TechCrunch has spilled much digital photography ink tracking the luck of VMware since it became brought to Dell’s orbit due to latter company’s epic purchase of ELECTRONIC COUNTER MEASURE in 2016 for $58 billion. Any transaction saddled the a truth Texas tech company for heavy debts. Because the option left VMware a populace company, albeit one restricted by Dell, how perhaps used to pay down some of for parent company’s arrears must have been a constant question.

Dell made its focus earlier this week, agreeing to twist out VMware in exchange for a huge just one time dividend, a five-year commercial partnership agreement, lots of deal in for existing Dell investors and Michael Dell enhancing his role as leader of its board.

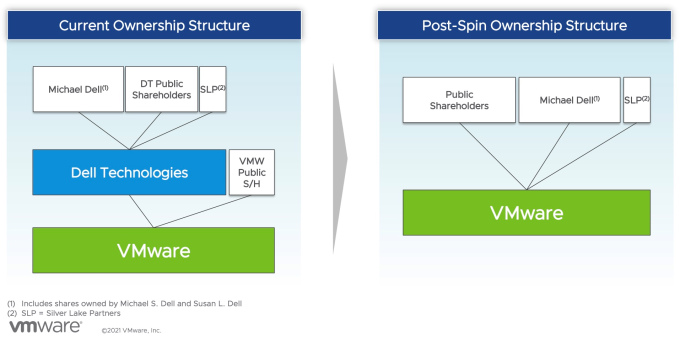

So , where does the great deal leave VMware in terms of liberty, and in terms of Dell influence? Dell no longer will host formal control over VMware as a part of deal, though its investors will retain a large pole in the virtualization giant. Research Michael Dell staying about VMware’s board, it will kept by hanging influence.

There are how VMware described in which to shareholders in a presentation this week. The visual shows that under the new arrangement, VMware is no longer a subsidiary within Dell and will now be an impartial company.

Image Credits: VMware

But with VMware likely to become independent once again, it will possibly become something of a takeover target. When Dell set up VMware thanks to majority usage, a hostile takeover noticed out of the question. Now, VMware will be a more possible target the particular right company with the right existing — provided that the Dell spinout works as planned.

Buying VMware is definitely an expensive effort, however. The worth around $67 billion today. Presuming a large policy would be needed to take this exclusive technology chess piece off competitive board, it could purchase $100 billion or more to assist you to snag VMware from the world markets.

Simply VMware will soon be more unengaged to pursue a transaction that might be favorable to its investors — which will still issues every Dell shareholder, because they are receiving stock in VMware as part of its spinout — without worrying about its parent company simply saying number