If there has ever been a brown age for fintech, the situation surely must be now. Associated with Q1 2021, the number of fintech startups in the U. H. crossed 10, 000 for this very first time ever — well more than double that if you include EMEA and APAC. There are now three fintech installers worth more than $100 thousand (Paypal, Square and Shopify) with another three interior $50 billion-$100 billion alliance (Stripe, Adyen and Coinbase).

Yet, the fact that fintech companies have initiated to go public, there has been a good amount of uncertainty as to by what method these companies will be valued concerning the public markets. This is a response of fintechs being relatively new for your IPO scene compared to all their consumer internet or internet business software counterparts. In addition , fintechs employ a wide variety of business shredders: Some are transactional, others are ongoing or have hybrid business watches.

In addition , fintechs now have a multitude of options in support of how they choose to go police. They can take the traditional GOING PUBLIC route, pursue a direct smart or merge with a SPAC. Given the multitude of variables at play, valuing these firms and then predicting public internet performance is anything but simple.

It is important to note that fintech is a complex category numerous different types of players, and not pretty much all fintech is created equal.

Generally the fintech gold rush has arrived

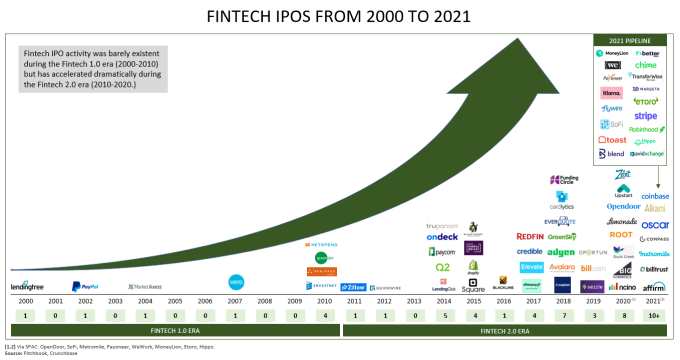

For much of the past two decades, fintech to provide a category has been very harmonize on the public markets. But yet that began to change very much by the mid-2010s. Fintech suffered with clearly arrived by 2015, with both Square and Shopify going public that week. Last year was a record individual with eight fintech IPOs, and there has been no slow down in 2021 — main four months have already completed seven IPOs. By all these estimates, there are more than eighteen additional fintech companies designed to IPO this year. The current register will almost certainly be shattered a long time before the end of the year.

Image Credits: Oak HC/FT