Lordstown Motors’ cash-rich SPAC dreams have turned out to be nothin’ more than wishes. The automaker reported Monday a disappointing first-quarter earnings that was a pile-up of red-ink-stained negativity.

Lowlights include higher-than-expected forecasted expenses, a need to raise more capital and lower-than-anticipated production of its Endurance vehicle this year — from around 2,200 vehicles to just 1,000. In short, the company is set to consume more cash than the street expected and is further from mass production of its first vehicle than promised.

The value of the company, which went public via a SPAC last year, has fallen sharply from its post-combination highs. Today its shares are off another 7% after the close of trading, thanks to its Q1 2021 report.

Investors were not thrilled with the company that 11 months ago showed off a prototype of Endurance, the all-electric pickup truck that it has bet its future on.

Lordstown Motors is an offshoot of CEO Steve Burns’ other company, Workhorse Group, a battery and electric transportation technology company that is also a publicly traded company. Workhorse is a small company that was founded in 1998 and has struggled financially at various points. Its offshoot, Lordstown Motors, has previously said it planned 20,000 electric trucks annually, starting in the second half of 2021, at the former GM Assembly Plant in Lordstown, Ohio. Lordstown Motors acquired in November the 6.2 million-square-foot factory from GM.

Production woes, capital concerns

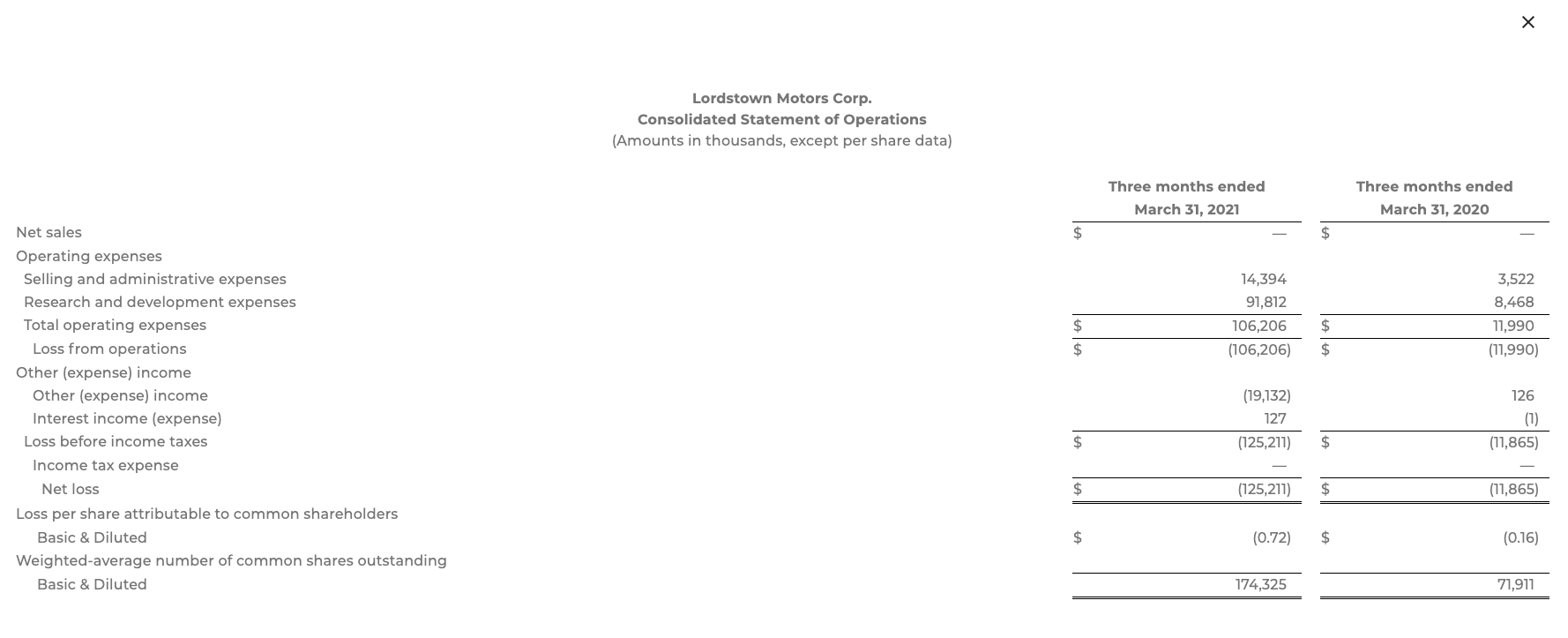

Lordstown reported a $125 million net loss on zero revenue, along with capital expenditures of $53 million in the first quarter. And yet, Lordstown had little to show for its outsized spending.

The company said in a release that it would still begin production of its Endurance electric pickup truck this year but that its output “would be at best 50% of our prior expectations.” That fact on top of its massive cash drawdown was hardly investor catnip.

“Our research indicates a very robust demand for our vehicles,” Burns told investors during a call Monday. “However, capital may limit our ability to make as many vehicles as we would like, and as such, we are constantly evaluating our capital needs and the various types of capital available to us, including strategic capital.”

The EV company anticipates ending 2021 with just $50 million to $75 million in liquidity, despite its recent SPAC combination that helped capitalize its operations. Lordstown finished 2020 with $630 million in cash; it wrapped Q1 2021 with $587 million. The company anticipates “capital expenditures of between $250 [million] and $275 million,” in addition to its regular cash consumption from operating costs.

Burns said the company was in discussions with an unnamed financial entity for asset-backed financing.

“We have zero debt and we have a lot of assets, and we’re buying a lot of parts. So there’s folks that want to finance that,” he said. Lordstown is also still pursuing an Advanced Technology Vehicles Manufacturing loan from the U.S. Department of Energy. Executives said DOE has done several rounds of due diligence but declined to comment on the timing, though Burns said multiple times that Tesla wouldn’t exist had it not gotten an ATVM loan in January 2010.

For post-combination SPAC companies, Lordstown’s lackluster results and bearish trading are yet more indication that the boom in using blank-check agreements to take EV and other automotive-focused companies public was perhaps premature.

Lordstown announced its SPAC merger in September 2020 with a market value of $1.6 billion. Its shares soared to $31.80 apiece at their 52-week highs. Today they are worth $8.77.

Burns lauded the company’s purported competitive advantages, including its hub motor architecture and physical simplicity, which he said would translate into a lower cost of ownership. But the company has stiff competition from new EV entrants Rivian and Tesla (should the Cybertruck ever hit production) and legacy automakers like Ford, which debuted the electric model of its nameplate F-150 truck model earlier this month with a price point under $40,000.

But Burns reiterated his feeling that the company was on par with its competitors and that it wants to be “ready to pounce” in response to vehicle demand. The CEO also said he was confident that the truck would hit the 250-mile target range, though this is less than both the Rivian R1T and the Ford F-150 Lightning.

Lordstown also gave a brief update on preorders following its announcement in January that it hit a milestone of 100,000 preorders. Burns said around 30,000 of those had been converted to what it’s calling “vehicle purchase agreements,” but he demurred on exactly how many of those customers have paid anything, saying only that “many of those” agreements, included some kind of down payment.

The company also began work on its second vehicle, an electric van, with a prototype anticipated later this summer.

Financial results

Turning to Lordstown’s first quarter performance, we’re observing a pre-revenue company in the weeds of testing and scaling production for an incredibly complex product. Which is an expensive endeavor.

Here’s the chart:

The company’s greater-than-before sales and administrative costs are whatever compared to its spiraling research and development spend. For investors holding onto Lordstown shares in hopes of its eventual early construction runs leading to mass production that is now further in the future, it’s a tough income statement to digest.

In the first quarter of 2021 the company spent around $91,000 in research and development expenses. “The higher than expected R&D spend is largely from higher part costs from a supply chain that remains under duress, from collocations, and which impacted our beta costs, higher costs of shipping included expedited shipping and greater use of temporary external engineering,” Lordstown CFO Julio Rodriguez said.

Company executives also briefly addressed accusations by short seller Hindenburg Research, who claimed the automaker was faking preorders of its vehicles. Hindenburg said that “extensive research reveals that the company’s orders appear largely fictitious and used as a prop to raise capital and confer legitimacy.”

Burns told investors that the company established a special independent committee to investigate the allegations in the report. This is in addition to a separate investigation from the U.S. Securities and Exchange Commission, which the company is cooperating with, he said.

In the wake of Lordstown’s results, however, shares of Tesla and Nikola were largely flat.