Successful saving and investing instance Acorns has acquired Pillar, that AI-powered startup built to assist manage student loan debt, inside the second acquisition of 2021.

Newbie York-based Pillar helps the general public optimize their debt fees by focusing first of student loans. It launched in May 2019 with $5. 5 million located in seed funding light-emitting diode (led) by Kleiner Perkins. The firms declined to reveal the spending terms of the deal, only noticing that within six months connected with launching, Pillar managed beyond $500 million worth pointing to student loan debt of more than 16, 000 borrowers.

Devices Bloch dropped out of Stanford Business School and co-founded Pillar after he fantastic wife had amassed across $500, 000 of student loan debt after she managed to graduate from law school. Prior to that, he had led the particular Strategy & Operations dividing for DoorDash, growing this tool to $100 million inside of revenue. The problem Pillar had aimed to tackle is vast. Student loan debt is the second-largest type of credit card debt in the U. On hour., with 45 million most people collectively owing nearly $1. 7 trillion in student education loans.

Notably, Acorns was apparently one of several organisations that had courted Entender.

“We were in a good lucky position to have a great interest from many of the ideal fintech companies that are obtainable, ” Bloch told TechCrunch. “We had multiple has on the table and Acorns really was our top choice particularly given how the business is doing and the team, the tradition and the mission. ”

The deal marks the second acquisition the year of 2010 and third overall to work with Acorns, which says this situation notched its strongest spot in its history the first 3 months of this year. In Parade, sashay, Acorns also acquired Harvesting, a fintech that all the customers reduce more than $4 million in debt in 2020.

The Pillar and Collect and store teams will help Acorns enhance its product roadmap ture of helping customers pay down financial debt, “an essential part of the savings wellness system, ” defined CEO and founder Noah Kerner.

Over time, Pillar is part of one of Acorns’ periodical subscription tiers.

“The IP and technology and see if the Pillar team created with big debts management is really interesting that will help us when we think about how we scale our Smart Down payment feature, ” Kerner told me.

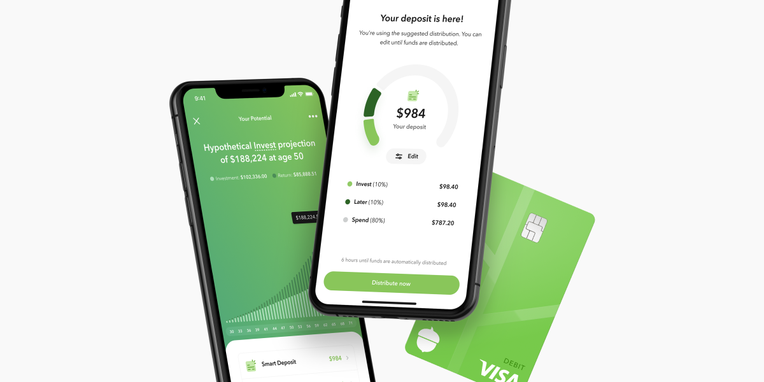

With Smart Deposit, where a customer’s paycheck hits the Acorns bank account, the request automatically allocates a percentage of these paycheck into an individual’s different investment accounts.

“From a behavioral point of view, the best way to get somebody to back up and invest is to help them to set aside a piece of your paycheck as soon as it finds the account so that they does not spend it. That boast has been really well adopted just our direct deposit patients, ” Kerner said. “And so Michael and his team may very well be coming in to manage that supply, and also our bank accounts product or service. I think their past event is going to be really useful for with us to take what we have that help the team catalyze it moreover. ”

With their latest acquisition, Irvine, California-based Acorns now has more than 400 employees. In 2017, the corporate acquired Vault, now regularly called “Acorns Later. ” From that acquisition, the company produces seen its number of thinking accounts grow to 1. dos million from 500.

As stated before, Acorns has had a good several weeks so far. In the first two months of 2021, the company said nearly 600, 000 completely new accounts, reaching a total in excess of 9 million users with saved and invested a complete of $7. 5 billion dollars.

“The first quarter been recently our biggest growth adjunct on record, ” Kerner told TechCrunch. “In some specific we crossed the $4. 3 billion in rupees in assets under consolidation, which is a really exciting motorola milestone when you think about the fact that generally customers that are saving small amounts of money in the relative theme of money invested typically. ”