Toward the end of our hour-long interview, Bitcoin.com founder Roger Ver drops a bombshell: He had considered killing himself to escape a jail sentence at the age of 23. Even for the most freedom-loving libertarian, this seems extreme. But Ver had worked out a way to escape his own death by having himself cryonically preserved, to be revived at a later date.

At 20 years old, Ver had already signed up with Arizona life extension company Alcor to be frozen after death, long before he was handed a 10-month prison stretch in 2002 for selling firecrackers on eBay.

“It’ll freeze your body in a big giant vat of liquid nitrogen when you die, in the hopes that future medical technology will be able to fix whatever it is that caused you to die in the first place — plus the damage caused by freezing,” he explains:

“And so in fact, I even considered — suicide isn’t the right word — but I considered killing myself temporarily, going into cryonic suspension and then coming out later, when the technology is better, to avoid going to prison. That’s how upset I was about going to jail.”

Now 42, and with a fortune he vaguely refers to as being in the billions, the Bitcoin Cash proponent intends to switch his investment focus to cryonics over the next decade, in the hopes of improving the experimental technology.

“Rather than investing in cryptocurrency stuff, I want to focus on the extreme life extension technologies because if you die, you can’t enjoy your life anymore,” he says. At various points during our conversation, Ver refers to his mission with a well-rehearsed tagline about helping build the tools to give people control over their own money (or variations thereof).

Riffing on this, he says his new focus will be to “build the tools that enable people to have as much time as they need in their lives to do the things that they enjoy, and spend it with the people they care about.”

If Ver gets run over by a bus tomorrow, there’s a card in his wallet and notes on his phone with instructions to immediately get in touch with Alcor to freeze his body, with the hope of eventual resurrection. “That’s certainly my hope,” he says, adding wryly, “The downside of that is that the company’s in Arizona, and I’m zipping all over the world.”

Paradise in the pandemic

Ver is currently bunkering down from the pandemic on the French-speaking island of St. Barts in the Caribbean, where it’s “summer all year round.” Following his run-in with United States authorities, he renounced his U.S. citizenship in 2014 and became a citizen of St. Kitts and Nevis. He spends a lot of time in neighboring Antigua, where he convinced businesses from gas stations to supermarkets to accept BCH. You can now even pay the $158,000 required to become a citizen in crypto.

Compared with 2017 and 2018, when Ver seemed to be everywhere arguing the case for big blocks and peer-to-peer cash, he’s been a lot less prominent lately. “I absolutely made a deliberate decision to do less media stuff,” he says. “That civil war is kind of over now. So, I don’t think I need to argue with words so much as build useful things for people around the world to use.”

He’s still pretty active behind the scenes though, playing an instrumental role in convincing Kim Dotcom to embrace Bitcoin Cash for his K.im content monetization platform.

Speaking to Bitcoin maximalist Tone Vays (who was decidedly unimpressed), Dotcom revealed that Ver had won him over. “He shared with me some of the innovations that he’s working on. I think the guy at the moment, in terms of his way of thinking and where he is in his innovation, is a step ahead. I feel it would be stupid to ignore someone like that.”

It sounds as if Ver may have also extolled the virtues of Bitcoin Cash to Tesla CEO Elon Musk, but he’s reluctant to confirm this.

“I hate to be coy, but I’m not going to comment on that question. I’m happy to talk about just about everything, but that’s one that I think we’ll have to save for another time.”

Well, that’s not a “No,” is it?

Elon Musk and Kim Dotcom talk Bitcoin Cash low fees!! Does Bitcoin high transaction fees matter? #bitcoin #BitcoinCash @elonmusk @KimDotcom https://t.co/BbeVkDbUUl pic.twitter.com/UkvLapITD4

— Ryan Giffin (@RyanMic87079594) March 29, 2021

The only bit of the story about Bitcoin forks

As one of the earliest and most ardent Bitcoin proponents, Ver is also one of the most controversial for his role in forking Bitcoin Cash away in November 2017. While BCH’s price and hash rate pale into insignificance against Bitcoin, as of late, the network’s transaction count is 100,000 more per day than Bitcoin’s, and its block size is larger too, suggesting it may actually be starting to be used as a currency.

But forks spawn forks, and the once-ally and Satoshi-claimant Craig Wright forked Bitcoin SV away from Bitcoin Cash a year later. At one point, Ver seemed to give some credence to Wright’s Satoshi claims, but relations soured, and the Australian now spends much of his time mounting lawsuits against Ver for libel for calling him a fraud. The most recent case was filed in Antigua in September. “100% for sure he’s going to lose that one too,” says Ver, without even a hint of concern.

But what was he hoping to achieve by hitching his fortune to Wright’s in the first place?

“Good question,” he says, “The things that Craig Wright was saying back then are totally different than what he’s been saying more recently. Back then, he was espousing a lot of this free market libertarian-type rhetoric.” Hesitating, he adds:

“I guess at the time, I was hoping to have one more ally. […] It turned out Craig wasn’t a good ally.”

Yet another Bitcoin Cash fork occurred in November last year, as a result of Bitcoin ABC’s “benevolent dictator” Amaury Sechet trying to impose an 8% tax on miners to pay for development. Rival implementation Bitcoin Cash Node, or BCH, won the battle for the name, and Sechet ended up with a coin called BCHA, or Bitcoin Cash ABC, which is currently worth about $36 to BCH’s $852.

While a tax was never going to fly with the “taxation is theft” elements of the BCH community, the loss of Bitcoin Cash’s lead developer, who was instrumental in the creation of the currency, would seem to be a major blow. But that’s not how Ver sees it. “The only time I ever became short Bitcoin Cash was when Amaury was trying to split the network,” he reveals.

Bitcoin ABC and @deadalnix have announced that they are forking away from #BitcoinCash on Nov 15th.

We wish them good luck with their new coin and thank them for the free airdrop to all BCH holders.— Roger Ver (@rogerkver) September 1, 2020

“I think it shows just how incredibly distributed, decentralized and censorship-resistant the Bitcoin Cash network is, based on the fact that Amaury is gone and the network is, you know, the price is higher than ever.”

And speaking of price, having watched Bitcoin go from cents to tens of thousands of dollars, Ver has some quite optimistic hopes for Bitcoin Cash. He believes the total addressable market for digital cash is 10 times higher than the market for digital gold, and argues that if Bitcoin can hit $64,000, then “$600,000 is well within the realm of possibility” for Bitcoin Cash.

Despite this, he’s no Bitcoin Cash maximalist and entertains the possibility that Ethereum or an Ethereum killer may also one day unseat Bitcoin, if BCH is somehow unable to.

“I have just about every cryptocurrency,” he says revealing significant holdings of Bitcoin, Ether, Binance Coin, XRP, ADA, Tether and DOT. No DOGE though.

Forked away from the family

Born in San Jose in 1979, Ver rarely speaks about his childhood, though his independence and rebellious streak were clearly evident even then.

“I guess I rebelled — I moved out of my biological parents’ home when I was 16,” he says. “And then I had kind of a new adopted family that I lived with ever since and consider my family at this point.”

He doesn’t want to reveal too much about them, especially since there were “hacking attempts, extortion attempts and threats to hurt myself or my family. So, I probably don’t want to give too many details that might help the world track down my new adopted family.”

“I was lucky enough to find them, and I’m incredibly thankful to have them in my life and to talk to them pretty much daily.”

Around 16 or 17, he began to devour economics books, including the work of libertarian author — and liberal hate figure — Ayn Rand, as well as the writings of Austrian economist and anarcho-capitalist founder Murray Rothbard.

Related: Is Ethereum left and Bitcoin right?

Ver laughs as he points out that Rand kicked Rothbard out of her “inner circle for being too extreme, so that’s my intellectual hero.”

“He wrote a number of really, really compelling, interesting and thought-provoking books with points of view I’d never been exposed to.” He adds, “I have no problem calling myself an anarcho-capitalist or voluntaryist because I think those are the only practical and moral ways for society to function.”

Ver is incredibly committed to his libertarian and voluntaryist ideals, to the point where he rationalizes away his millions in donations to the Foundation for Economic Education, Liberland, Antiwar.com and FreeRoss.org by framing his philanthropy as “self-interest.” Some libertarians, such as Rand, view altruism with a degree of suspicion, believing it to be incompatible with individual rights and freedom.

“It’s because I like and support what those people are up to,” he says. “So, I want to donate money to them not because I’m being selfless but because I’m being selfish. Because the value I think I’ll get back from myself will be more than whatever the value of the cryptocurrency that I sent to them would have been.”

Economics 101 makes mini-millionaires

Ver put his understanding of economics to good use after discovering he could buy hard drives from bankrupt companies at auction for $100 each, and sell them on eBay for almost $400. This formed the basis of his company Memory Dealers, and Ver later founded Agilestar, which dealt in fiber optic transceivers.

“From studying economics books, you’ll learn that’s all any business is: moving things, whether it’s physical goods or intellectual capital or whatever else, from where it’s worth less to where it’s worth more.”

One endeavor though almost ruined his life. “Like any young man,” he says, “I liked firecrackers.” He explains that he bought firecrackers called “Pest Control Report 2000,” designed to scare birds away from crops, from Cabela’s sporting goods catalog. Noting that these fetched a higher price on eBay, he started reselling them for profit.

“It was just kind of a little side project,” he says. “If I’d known it was illegal, I wouldn’t have done that.”

The authorities charged him with dealing in explosives without a license, illegally storing them and mailing “injurious articles.” Ver accepted a plea bargain to get a 10-month sentence.

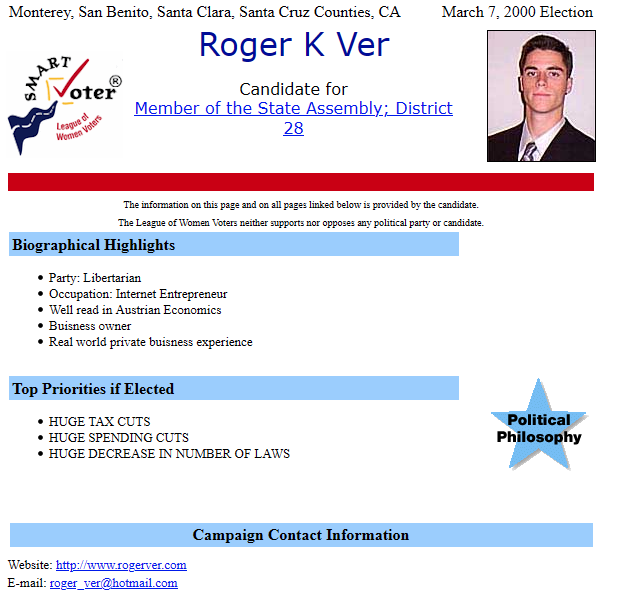

He still believes the charges against him were politically motivated, stemming from his outspoken criticism of the authorities during a run for California State Assembly as a Libertarian candidate in 2000.

This is impossible to prove, of course. However, Ver says he was the only person out of dozens of resellers charged over the firecrackers, and manufacturer Max2000, which sold a million of them, simply agreed to stop selling them the following year.

Ver’s opponents continually bring up his criminal record to discredit him. In November 2019, Nouriel Roubini (aka Dr. Doom) attacked him for being a convicted criminal during a debate in London. Afterward, Ver said this was proof he’d won.

“The fact that he was attacking me for having sold firecrackers on eBay, which has nothing to do with whether or not cryptocurrencies are useful to the world, I think it’s a pretty clear sign that I did just fine.”

Prison life was particularly tough on a freedom-loving libertarian, though he admits the boring parts were preferable to anything exciting happening. “Excitement in prison is never ever good excitement,” he says. “It’s only bad excitement. And the longest 10 months of my life also, by far.”

This is my story of being tortured in prison, but I’m not the only one.https://t.co/eHZuvfUA6E#FreeRoss pic.twitter.com/hhWoCIIauP

— Roger Ver (@rogerkver) July 5, 2018

A few days after he arrived, a prison guard planted a shiv on him and started screaming questions about who Ver planned to murder, convincing Ver he’d get another two years on his sentence.

Shocked, Ver began to cry, pleading with the guard, “It’s not mine, it’s not mine, I don’t know where it came from.” Seeing his obvious distress the guard suddenly smiled and patted him on the shoulder. “Relax, I’m just kidding with you. Have a seat.”

Ver thinks of this as psychological torture. “I think he was just bored, and the entertainment for him was ‘Let’s talk to this new guy,’” he says. “The prisoners know the guards can do whatever they want. I don’t know if he was trying to instill that on a new guy. I think that everybody there knows it real quickly that that’s the case.”

On his final day, he found his breakthrough (albeit, minor) moment of vengeance. Ver recalls what the prison guard said on his way out the door: “Oh, you’ll be back.”

“I said, ‘No, I won’t, but you’ll be back. You’ll come here every day until the day you retire.’”

From Skid Row to Santana Row

Ver made his first million the year after he was released, and the probation officers had to come visit him at his opulent new apartment in Santana Row, San Jose.

“It was kind of an interesting experience to have these people. They’re supposed to be the boss of me and telling me what a horrible person I am and keeping an eye on me to make sure I don’t do anything wrong, but I’m living in one of the fanciest apartment complexes in Silicon Valley,” he says.

“I had a lot more financial power than they did. But they had a lot more legal power over me and my life, so it was a kind of an uneasy imbalance of power.” Ver’s sentence included a three-year period of supervised release. The minute it was over, Ver said goodbye to the United States for good and moved to Japan.

“I got tossed in jail for the things that I said. And so the day I was allowed to leave the U.S., I left the U.S. and never lived there ever again.”

He semi-retired and spent much of his time working on his jiujitsu and competing in tournaments. Now a brown belt, he still carves out an hour for it each day.

He first heard about Bitcoin while listening to libertarian radio show “Free Talk Live” in 2011. His ears harkened at the mention of buying drugs on Silk Road — he wasn’t interested in the drugs, he was fascinated with how users could pay with money outside of state control.

“I was like, okay, this is the next big thing. This is the opportunity I’ve been waiting for my whole life. This is kryptonite to the state in the government’s ability to control people. I want to promote that full time.”

Unlike many new investors who are attracted to the “get-rich-quick” aspect of crypto, Ver was already rich when he learned about Bitcoin, and was able to establish a different relationship with it.

“I had a Lamborghini before Bitcoin had ever even been invented. And I sold the Lamborghini to buy more Bitcoin. But having the money made it much, much easier to get involved,” he says.

There are reports that Ver amassed around 400,000 BTC, which today would be worth $20 billion — though he gave much of it away to convert unbelievers.

Ver also invested in much of the foundational infrastructure for the cryptosphere, including Bitpay, Zcash, Kraken and Blockchain.info (now Blockchain.com). He was a co-founder of the Bitcoin Foundation and an adviser to Binance. And of course, he spreads Bitcoin Cash adoption through Bitcoin.com. While he’s known colloquially as “Bitcoin Jesus,” he likes to think of himself more akin to “Bitcoin Johnny Appleseed,” planting the seeds that have “all grown up into these big giant businesses that we have today.”

While it has made him an extremely wealthy man, crypto has also given Ve’’s life a meaning and purpose that it may not otherwise have had. “The closest answer I can come up with is that the meaning of life is to enjoy the journey of your life each day,” he says. “So, figure out what makes you happy, and try and do that.”