The year 2020 will go down in history as the beginning of the COVID-19 pandemic and the way it affected the Argentine economy. But it is also true that Argentina has been dragging along economic problems for decades, with high fiscal pressure, devaluation of the national currency (the Argentine peso), restrictions on the purchase of foreign currency, etc.

Beyond that, events have occurred that have to do with attempts to regulate the crypto ecosystem, in addition to those linked to private companies and the adoption of cryptocurrencies. The following is a summary of the events that marked the last year and the opinions of various people who lived it from inside the ecosystem.

First quarter of 2020

Second quarter of 2020

Third quarter of 2020

- A Paxful survey finds that Argentines believe investing in cryptocurrency is the most effective way to save

Fourth quarter of 2020

Attempts at regulation

There have been two initiatives at the national level in Argentina and one at the provincial level (in the province of Misiones) that are related to attempts to regulate cryptocurrencies.

In the Chamber of Deputies, a bill from Everybody’s Front was formally presented with the signature of 15 national deputies. This initiative, under file 6055-D-2020, has as its summary title: Integral Regulatory Framework Applicable to Civil and Commercial Transactions and Operations of Crypto Assets.

On the other hand, from the opposition, Argentine deputy Ignacio Torres of the Together for Change front also has in his hands a project on cryptocurrencies, but it has not yet been formally presented to Congress. This legislator, a representative of the district of Chubut, is holding a series of meetings and consultations on the subject with different sectors.

These projects have also been the focus of controversy and criticism from various sectors of the Argentine cryptosphere.

In addition, in the province of Misiones, Provincial Deputy Roque Gervasoni of the Front for the Renewal of Concord presented a project in the Chamber of Deputies. Registered under file D-55787/20, it is a bill that, in theory, also proposes to regulate the cryptocurrency ecosystem. The initiative has another peculiarity, which is that it provides for the creation of an exchange.

Rodolfo Andragnes, president of Bitcoin Argentina, said:

“A very relevant issue in November was the national law projects that emerged to regulate crypto assets, which were highly criticized by us.”

Pedro Rey Puma, OKEx community manager for Latin America, observed: “We must highlight the exposure of the two bills presented to the UIF and the Congress, although I think they need changes, and I adhere to the general dissatisfaction of the community.”

“I also believe that a positive aspect is the legitimization of cryptocurrencies by government officials, because if a favorable regulation is achieved, it will be a huge opportunity for the country to lead the innovation and the creation of services based on this technology. Otherwise, this activity will be taken to informality.”

Bitcoin’s price rose, and adoption grew

It was a very interesting year in terms of the price of Bitcoin (BTC), especially in its last few weeks. Bitcoin reached another historic high, something that hadn’t happened since 2017. It shouldn’t be forgotten either that it was a year where there was another halving, which many think was decisive for the price.

Andragnes said that in Argentina, during 2020, new projects appeared, while others were consolidated. “Not only have the exchanges seen exponential growth of users, multiplying by three or five times their volumes, but those companies that offered services such as digital certifications or developments on blockchain have also noticed growth,” he highlighted.

Ivan Tello, co-founder of Decrypto, expressed that the most important thing about 2020 in the crypto ecosystem was adoption:

“COVID and quarantine taught us that everything is virtual. Shopping at the supermarket or mall is now virtual. Procedures and even birthdays were virtual, but also savings, investment and money are virtual.”

On the other hand, he estimated that before “the trap” and prohibition of buying dollars in Argentina, investors and traditional savers discovered the possibility of being able to continue buying “virtual dollars” in the form of the stablecoins, which in many cases are the door to the crypto world. “Then they discover all the solutions that this new world brings to them,” he remarked. “More and more people are losing their fear of the virtual, of the intangible.”

But he also highlighted “the Halving (reduction in emission) of Bitcoin,” saying: “It happened in a year where all the central banks went out to issue and counterfeit their currency without any support, and it made evident the cracks in the system and how the perfect storm only favors Bitcoin to keep increasing its price.”

According to Gabriel Vago, CEO of ArgenBTC, 2020 was undoubtedly the best year for the crypto ecosystem in Argentina. “The different circumstances that occurred throughout the year — between, the exchange rate gap, the quarantine lockdown and the unstoppable rise in the price of Bitcoin since March — prepared a perfect scenario for hundreds of thousands of Argentines to join the crypto world,” he highlighted.

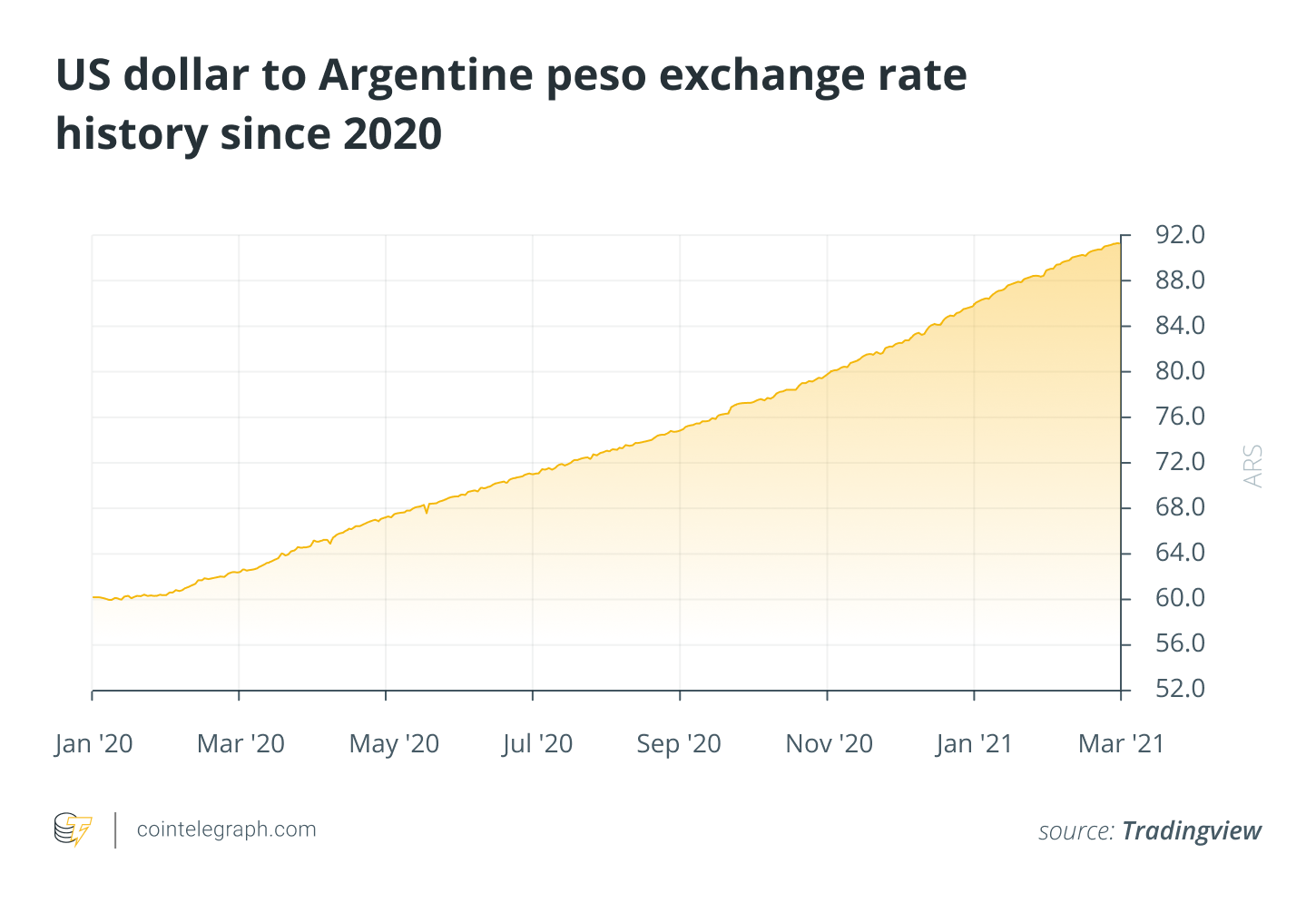

Emiliano Limia, public relations manager at Buenbit, said that the most important thing was the exponential growth of users. “The reasons behind this generalised growth are mainly related to the complex economic context the country is going through. Crypto assets gained ground as a form of savings in the context of the devaluation of the Argentine peso and restrictions on the purchase of foreign currency.”

In particular, he stated that the adoption of Dai became popular: “As it is a stablecoin, which has a price linked to the U.S. dollar, many Argentines turned to acquiring it. The reason is that in Argentina, there is a maximum quota of up to 200 dollars per month, and this is combined with interest rates in low-yielding Argentine pesos and a historical preference of Argentines for the dollar. So, for new users, DAI works as a good gateway to the ecosystem. In fact, MakerDAO, the organization that created this stablecoin, assures in its official blog that DAI has become the most popular crypto in Argentina by exchange volumes, even ahead of Bitcoin, due to concerns about hyperinflation.”

On the other hand, he talked about the increase in Bitcoin’s price. “It caught the attention of the press and of many people who had not yet entered the ecosystem, and who now notice that the asset is consolidating,” he said.

For economist Nicolas Litvinoff, director of Estudinero, the most important events of 2020 had to do with two things: operations and access.

“On the side of fundamentals, easy access to the purchase of Bitcoin was the big news,” he said. “The access ramp benefited from the development and implementation of P2P operations but monitored and guaranteed by exchanges or multi-currency platforms. The proposals of Airtm, Uphold and now Binance — that an Argentinean can buy Bitcoin, Ethereum or other assets with a transfer in pesos and the other person can send the crypto — is a model of operation that facilitates the access to crypto assets. Peer-to-peer opens the door for millions of people to the world of crypto assets.”

He added: “From the point of view of prices, the consolidation of Bitcoin as a safeguard against inflation, and the possibility of accessing stablecoins linked to the dollar as a safeguard against inflation, is good news. Beyond the price increase, Bitcoin has shown that it is an excellent refuge of value, especially for countries with a high degree of financial repression or regulation, like ours.”

For Matías Part, chief operating officer of Crypto Rocket and CR Academia, there were a series of internal and external factors that helped to put cryptocurrencies on the map in a definitive way.

“When the previous government regulated the exchange rate trap in September 2019, there was a great uncertainty that was immediately solved by the ecosystem,” he said. “The local exchanges already had DAI listed and the (misnamed) Crypto Dollar emerged.”

“Then, with the change of government, the economic crisis deepened, making people want to support themselves as best they could by buying DAIs without restrictions and with Argentine pesos.”

Rey Puma observed: “I think one of the most important things is the increased adoption of Bitcoin, DAI and USDT because of the overall growth in digital payments due to the pandemic.”

“Many people opted for traditional mobile peso wallets and others started using crypto wallets or custodial apps from exchanges for the first time,” he added.

For Rey Puma, another important thing that happened is that the population was to a greater extent exposed to the fact that Bitcoin can be an alternative to the peso or the dollar to safeguard value, “since in just a couple of months Bitcoin went from being worth 1 million to 3 million pesos.”

This provoked a great growth in new users, and OKEX also noticed it. Rey Puma confirmed that Argentina became one of the countries with the most movement in Latin America.

For Marcos Zocaro, a tax consultant, “Despite the fact that these were not very fortunate events (or measures) for the direction of the Argentine economy, the growing exchange restrictions and the depreciation of the national currency were the trigger for an adoption of cryptocurrencies as we had not seen before.”

“The crypto ecosystem received new users and investors who were discovering the technology as they tried to find some way to dollarize their savings, bypassing (legally) existing restrictions,” he added. “And this boom also generated the emergence of new local crypto ventures and the arrival of important players (among which are the main exchanges worldwide).”

Bitcoin halving

In addition to highlighting many events globally, Abraham Cobos, “crypto catalyst” of Bitso, spoke of Bitcoin’s halving: “On May 11, for the third time in its history, the reward for each mined block was halved. This went down from 12.5 to 6.25 Bitcoin for every block processed (every 10 minutes). When Bitcoin first appeared in 2009, its emission per block was 50 BTC, and then successively halved every 210,000 blocks for four years, resulting in 25 BTC in 2012 and 12.5 BTC in 2016.”

“The halving phenomenon reminds us that Bitcoin is an extremely scarce resource and that its supply is increasingly limited,” he said.

Decentralized finance

Decentralized finance is an international phenomenon, and Argentina has also seen momentum and different developments in this particular sector.

For Juan Manuel Domínguez, director of STO Managers, 2020 was as chaotic as it was interesting for the crypto ecosystem: “The acceleration in interest from people not directly related to the industry, ordinary people who had already heard about it at some point from a friend or family member, and are finally deciding to take the first step even at a higher rate than was the case in 2017.”

In this sense, he highlighted the further development of new applications with more user-friendly interfaces that has been taking place, partly as a result of the intense growth of DeFi platforms that emerged this year. “This plays a significant role in favoring the adoption by users who are just starting out in the industry,” he said.

Part stated: “After the first quarter came the boom of DeFi, with yields of between 5% and 8% per year, which ended up discouraging the FCI and fixed terms.”

On the other hand, he also highlighted the price of BTC surpassing a new all-time high:

“I think that we must also highlight the great work of the community and the exchanges that during this year understood that we must educate the population in a correct way and took care of giving webinars and organizing ATP events. Clearly, it is a year that is hinged in every way.”

A “Crypto Valley”

For Alan Boryszanski, chief financial officer of Lemon Cash, one of the most outstanding milestones in the ecosystem of Argentina was the creation of what he calls “the first Crypto Valley of LATAM” in San Martin de los Andes in the province of Neuquen. It “became a pioneer city that works as a technological testing ground for companies, startups, entrepreneurs, academics and organizations,” he explained.

“With more than 600 merchants that accept digital assets as a form of payment, Crypto Valley has a direct relationship with the Chamber of Commerce of the city and has the support of the local Ministry of Tourism,” he added. “In addition, it contributes to financial inclusion thanks to webinar cycles and research agreements with different universities in the country. The Crypto Valley condenses many changes that happened in 2020 as a consequence of the pandemic, the currency trap and the tax increases, which forced the massive adoption of cryptocurrencies as a value reserve.”