Crypto traders are drawn to the market by its bombastic growth and lucrative opportunities to make a profit. However, not every investor is seeking volatility or using degenerate leverage levels to gamble at derivatives exchanges.

In fact, stablecoins usually comprise half of the total value locked (TVL) on most decentralized finance (DeFi) applications that focus on yields.

There’s a reason why DeFi boomed despite Ethereum network median fees surpassing $10 in May. Institutional investors are desperately seeking fixed income returns as traditional finance seldomly offers yields above 5%. However, it is possible to earn up to 4% per month using Bitcoin (BTC) derivatives on low-risk trades.

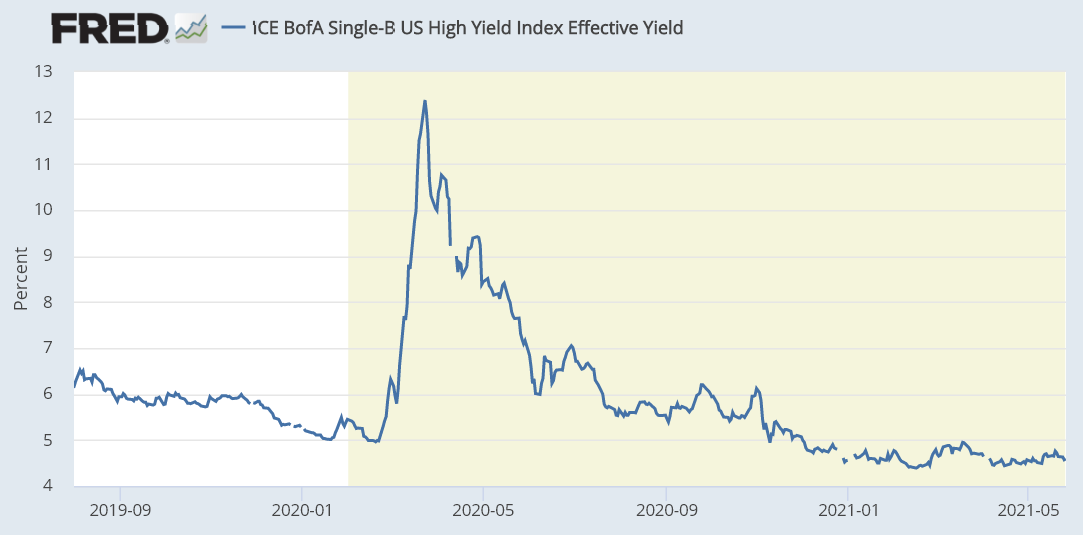

Non-investment grade bonds yield. Source: U.S. Federal Reserve

Non-investment grade bonds yield. Source: U.S. Federal Reserve

Notice how even non-investment grade bonds, far riskier than Treasury Bills, yield below 5%. Meanwhile, the official inflation rate in the United States for the past 12 months has stood at 4.2%.

Paul Cappelli, a portfolio manager at Galaxy Fund Management, recently told Cointelegraph that Bitcoin’s “inelastic supply curve and deflationary issuance schedule” make it a “compelling hedge against inflation and poor monetary policies that could lead to cash positions becoming devalued over time.”

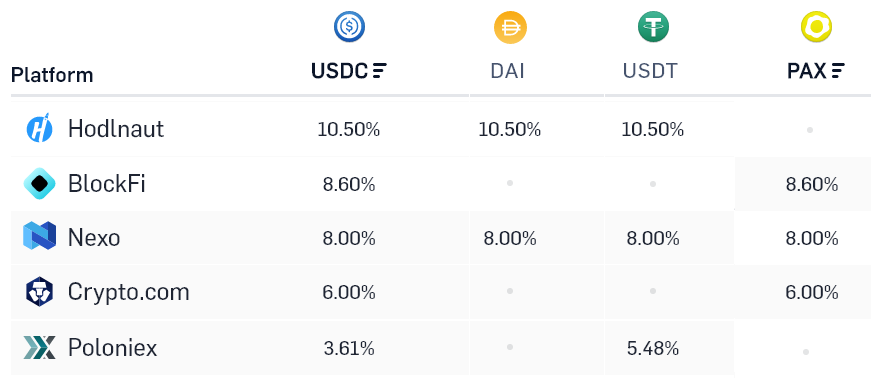

Centralized services such as Crypto.com, BlockFi, and Nexo will typically yield 5% to 10% per year for stablecoin deposits. To increase the payout, one needs to seek higher risks, which does not necessarily mean a less known exchange or intermediary.

Stablecoin yields on centralized services. Source: loanscan.io

Stablecoin yields on centralized services. Source: loanscan.io

However, one can achieve a 2% weekly yield using Bitcoin derivatives. For those instruments, liquidity currently sits at centralized exchanges. Therefore the trader needs to factor in counterparty risk when analyzing such trades.

Selling a covered call can become a semi-fixed income trade

The buyer of a call option can acquire Bitcoin for a fixed price on a set future date. For this privilege, one pays upfront for the call option seller. While the buyer typically uses this instrument as insurance, sellers are usually aiming for semi-fixed income trades.

Each contract has a set expiry date and strike price, so potential gains and losses can be calculated beforehand. This covered call strategy consists of holding Bitcoin and selling call options, preferably 15% to 20% above the current market price.

It would be unfair to call it a fixed income trade as this strategy aims to increase the trader’s Bitcoin balance, but it doesn’t protect from negative price swings for those measuring returns in USD terms.

For a holder, this strategy does not add risk as the Bitcoin position will remain unchanged even if the price drops.

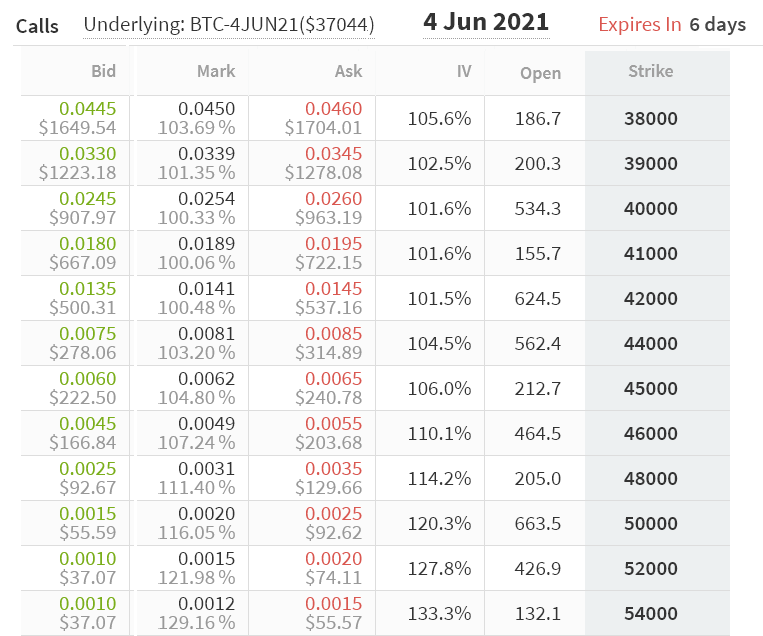

Bitcoin June 4 call options markets. Source: Deribit

Bitcoin June 4 call options markets. Source: Deribit

Considering that Bitcoin was trading $37,000 when the above data was gathered, a trader could sell the $44,000 call option for June 4, maturing in six days. Depositing a 0.10 BTC margin should be enough to sell 0.30 BTC call option contracts, thereby receiving 0.00243 BTC in advance.

Two outcomes: higher Bitcoin quantity or larger USD position

There are essentially two outcomes, depending on whether Bitcoin trades above or below $44,000 at 8:00 am UTC on June 4. The $44,000 call option will become worthless for any level below this figure, so the option seller keeps the 0.00243 BTC advance payment in addition to the 0.10 BTC margin deposit.

However, if the expiry price is higher than $44,000, then the trader’s margin will be used to cover the price difference. At $46,000, the net loss is 0.011 Bitcoin, therefore reducing the margin to 0.089 ($4.094). Meanwhile, at the time of the deposit, the 0.10 Bitcoin margin was worth $3,700.

Indeed the covered call option seller would have made more money by holding the 0.10 Bitcoin from the beginning, as the price increased from $37,000 to $46,000. Nevertheless, by receiving the 0.00243 BTC advanced payment, one will increase the Bitcoin holdings even if the price moves below $37,000.

That 2.4% profit in Bitcoin terms will happen for any expiry below $44,000, which is 18.9% higher than the $37,000 when Deribit option prices were analyzed.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.