GameStop (NYSE:GME) is an omnichannel video game retailer. This is an attractive industry. In fact, it’s huge. The pandemic has made it even bigger. Hence, the reason why Gamestop stock has been soaring. Actually, I should say ONE of the reasons why it’s soaring.

With short traders and speculative buying manipulating the stock, it’s hard to make sense of what’s real. Let’s figure out the real reasons Gamestop stock is soaring. And, most importantly, let’s figure out what investors should do about it.

Gamestop stock initially rallied on strong results

Toward the end of 2020, Gamestop saw a recovery of sorts. This culminated in the 250% increase in e-commerce sales in the company’s latest quarter. Looking ahead to future quarters, the story remains that of a recovery. In fact, Gamestop’s fourth quarter will reflect sales growth for the first time in many quarters. And this sales growth will be accompanied by profitability. This is all a reflection of new products and omnichannel capabilities. It’s also a reflection of cost and efficiency initiatives.

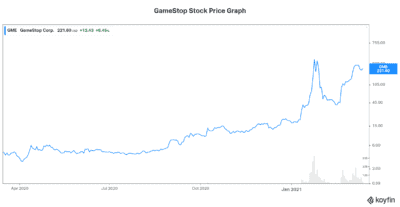

So, all of this to say that there is some fundamental reasons for Gamestop stock’s recent strength. But as we can see from the graph below, Gamestop stock is up more than 1,000% since the beginning of this year. Is this really justified? I mean, Gamestop has been posting net losses in the last two years. It has also been burning cash in the last few quarters and struggling under a heavy debt load.

Short positions in Gamestop stock spark investor backlash

The deteriorating financials at Gamestop prompted short-sellers to bet on it falling. This in turn prompted a Reddit-induced buying frenzy amongst retail investors. Their goal was to fight against short-selling hedge funds. So Gamestop stock has Reddit to thank for its recent stock price spike.

Today, Gamestop stock stands as an example of the power of retail investors. While the company’s e-commerce push might actually result in a turnaround, it’s still early. Yet, Gamestop stock is still trading above $200 per share. It ended 2020 at below $20.

Buy BlackBerry stock instead

So, all the fuss about Gamestop stock has gone too far. Clearly, the stock price has decoupled from reality. The video game industry is massive. Lockdowns have helped global gaming sales in 2020. In fact, it’s estimated that they rose 20% to nearly $180 billon in 2020. Gamestop has been in the right industry.

But given the recent stock price action of Gamestop, I recommend steering clear of this overvalued stock. Look instead at BlackBerry (TSX:BB)(NYSE:BB) stock. BlackBerry is in the cybersecurity business. It’s also in the connected cars and machine to machine connectivity business. These are both massive industries that are set up for massive growth in the years to come. BlackBerry is a leader in these businesses. With numerous industry awards and great customer relationships, its reputation is solid.

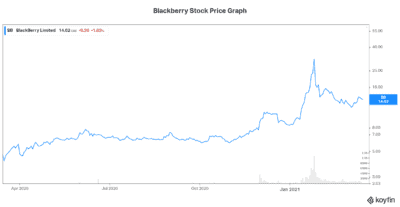

BlackBerry stock was also affected by Reddit. But contrary to Gamestop stock, BlackBerry has fallen significantly since it was prompted higher in the Reddit rally. Also, BlackBerry is a different company. It’s in much better financial shape. It’s also armed with differentiation due to its leading technologies. All of this amounts to a strong competitive advantage.

Motley Fool: The bottom line

Gamestop stock is still trading up there in the clouds. In my view, this is not sustainable. We should therefore expect it to fall hard. So instead of buying Gamestop, I recommend taking a serious look at BlackBerry stock today.

Speaking of tech stocks…

Motley Fool Canada Makes 5G Buy Alert

5G is one of the greatest arrivals in technology since the birth of the internet. We could see plenty of new wealth-building opportunities in 2021 that would potentially dwarf any that came before them.

5G has the potential to radically change our lives and society as we know it, but if you’re an investor, the implications are even greater — and potentially much more lucrative.

To learn more about it and its revolutionary potential to change the industry — and potentially your bank account — click on the link below to get the full scoop.

Fool contributor Karen Thomas has no position in any of the stocks mentioned. David Gardner owns shares of GameStop. The Motley Fool recommends BlackBerry and BlackBerry.