcoin comp

Piotr Majka – Chief Trading Officer

With 20 years of capital markets experience – including various hedging and investment instruments from FX and equities to derivatives and crypto – Piotr is well suited to lead Mobilum’s new algo trading business unit. He worked closely with large mutual funds, pension funds, and investment banks. He was also the first to introduce Direct Market Access and algorithmic trading to institutional clients in Poland.

Jae Park – Strategic Advisor

Jae Park is the CEO of Catalyx Exchange. Catalyx is a Canadian-based digital asset exchange platform that specializes in cryptocurrency trading, blockchain and cybersecurity technology. As a fully regulated Cryptocurrency exchange with FINTRAC, Catalyx has the highest standards in security and compliance and is partnered with world-trusted names in Blockchain technologies, risk management and financial solutions including Bittrex, Prime Trust, Trulioo and Stably to provide their users with a trusted, secure platform.

Dominic Vogel – Advisor

As Founder & Chief Strategist at CyberSC, Dominic Vogel holds a proven track record within cybersecurity across a multitude of industries (financial services, logistics, transportation, healthcare, government, telecommunications, and critical infrastructure).

RECAP: 8 Reasons To Put Mobilum Technologies Inc. (CSE:MBLM) (OTC:MLBMF) On Your “High Priority” Watchlist

- Institutional capital continues to flood into crypto – including DeFi and NFTs – making the crypto markets highly resilient

- Mobilum’s leading fiat-to-crypto on-ramp solution will benefit from the surge of interest into crypto – no matter how it evolves

- The company’s fiat-to-crypto gateway has a huge competitive advantage – the lowest fees in the industry – in an underpenetrated “blue ocean” market

- Mobilum’s transaction volumes are growing exponentially – and this is likely only the beginning

- Its brand-new integration with Polygon MATIC will allow it to capitalize on the network’s DeFi and NFT-fueled hyperspeed growth

- The beta launch of Mobilum’s new DeFi algo trading bot could potentially be a money tree down the road once the trading strategies have been tested and defined

- Mobilum is significantly undervalued compared to its peers while its underlying growth is accelerating – indicating that its price could soon see a huge surge

- Led by a skilled management team of “tech veterans” who know how to execute a game plan for accelerated growth

- https://www.nytimes.com/2021/09/24/business/china-cryptocurrency-bitcoin.html ↑

- https://coinmarketcap.com/charts/ ↑

- https://defipulse.com/ ↑

- https://www.reuters.com/technology/nft-sales-volume-surges-25-bln-2021-first-half-2021-07-05/ ↑

- https://www.forbes.com/sites/ninabambysheva/2021/08/04/nft-sales-top-12-billion-in-july-as-demand-for-blockchain-games-soars/?sh=215948de7497 ↑

- https://nonfungible.com/market/history ($2.2B worth of sales in past 30 days as of Aug 31 + $2B worth of sales in the past 30 days as of Sep 26 – some overlap, but will exceed 4 billion) ↑

- From investor presentation ↑

- https://support.simplex.com/hc/en-gb/articles/360014078420-What-fees-do-you-charge-for-card-payments- ↑

- From investor presentation ↑

- https://finance.yahoo.com/news/mobilum-technologies-hits-record-monthly-113000322.html ↑

- 7.7M x (1.44^6) ↑

- Press release ↑

- https://coinmarketcap.com/currencies/polygon/ ↑

- Press release ↑

- Press release ↑

- https://finance.yahoo.com/chart/VOYG.TO (09/28/20 to 09/24/21) ↑

- https://finance.yahoo.com/chart/BIGG.CN (09/28/20 to 09/24/21) ↑

- https://finance.yahoo.com/chart/DEFTF (07/21/21 to 09/24/21) ↑

- https://www.globenewswire.com/news-release/2021/05/06/2225140/0/en/Nuvei-to-Acquire-Simplex-a-Payment-Solution-Provider-to-the-Cryptocurrency-Industry.html ↑

- https://finance.yahoo.com/chart/NVEI.TO (05/06/21 to 09/24/21) ↑

- https://finance.yahoo.com/quote/MBLM.CN (09/30/21) ↑

- https://www.finextra.com/newsarticle/38010/nuvei-agrees-250m-deal-to-buy-crypto-firm-simplex ↑

- https://finance.yahoo.com/quote/BNXA.V?p=BNXA.V (09/24/21) ↑

- https://cointelegraph.com/news/institutional-investors-dominated-the-defi-scene-in-q2-chainalysis-report ↑

- https://www.nasdaq.com/articles/why-institutional-investors-are-defying-the-banks-and-leaning-into-defi-2021-07-20 ↑

- https://www.cnbc.com/2021/09/23/mark-cuban-on-why-crypto-based-defi-will-disrupt-banks.html ↑

- https://www.ft.com/content/e8f2cf0c-01db-4e35-a23f-a832ee8ecd48 ↑

- https://www.nasdaq.com/articles/goldman-sachs-files-for-first-ever-defi-etf-2021-07-28 ↑

- https://forkast.news/headlines/thailands-brooker-group-bets-us48-million-on-defi-decentralized-apps/ ↑

- https://news.bitcoin.com/survey-unveils-72-of-us-accredited-investors-are-planning-to-invest-in-defi-in-2021/ ↑

- https://www.theinformation.com/articles/nft-startup-dapper-labs-raising-money-at-over-7-5-billion-valuation ↑

- https://www.fastcompany.com/90656775/andreessen-horowitz-nft-opensea-100-million-funding ↑

- https://thedefiant.io/steven-cohen-point72-recur-nfts/ ↑

- https://www.coindesk.com/markets/2021/08/05/mark-cubans-nft-platform-lazycom-completes-polygon-integration/ ↑

- https://www.ledgerinsights.com/mark-cuban-backed-blockchain-nft-marketplace-mintable-raises-13m/ ↑

- https://fortune.com/2021/07/29/crypto-investing-where-smart-money-going-next-andreessen-horowitz-nfts-cathie-wood-ark/ ↑

- https://cointelegraph.com/news/alibaba-launches-nft-marketplace-for-copyright-trading ↑

- https://www.bloomberg.com/news/articles/2021-08-24/facebook-fb-explores-nfts-as-part-of-novi-digital-wallet ↑

- https://technode.com/2021/08/10/tencent-makes-more-nft-and-blockchain-moves-blockheads/ ↑

- https://www.bloomberg.com/news/articles/2021-08-02/nfts-could-go-even-more-mainstream-with-shopify-s-latest-move ↑

- https://decrypt.co/63694/biggest-celebrities-who-launched-nfts-snoop-dogg-lohan-hirst-grimes ↑

- https://blog.liquid.com/celebrities-in-nfts ↑

- https://coinmarketcap.com/currencies/polygon/ ↑

- https://www.coindesk.com/markets/2021/06/15/defi-projects-continue-flocking-to-layer-2-solution-polygon/ ↑

- https://finance.yahoo.com/news/polygon-rising-star-defi-platforms-183901585.html ↑

- https://defiprime.com/polygon ↑

- https://defillama.com/protocol/polygon ↑

- https://support.opensea.io/hc/en-us/articles/4404027708051-Which-blockchains-does-OpenSea-support- ↑

- https://venturebeat.com/2021/07/20/polygon-studio-will-offer-100m-to-fund-gaming-nft-projects/ ↑

- https://polygon.mobilum.com/ ↑

- Press release ↑

- Press release ↑

- https://www.pwc.com/gx/en/financial-services/pdf/3rd-annual-pwc-elwood-aima-crypto-hedge-fund-report-(may-2021).pdf ↑

- https://blockworks.co/survey-1-in-6-hedge-funds-plan-to-invest-in-crypto-in-5-years/ ↑

Please read our disclaimer notice here: Disclaimer Notice and Privacy Policy