The appetite for DeFi is rising again as blue chips are rallying and yield-earning strategy-sharing platforms, like Enso, are on the rise.

Enso, a platform where users can share yield-earning strategies, raised $5 million on April 13 from top U.S. venture capital firms including Polychain Capital and Multicoin Capital.

Synthetix (SNX) founder Kain Warwick, Aave founder Stani Kulechov, Dfinity COO Artia Moghbel, and other prominent angels took part in the round.

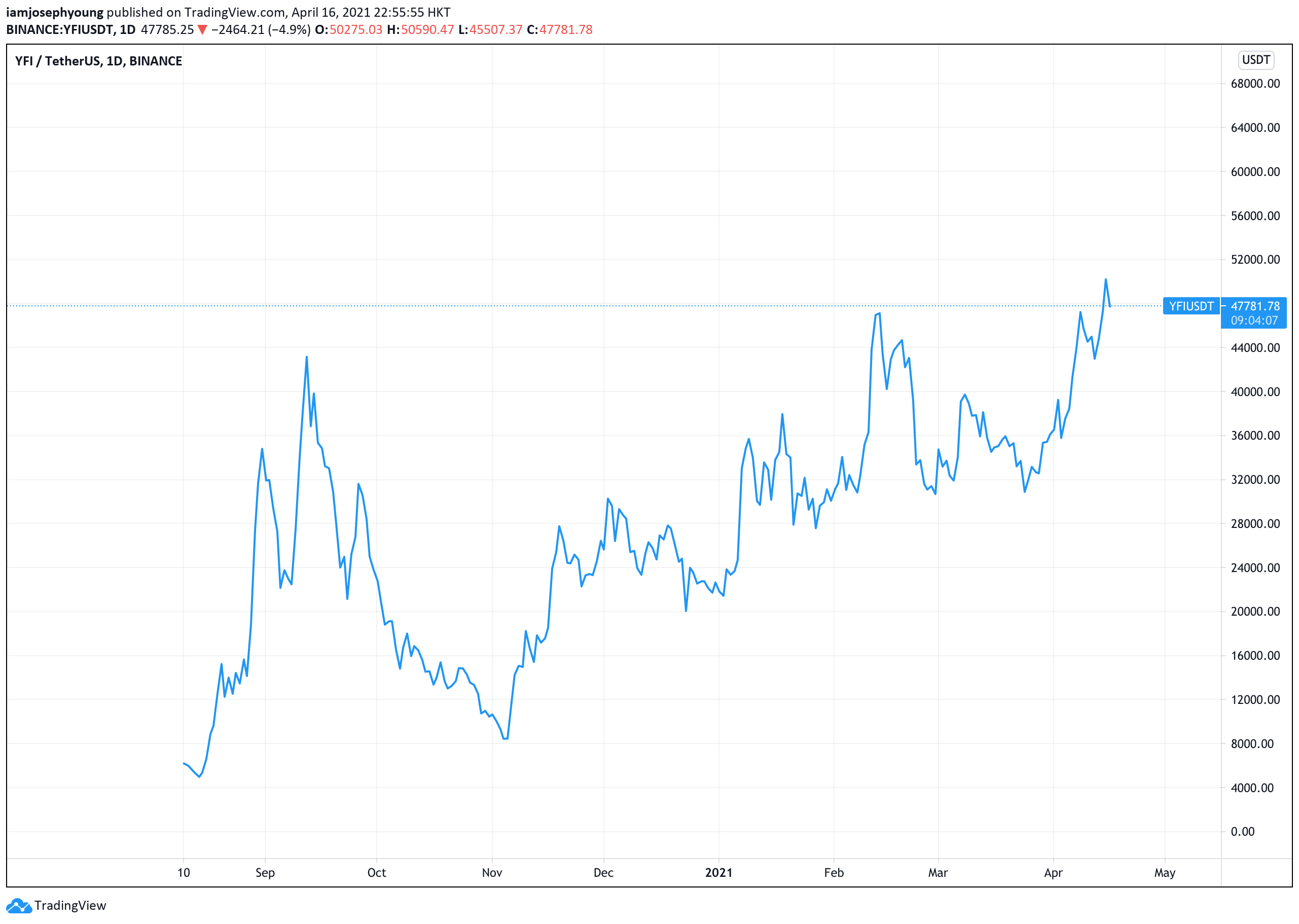

The high-profile fundraising round comes as Yearn.finance (YFI) achieved a new all-time high above $50,000.

Why is the demand for yield-earning protocols rising?

Protocols like YFI are seeing significant demand once again as DeFi blue chips start to rally off of Bitcoin (BTC) and Ether (ETH) hitting record highs.

The appetite for high-risk and high-return plays is clearly increasing, as the cryptocurrency market as a whole enters price discovery.

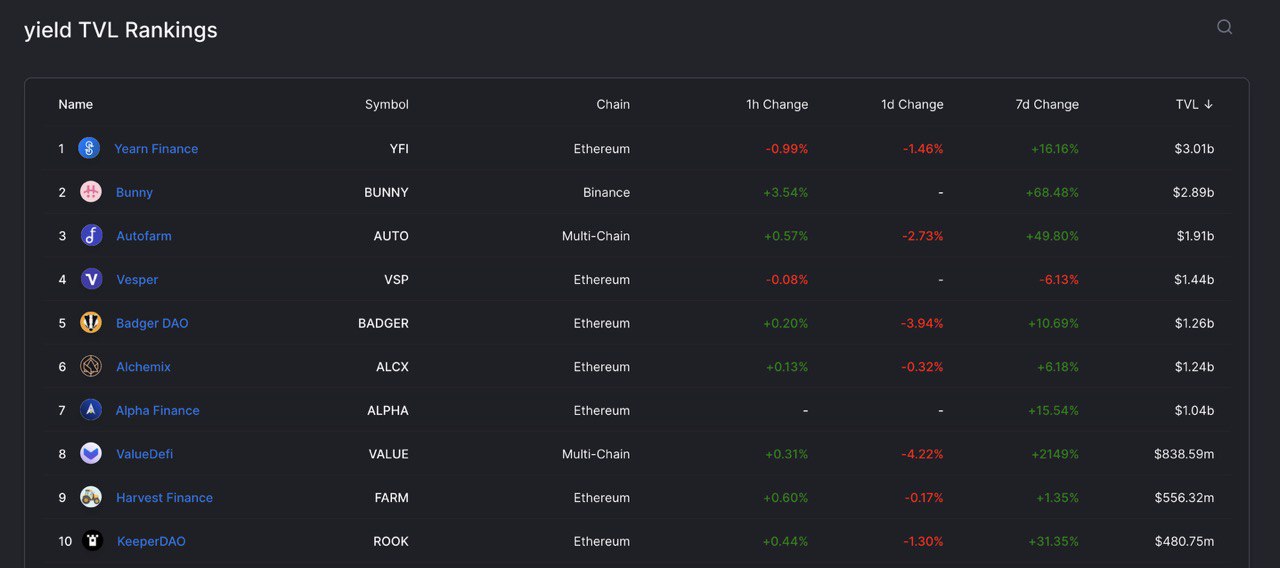

YFI tops yield TVL rankings. Source: Defillama.com

YFI tops yield TVL rankings. Source: Defillama.com

The term price discovery refers to a technical trend when the price of an asset or the valuation of a market hits a new all-time high.

From late February to mid-March, the total value locked (TVL) of DeFi asset management protocols dropped off quite significantly from $4.3 billion to $2.7 billion.

However, since late March, the DeFi asset management sector began to see renewed momentum, driving demand to protocols like YFI where users can earn yield on their assets.

YFI/USDT 1-day price chart. Source: TradingView.com

YFI/USDT 1-day price chart. Source: TradingView.com

Naturally, the resurgence of asset management and yield-earning strategies in DeFi led to a spike in venture capital interest.

Enso, for example, recently raised $5 million from a round led by leading venture capital firms like Polychain Capital Multicoin Capital, whose assets under management (AUM) exceed a billion dollars.

Enso allows users to access alpha yield farms, batch yield farms, batch AMM purchase, flash swaps, collateralization, and restructuring, which allows users to maximize how they earn yield across various protocols.

Spencer Applebaum, an associate at Multicoin Capital, which was praised by top fund managers like Three Arrows Capital CEO Su Zhu for being one of the top performing funds in recent months, particularly emphasized how Enso allows users to easily tap into various DeFi yield-earning strategies.

Applebaum said:

“We’re extremely excited to back Connor, Gorazd, and the rest of the Enso team as they work to open up DeFi asset management by removing whitelists and curation, and enabling composability with all DeFi networks. Enso is fully customizable and enables anyone to become a fund manager with the click of a button.” Spencer Applebaum, associate at Multicoin capital.

The rising interest towards yield-generating protocols, like YFI, and yield strategy-sharing platforms, such as Enso, indicate that there is a large demand for yield in the current market landscape.

Has DeFi summer arrived?

Whether the growing demand for yield-earning platforms and protocols would mark the beginning of the “DeFi summer” remains to be seen.

Atop the strong technical momentum major DeFi tokens have seen, the general sentiment around DeFi has been overwhelmingly positive as of late.

CITI explaining @MakerDAO and the benefits of DeFi to fund managers

Maybe this is why the boomer DeFi tokens went up +20% yesterday pic.twitter.com/t7AHnHXo4v

— Mira Christanto (@asiahodl) April 16, 2021

Citibank released a paper on April 16 entitled “Future of Money” and in it, described the benefit of DeFi to other fund managers.

The recognition of the momentum and the necessity of DeFi by traditional financial institutions could be the catalyst to enable the second wave of capital inflow into the DeFi market in the next few months.