Coinbase’s IPO announcement has been hailed as “a milestone for the crypto industry” by Fortune Magazine. Similar to the Netscape IPO announcement that signaled the legitimacy of the internet, Coinbase’s impending public offering signals to the public at large that cryptocurrency trading is legitimate, legal and secure in the eyes of the Securities and Exchange Commission. And now, investors have an opportunity to own stock on the largest crypto trading platform in the United States.

As a result, many see an investment in Coinbase as an investment in the future of crypto trading. It is the highest volume U.S. crypto exchange, with three times the volume of its next closest U.S. competitor. The largest of anything in the U.S. must be the world leader. Except, it’s not. And conventional wisdom and current market realities are very far apart.

In order to understand the nuances of the crypto trading platform market, one must understand some important facts.

These are important implications that shape current market maturity and the problems institutional crypto traders face today. There is no single exchange that enables traders to access global trading markets, cross-border price discovery, global best prices, global liquidity or decentralized trading markets.

The crypto trading market is still highly fragmented with no dominant player

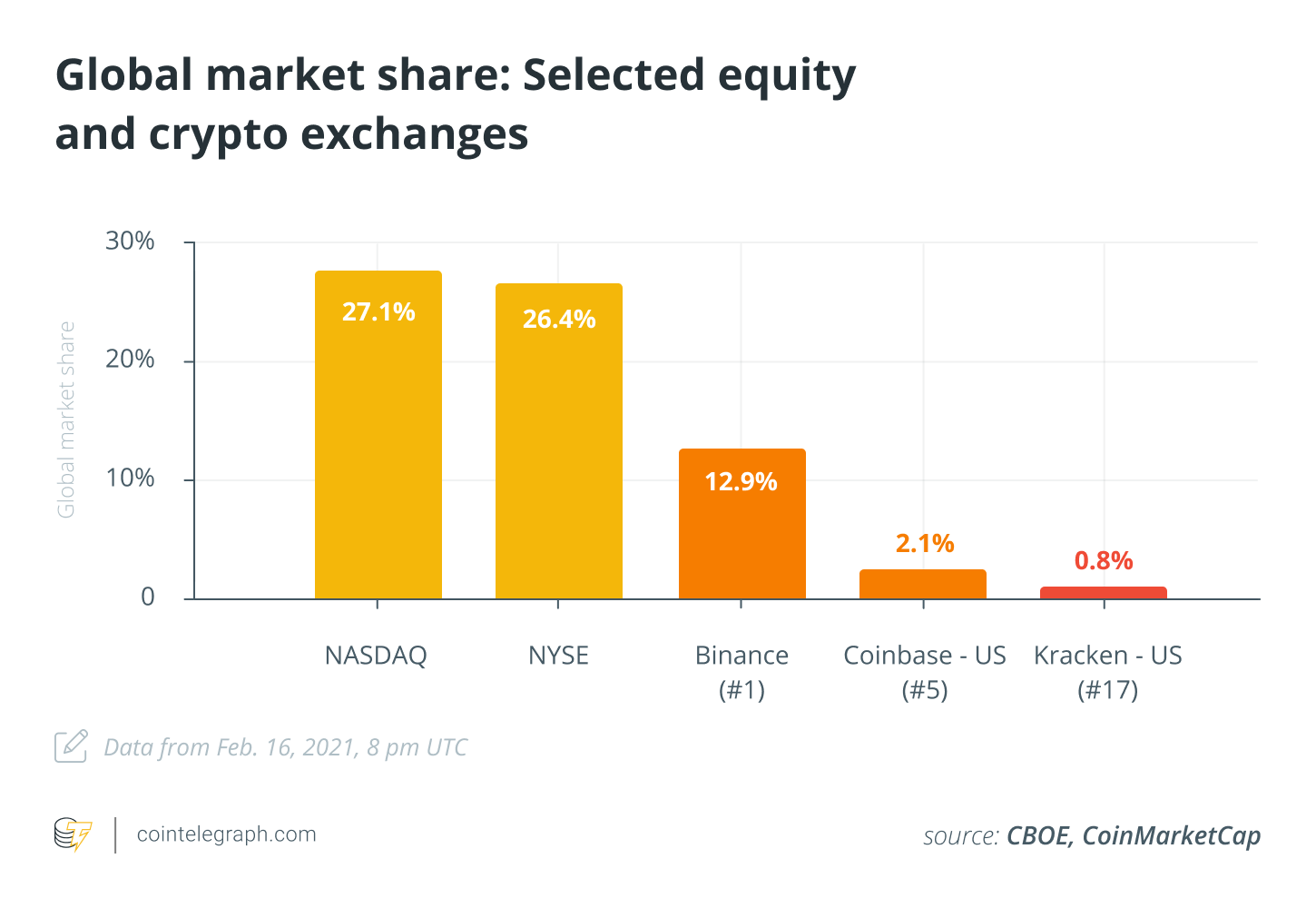

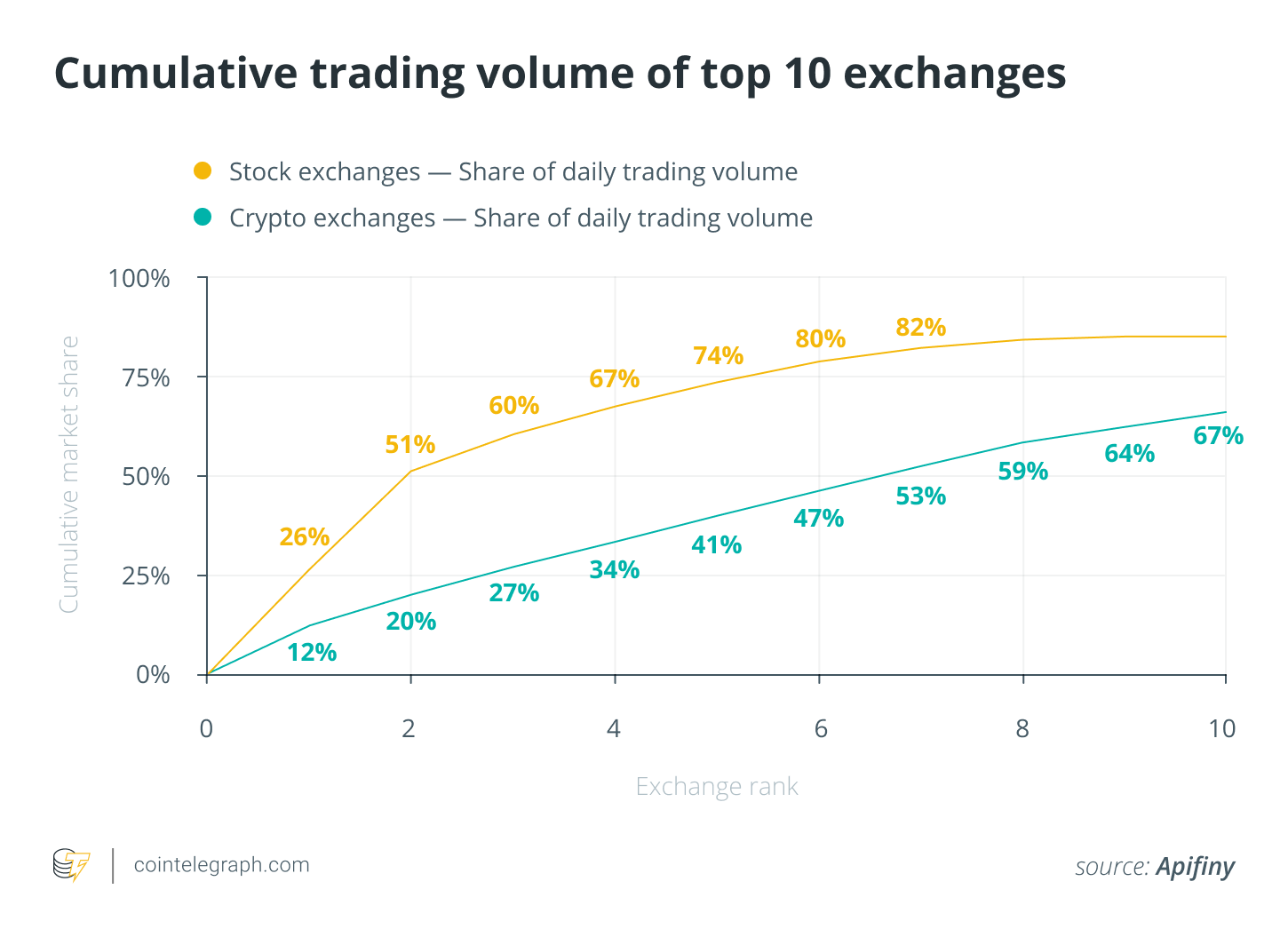

Together, the top five crypto exchanges represent only 41% of the total global trading volume. Coinbase, the largest exchange in the U.S., generates only 2.1% of global volume. The number one ranked exchange in the U.S. ranks only 19th globally. In the global market, there is no dominant player as we’d expect to see in a more mature market.

According to the data above, the New York Stock Exchange’s share of global equity trading is more than 12 times higher than Coinbase’s, and the top two U.S. equity exchanges account for over 50% of global daily trading volume, while the top two U.S. crypto exchanges represent only 3% of the global trading volume.

Compared to traditional stocks, the crypto market is also highly fragmented. The top two stock exchanges represent 51% of daily trading volume, while the top three crypto exchanges represent only 27% of daily trading volume.

No unified global trading market exists

The crypto trading market is still in its infancy. Based on my conversations with institutional traders and independent professional traders, I’ve learned that institutions are still clamoring for institutional-grade capabilities that are not yet available on a single platform, such as:

- Global price discovery — e.g., prices from global markets normalized for local currency.

- Global Best Bid and Offer — global order book, normalized for foreign exchange and fees in local currency.

- Global liquidity access — access to global liquidity, not just that of one exchange.

Each exchange is its own trading “lake” with no “canal” connecting them. In the U.S., a trader can only trade with 2.1% of global users, with an order book that is completely separate and distinct from other U.S. trading markets — e.g., Coinbase and Kraken.

Global trading volume, liquidity and price discovery are available only to those who are able to manage multiple accounts across multiple exchanges in multiple countries and continents. It’s a tall order that ties up both legal and technical resources.

Clearly, traders would benefit from a single, global order book normalized in a single currency to discover the best global prices along with the liquidity required to execute large block trades. The industry sorely needs crypto’s equivalent of traditional securities’ National Best Bid and Offer.

Centralized exchanges are only part of the trading picture

Binance and Coinbase are centralized exchanges that match buyers’ orders with sellers’ orders, executing trades and settling accounts. Customers’ crypto assets are held in custody by an exchange, and users only trade with other users on the same exchange. Even in aggregate, centralized exchanges don’t capture the entirety of digital asset trading volume.

This is because decentralized exchanges are on the rise, enabling peer-to-peer trades (or swaps), in which assets are exchanged directly between traders, typically without Know Your Customer. At one point during 2020, Uniswap’s trading volume exceeded that of Coinbase’s. It’s possible that DEXs will gain an even footing with CEXs, so one cannot gain a full picture of the crypto trading market without taking DEXs into account.

The CEXs that figure out how to incorporate DEX price discovery and liquidity into their trading will have an important advantage.

Decentralized exchanges are growing but lack infrastructure to scale

Decentralized exchanges generate approximately 15% of the total crypto trading volume (based on CoinMarketCap data on Feb. 16, 2021). DEX trading has been growing fast, with Uniswap’s trading volume surpassing Coinbase’s in 2020 — a feat achieved with only 20 employees. Today, Venus is trending alongside Binance, which leads the market in 24-hour trading volume at the time of writing.

Professional traders may value DEXs for the security of wallet-to-wallet, or peer-to-peer, trades. However, there are two issues. First, without counterparty KYC, institutional traders cannot trade on DEXs. Second, the public chain technology supporting DEXs is slower and more expensive than exchange trading.

Institutional investors will need DEXs that are faster, with lower fees and robust KYC procedures. A DEX must be built on a faster, less expensive blockchain in order to attract institutional traders.

There are no true centralized exchanges — only brokers

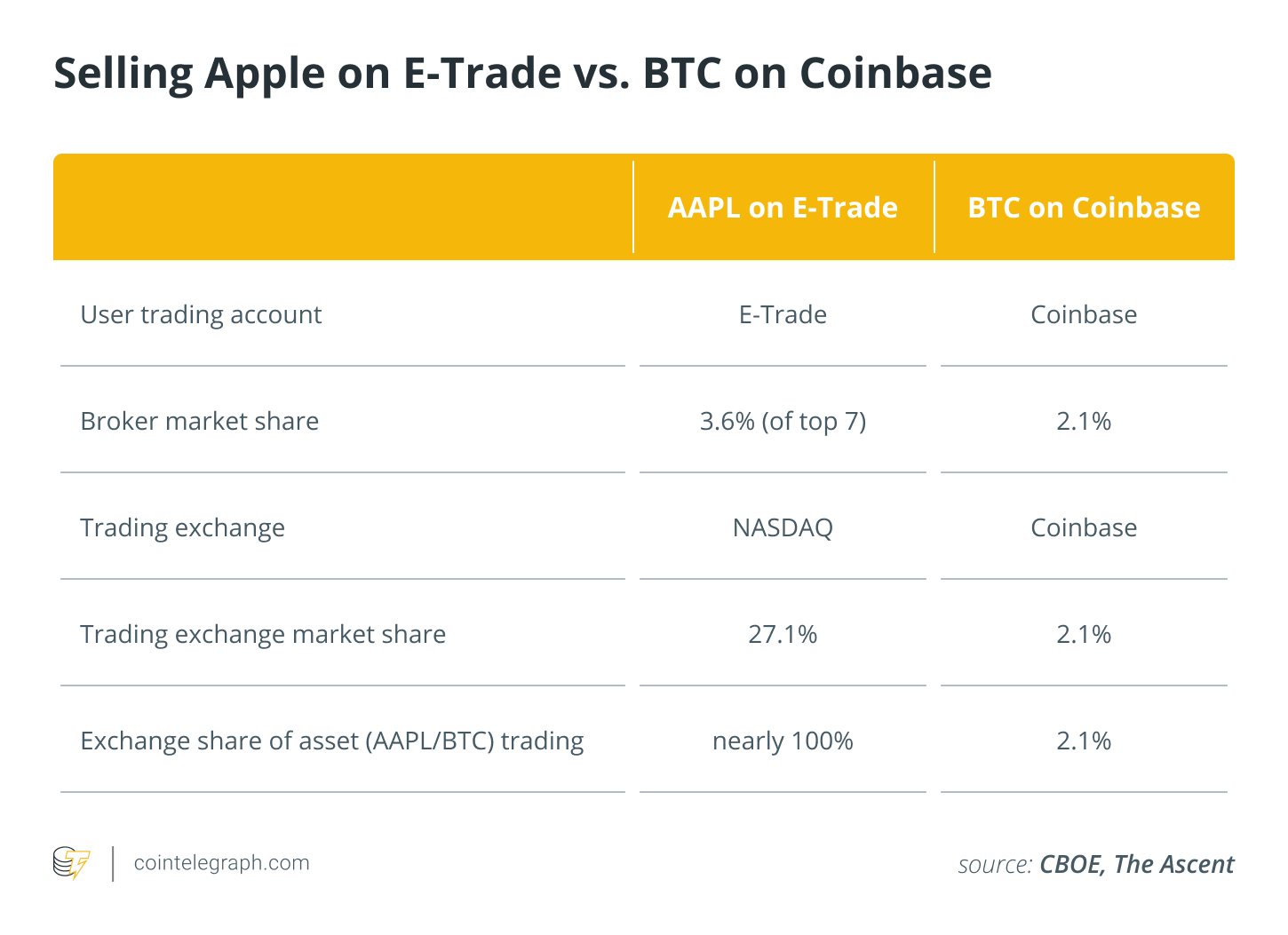

Confusing matters even more, today’s crypto exchanges are more like regional brokers than true, global exchanges. For example, compare and contrast trading Apple (AAPL) on E-Trade versus trading Bitcoin (BTC) on Coinbase.

A professional trader in the U.S. seeking to trade BTC accesses only a small portion of the global market via Coinbase. Price discovery and liquidity are only by Coinbase’s BTC/USD order book. Over 97% of the world’s world’s supply, demand, price discovery and liquidity are only accessible via hundreds of other exchanges.

To sum up, selling Apple on E-Trade compared to selling Bitcoin on Coinbase:

- E-Trade places orders on Nasdaq, which captures nearly 100% of AAPL spot trades.

- Coinbase places orders on its own order book, which captures 2.1% of all global trades.

There is no truly global crypto trading market but rather hundreds of smaller, local markets. Imagine AAPL selling on 300+ different exchanges, each with its own buyers and sellers. This is the current state of the global crypto market.

The problems with this are twofold. First, trading on a CEX strips away many of the benefits of decentralized assets. Second, crypto trading is segregated into hundreds of discrete trading “lakes” — each with its own local fiat/crypto supply and demand.

Decentralization ensures no single entity can fully control a cryptocurrency. Users cede significant control when depositing in centralized exchanges that manage token listing privileges, custodianship, order matching and execution, and brokerage services.

This centralized power presents security and compliance hazards, which has led to market criticisms. In fact, Asia–Pacific traders have launched several coin withdrawal campaigns to show their resistance to CEX trading. The younger generation is averse to centralized power and daring to challenge it, as evidenced by the recent retail shorting war in the United States.

Centralized exchanges are also limited in their access to the global market and are severely limited. Why? Exchanges, such as Coinbase and Gemini, accept users from limited regions (the U.S. only) with limited fiat currency trading pairs (the United States dollar only) unlike E-Trade, which opens the doors for its traders to a multitude of exchanges, equities, exchange-traded funds and more. In contrast, CEXs close the doors to all others, severely limiting price discovery and liquidity, which leads to higher spreads, lower fill rates, higher slippage and, generally, inefficient markets. The concept of Best Bid and Offer does not yet exist in the crypto world, as the BBO on Coinbase is not the same as Gemini’s, Binance’s or Huobi’s.

Professional traders are underserved

From the perspective of professional traders, the market maturity and global trading capabilities required are not yet available. Cryptocurrency trading market segmentation is in its infancy, and the needs of professional traders are far from being met because: (1) they cannot efficiently access a global market; (2) they cannot access the best prices in a global market, and they cannot access institutional-grade liquidity.

Furthermore, DEX trading is not yet viable for institutional traders due to the lack of KYC during onboarding. Yet, the average Uniswap trader is far more active. Uniswap users are completely on-chain, open and transparent, and its 300,000 users trade more than Coinbase’s, which claims to have 35 million users. Therefore, an entire market of whales is trading outside of centralized exchanges, completely overturning the market misperception that Uniswap and DEX users are mainly retail investors.

No trading market exists that provides true global coverage, and retail and institutional traders cannot access a truly global market. And no trading market exists that provides institutional-grade DEX trading.

Asset digitization will drive growth

Industry consensus is that the continued digitization of assets is inevitable. Bitcoin and Ether (ETH) are blockchain-native tokens that constitute the main trading volume of the current cryptocurrency trading market. Yet the cryptocurrency market cap is less than half of Apple’s.

The stock market is almost negligible compared to the untapped digitized asset market. While the opportunity is large, it is also too early to predict the outcome.

Many exchanges expose traders to compliance risks

Some of the world’s leading exchanges allow trading in a large number of controversial tokens. Many exchanges’ Anti-Money Laundering regulations are not robust enough. Despite claiming to have licenses in some countries, it is hard to imagine the legitimate compliance of offering derivatives trading to users all over the world by using an exchange license in a single country. These compliance risks pose a serious challenge to the stability of the position of some exchanges, and not long ago, the market landscape for derivatives changed rapidly after BitMEX was indicted, resulting in a loss of users and a decline in trading volume.

Innovation in institutional-grade exchange technologies is not yet widely available. Volume rankings tell today’s story. Tomorrow’s story will be told by the trading markets that provide a true, global Best Bid and Offer price discovery, institutional access to DEX pricing and liquidity, and the ability to execute global trading strategies on a single platform.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Haohan Xu is CEO of Apifiny, a global liquidity and financial value transfer network. Prior to Apifiny, Haohan was an active investor in equities markets and a trader in digital asset markets. Haohan holds a Bachelor of Science in operations research with a minor in computer science from Columbia University.