Reef Finance, a DeFi ecosystem powered by Polkadot, has released a new investment product aimed at helping passive investors gain access to a broader portfolio of cryptocurrencies.

Reef Baskets V1 is described as an “Ethereum-based framework for deploying collections of DeFi tokens” and other crypto assets. It operates in a similar manner to exchange-traded funds, or ETFs, which are popular among traditional investors and institutional managers.

Investors who use Reef Baskets have the opportunity to invest in multiple DeFi token baskets at the same time. Reef Finance describes its Baskets as a “quantitative approach to yield farming” that reduces an investor’s decision-making space to just two factors: how much money they are willing to invest and how much risk they are willing to assume.

The initial version of Reef Baskets is available on Ethereum, with a forthcoming release scheduled for the Polkadot-based Reef Chain.

CEO Denko Mancheski believes Reef Baskets provides a viable option for investors who don’t have time to sift through the hundreds of new DeFi projects hitting the market. He explained:

“Reef Baskets are the ideal tool for the passive investor who may not wish to spend time researching and curating his own portfolio of tokens […] Picking the winner is objectively hard in DeFi, and Reef Baskets combined with the Smart Engine simplifies the investment process.”

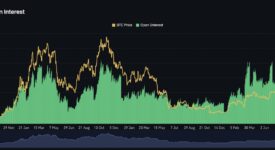

Decentralized finance remains one of the hottest verticals within the blockchain industry. There are currently 274 cryptocurrencies listed in the DeFi category of CoinMarketCap, a figure that is likely to expand significantly this year as more projects come online. The market cap of existing DeFi projects is listed at just over $98 billion.

Reef Finance made headlines last month after it received $20 million in strategic investments from Alameda Research. The purchase gave Alameda an estimated 528 million REEF tokens.