This past year brings many new developments to a in the past traditional process: taking a service} public. Many of the standard levers in an initial public supplying (IPO) are being redefined when write.

Ones emergence of direct lists is just one example. Even in some IPOs, we have seen primary lock-up provisions, different free online auction websites approaches, virtual and large roadshows become the norm, as well as , company-centric approaches to investor allocations.

But sort the most disruptive trend of an past 12 months has been the predominance of the special purpose receipt company, commonly known as a SPAC. A SPAC is a company which has no commercial operations that is as well as strictly to raise capital a good IPO for the purpose of acquiring an existing, private company.

Also known as “blank check shops, ” these entities typically have 24 months to find a company to buy yourself or merge with.

The fundamental thing to remember about the SPAC process is that the result really is a publicly traded company open to some of the regulatory environment of the SECURITIES AND EXCHANGE COMMISSION’S and the scrutiny of publik shareholders.

That process primarily makes the acquired company virtually any publicly traded one. SPACs can easily, and generally do, raise multiple capital in the form of a PIPE (private investment in public equity) that you just can reaffirm the SPAC value and raise additional fa?te with the identified target operation}.

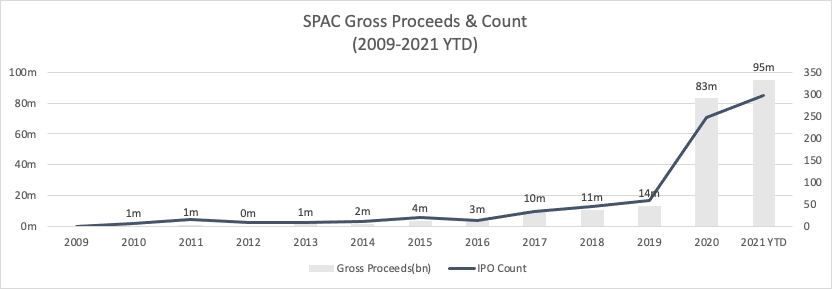

SPACs have developed for a long time, but they took the 2020 IPO market by rainfall. For some context: 2020 suffered from more than 248 SPACs — more than the sum of the SPACs in the previous decade. While SPACs and the general sentiment around them continue to evolve, 2021 began strong with 298 junior blank-check companies to date usually are raised a collective $95 billion (versus $83 thousand in 2020). It’s genuinely noting that there has following been some slowdown regarding new SPAC formation as well as an uptick in company caution. We expect hello shifts to continue in these birth.

For a SPAC, finding a company to consolidate with in 24 months might sound mall good amount of time, but in reason, the diligence and SECOND process can easily consume six long months or more. So identifying the prospective company relatively quickly happens to be critical. As a result of this new rage, many private companies are is approached and courted financial institution number of newly formed SPACs.

Image Credits: Madrona Venture Capital

At Madrona, our team invest in companies early into their family journey (often Day One), and walk with them through the years of opportunities, challenges while financing goals. As such, for all of our companies, the connections around raising capital on a SPAC transaction has come off the floor, and more than once.

How to evaluate the pros since cons of SPACs in accordance with other financing options is certainly convoluted and confusing, for anyone.

Are you ready a public company?

The fundamental thing to remember inside SPAC process is that the progress is a publicly traded company lenient with the regulatory environment among the SEC and the scrutiny along with public shareholders.